Tesla Inc TSLA CEO Elon Musk on Monday expressed hope that the company’s stock will touch $690 in the future, without specifying a timeline.

What Happened: “At some point in the future, I think that will happen,” Musk wrote on X in response to an X user who said that they are now waiting for the stock to hit $690.42.

Don’t Miss:

- Warren Buffett once said, "If you don't find a way to make money while you sleep, you will work until you die." These high-yield real estate notes that pay 7.5% – 9% make earning passive income easier than ever.

- It’s no wonder Jeff Bezos holds over $70 million in art — this alternative asset has outpaced the S&P 500 since 1995, delivering an average annual return of 11.4%. Here’s how everyday investors are getting started.

Tesla stock closed 6.14% higher at $463.02 on Monday. The stock is up 86.39% year-to-date, according to data from Benzinga Pro, thanks to its rally since Donald Trump‘s landslide victory in the U.S. Presidential elections.

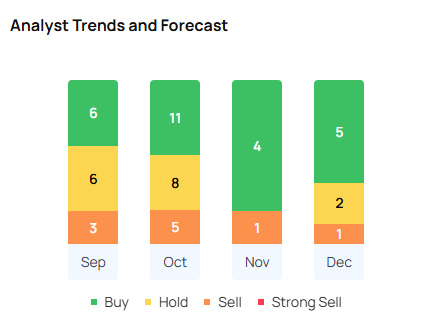

Analyst Take: Mizuho Securities analyst Vijay Rakesh on Monday increased the price target on Tesla to $515 from $230 and upgraded the stock’s rating from “neutral” to “outperform.”

Wedbush analyst Dan Ives earlier this week also raised the price target on the EV giant’s stock from $400 to $515. "…we believe the Trump White House will be a ‘total game changer' for the autonomous and AI story for Tesla and Musk over the coming years," Ives said in a post on social media platform X.

Why It Matters: Many, including Ives, are hopeful that Musk's newly forged friendship with President-elect Donald Trump will enable a better environment for the deployment of autonomous vehicles while his other policies against EVs will harm smaller rival players, effectively reducing competition for Tesla.

Tesla stock has surged over 60% since the 2024 election results were announced. As per Benzinga’s analysis of technical indicators, the stock price is high and overbought.

Tesla shares are trading at a price nearly 126 times over its 2025 earnings, according to Benzinga Pro data. At the same time, the average forward price-to-earnings of its peers stand at 25.75 times, implying that Tesla is over five times more expensive than its industry's average.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Check It Out:

A 9% Return In Just 3 Months

EquityMultiple's ‘Alpine Note — Basecamp Series' is turning heads and opening wallets. This short-term note investment offers investors a 9% rate of return (APY) with just a 3 month term and $5K minimum. The Basecamp rate is at a significant spread to t-bills. This healthy rate of return won't last long. With the Fed poised to cut interest rates in the near future, now could be the time to lock in a favorable rate of return with a flexible, relatively liquid investment option.

What's more, Alpine Note — Basecamp can be rolled into another Alpine Note for compounding returns, or into another of EquityMultiple's rigorously vetted real estate investments, which also carry a minimum investment of just $5K. Basecamp is exclusively open to new investors on the EquityMultiple platform.

Looking for fractional real estate investment opportunities? The Benzinga Real Estate Screener features the latest offerings.

Image via Tesla

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.