Congresswoman Marjorie Taylor Greene is fighting against criticism from recent stock buying activity that came shortly before a market rally.

Here's what Greene had to say.

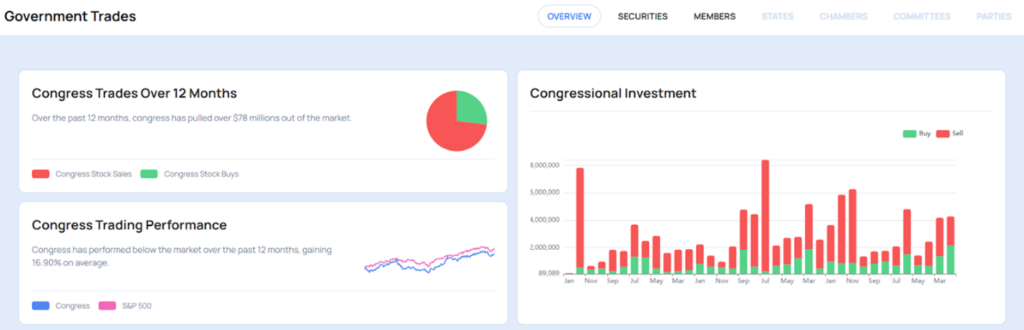

What Happened: Disclosures from Rep. Greene (R-Ga.) showed her buying shares of several stocks as the market declined on news of President Donald Trump's reciprocal tariffs, as shown on the Benzinga Government Trades page.

Those stocks quickly soared after Trump announced a pause to tariffs, turning Greene's investment of $21,000 to $315,000 into a quickly profitable one that drew attention from many accounts that follow Congress trading activity.

Don't Miss:

- ‘Scrolling To UBI' — Deloitte's #1 fastest-growing software company allows users to earn money on their phones. You can invest today for just $0.26/share with a $1000 minimum.

- Hasbro, MGM, and Skechers trust this AI marketing firm — invest pre-IPO from $0.60 per share.

Greene bought shares of technology stocks like Apple Inc AAPL, Amazon.com Inc AMZN, NVIDIA Corporation NVDA and Qualcomm Inc QCOM that were hurt by potential tariffs. Greene also disclosed buying Nike Inc NKE and Lululemon Athletica LULU shares, which soared after Trump paused tariffs.

Greene took pride in her transactions, despite other members of Congress calling for an investigation into whether Trump and his allies participated in insider trading.

"I think that criticism is laughable. President Trump has been talking about tariffs for decades," Greene told reporters when asked about the trades at a recent town hall event in Georgia in a clip shared by Unusual Whales. The Congresswoman used the opportunity to boast about her stock performance, which ranked her as one of the top trading members of Congress in 2024.

"I don't place my buys and sells,” Greene said, citing an agreement she has with her portfolio manager, who handles all the buying and selling of stocks. "He did a great job. Guess what he did. He bought the dip. And that's what anybody that has financial sense does.”

Greene also said her portfolio manager did not have inside information, everything was public and a potential tariff pause wasn't a secret.

Why It's Important: Greene is Trump’s close ally. The timing of the buys shortly before the tariff pause was announced has raised red flags.

Rep. Hakeem Jeffries (D-N.Y.) urged a ban on stock trading by members of Congress after news of Greene's trades circulated.

"We obviously continue to highlight while this is problematic," Jeffries told MSNBC.

Several Congress members have called for a ban on the buying and selling on stocks and options by members of Congress, but the item has not been voted on in recent years.

Greene went several years without disclosing stock purchases before unveiling a handful in 2024 in May 2024. That disclosure has been followed up with trades every month or two, including the most recent trades.

As Benzinga previously reported, several of Greene's trades could be problematic given the timing and her committee assignments.

Greene disclosed buying shares of the iShares Bitcoin Trust IBIT ETF shortly before Trump announced he would make a Bitcoin Strategic Reserve.

Greene also disclosed buying shares of Palantir Technologies PLTR earlier this year. Greene serves on the Subcommittee on Counterterrorism and Intelligence under the House Committee on Homeland Security. Palantir is the recipient of government contracts related to Homeland Security. Critics argue that Greene and other members of Congress could have access to inside information from committee assignments and new contracts before they are made public.

While Greene insists she does not have prior knowledge of what stocks her portfolio manager bought or why he was able to time the bottom so perfectly, increased public pressure could lead to more discussion of banning Congress from trading in the future.

Read Next:

- It’s no wonder Jeff Bezos holds over $250 million in art — this alternative asset has outpaced the S&P 500 since 1995, delivering an average annual return of 11.4%. Here’s how everyday investors are getting started.

- Deloitte's fastest-growing software company partners with Amazon, Walmart & Target – Last Chance to get 4,000 of its pre-IPO shares for just $0.26/share!

Image: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.