In just a short amount of time following the 20th Party Congress, we have seen multiple green shoots in the Chinese market. Among them, the most important ones are the pivot on China’s zero-COVID policy and more concerted property rescue measures. We are also seeing signs of more regulatory easing for big tech, such as fintech initial public offerings and gaming license approvals, as well as some de-escalation of geopolitical tensions following the recent G20 meeting. Contrary to the market’s gloomy view, we think this shows that the government is focusing on economic recovery.

Key Takeaways:

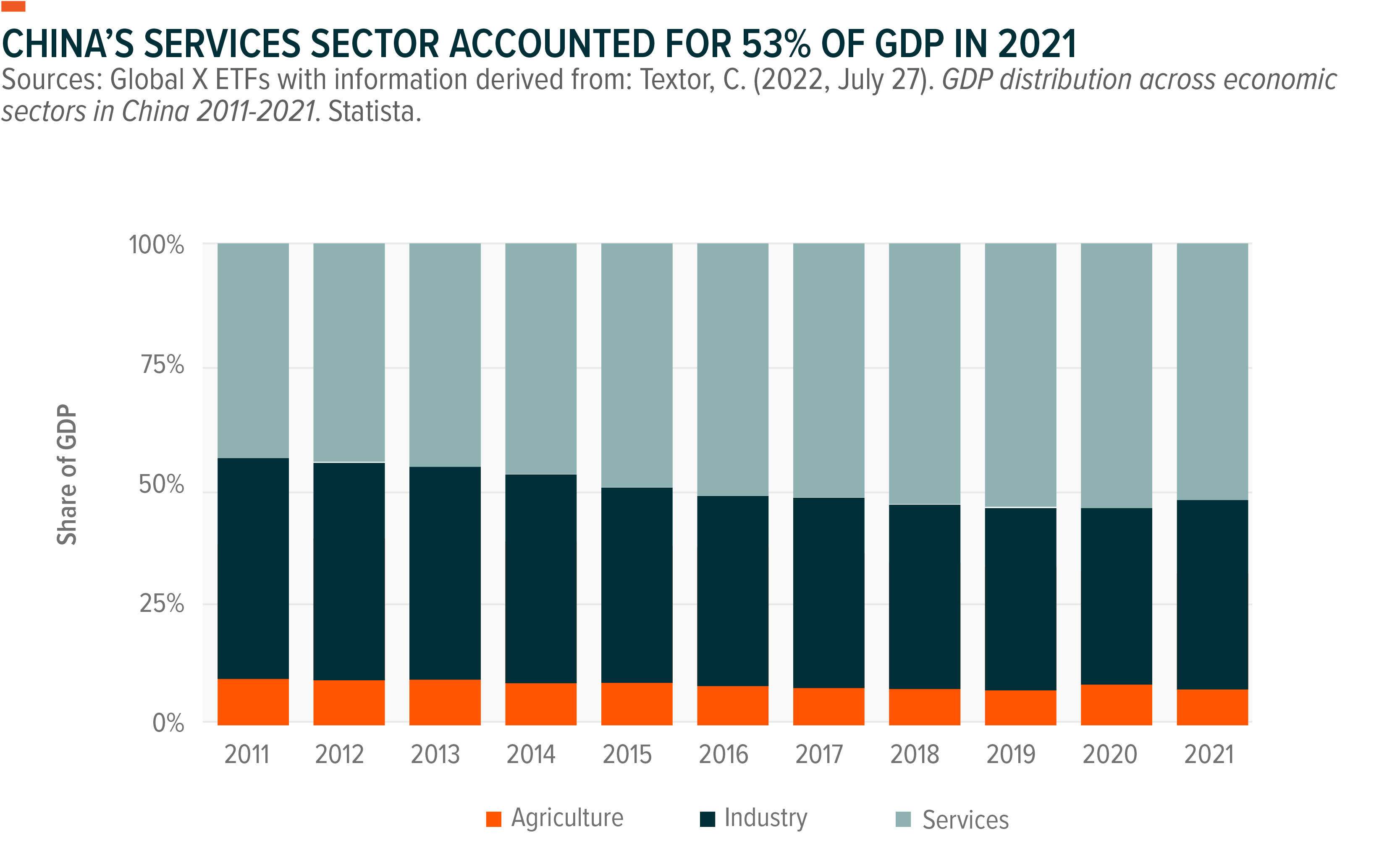

- New measures to relax COVID control guidelines reflect a policy pivot toward prioritization of growth and signal the beginning of the end of the zero-COVID policy. This shift is critical to China’s recovery, given that the services sector accounts for over half of the country’s GDP.

- The property sector has also seen a slew of new measures, ultimately lowering the chance of potential defaults and systematic risks to overall financial markets.

- With the shift in tone following the 20th Party Congress, we are now more optimistic about China’s market recovery as the new measures should support earnings recovery in 2023 and 2024.

Property Policy Pivot Offers Relief to Embattled Sector

After the Party Congress, we are seeing signs of coherent policy support in the property sector. For example, in November, the People’s Bank of China (PBOC) and the China Banking and Insurance Regulatory Commission (CBIRC) announced 16 measures to support the property market. These include 1) providing financing support to property developers with liquidity problems to ensure housing delivery to homebuyers, with the goal of defusing risky projects, and 2) extending the grace period for banks to fulfil property and mortgage cap requirements. Additionally, relaxed escrow account management also allows developers to withdraw up to 30% of the project construction cost with a letter of guarantee by commercial banks.1

According to estimates by Jefferies, recent policies and guidance, together with the package, will inject 1.3tn RMB of credit into the property sector.2 This will significantly ease private developers’ liquidity and cover their public bond and trust products to be matured by the end of 2023 (1tn RMB).

Private developers may still face insolvency risk as property prices are capped by the sentiment that “property is for living, not for speculation,” while the recovery of housing sales is still dependent on the economic outlook, which is affected by the progress of China’s zero-COVID pivot. However, the recent policy measures can effectively ease developers’ overall liquidity risk and buy time for the property market to stabilize. We believe this will lower the chance of potential defaults and mitigate systematic risk for the broader financial market.

Zero-COVID Policy Pivot Likely to Brighten Macro Picture

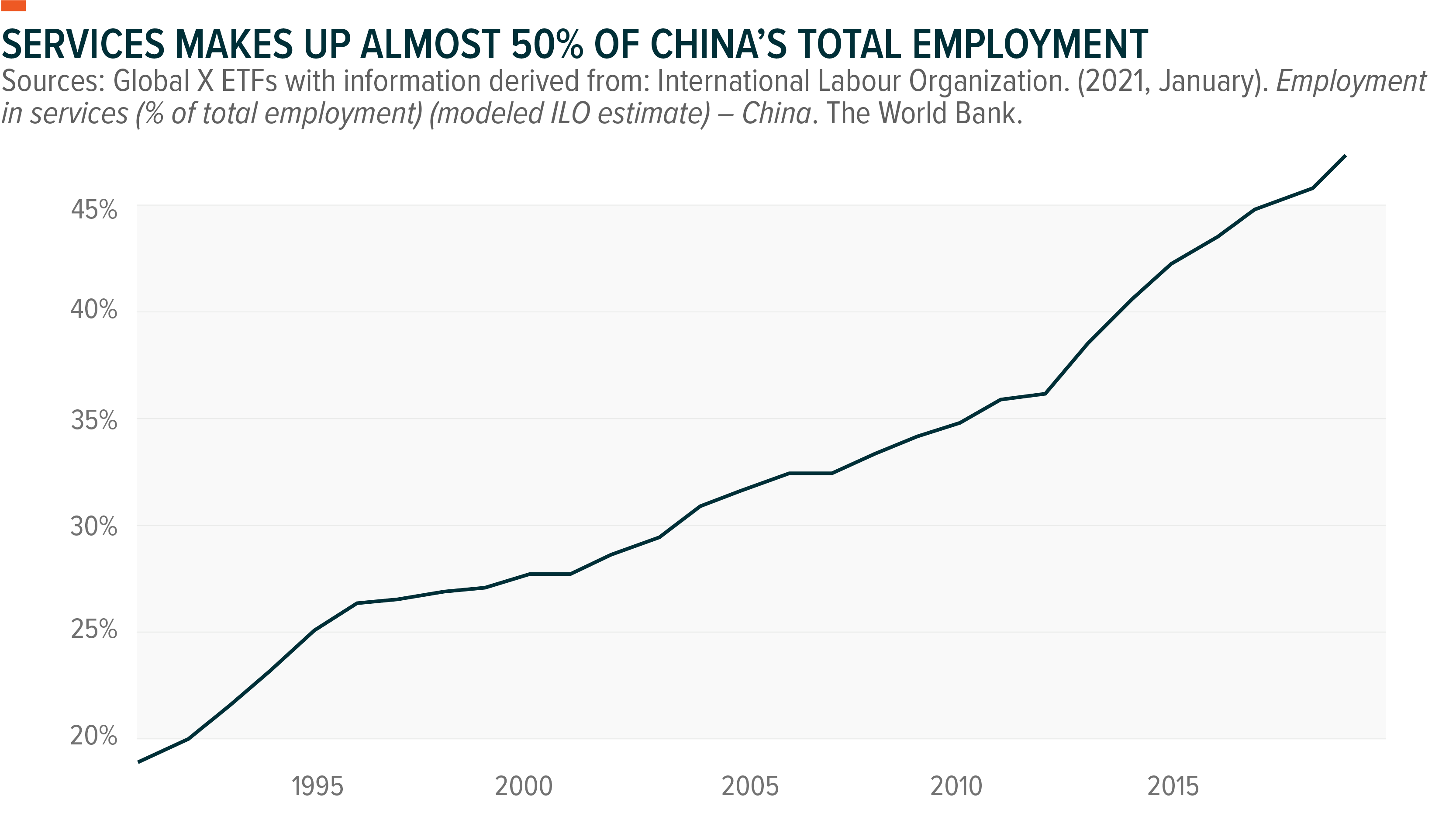

China’s services sector accounted for more than half of the country’s GDP in 2021 and nearly 50% of China’s total employment in 2019.3,4 However, as the zero-COVID policy significantly restricted services industries, the impact on employment and consumer confidence has negatively fed into consumption and other economic activities, causing a vicious downward spiral.

However, we are now seeing clear and coherent signals that China will begin its pivot away from the zero-COVID policy. Specifically, China’s National Health Commission (NHS) delivered 20 new measures in November to optimize Covid control guidelines, including 1) cutting quarantine requirements for close contacts and inbound travel restrictions, and fine-tuning the administration of mass testing; 2) requiring more targeted mobility restrictions; 3) drawing up plans to accelerate vaccination, particularly for the elderly; and 4) ramping up Covid-specific medical capacities with a tiered medical response system for Omicron cases.5

We believe these measures reflect a policy pivot toward prioritization of growth. Rather than a sudden and total abandonment of the zero-COVID policy, this pivot is more like the construction of an exit ramp. COVID policy now focuses more on flattening the curve and boosting medical capabilities to minimize further economic disruption, which would pave the way for an eventual reopening. Though the path to reopening could be bumpy, with uneven changes across regions and strain on the healthcare system, we see this as the beginning of the end of zero-COVID.

With the latest mutations of the Omicron variant appearing milder and less severe than earlier COVID variants, we believe China is poised for reopening. Moreover, China’s domestically developed vaccines appear to be just as effective in reducing the severity of symptoms if a booster dose has been administered, meaning the population is probably more protected than most initially perceived. These factors will likely give policymakers the confidence to continue down the path of reopening, despite any short-term bumps that could be expected along the way.

Conclusion

Property sector woes and the zero-COVID policy are two of the main headwinds blowing on China’s economy. Both of these areas are now benefitting from policy pivots, which could potentially support earnings recovery in 2023 and 2024. Along with potential regulatory easing on big tech and the de-escalation of geopolitical tensions, we believe these will provide a strong foundation for China’s market recovery.

Related ETFs

CHIC: The Global X MSCI China Communication Services ETF seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI China Communication Services 10/50 Index.

CHIE: The Global X MSCI China Energy ETF seeks to invest in large-, mid- and small-capitalization segments of the MSCI China IMI Index that are classified in the Energy Sector as per the Global Industry Classification System (GICS).

CHIH: The Global X MSCI China Health Care ETF seeks to invest in large- and mid-capitalization segments of the MSCI China Index that are classified in the Health Care Sector as per the Global Industry Classification System (GICS).

CHII: The Global X MSCI China Industrials ETF seeks to invest in large- and mid-capitalization segments of the MSCI China Index that are classified in the Industrials Sector as per the Global Industry Classification System (GICS).

CHIK: The Global X MSCI China Information Technology ETF seeks to invest in large- and mid-capitalization segments of the MSCI China Index that are classified in the Information Technology Sector as per the Global Industry Classification System (GICS).

CHIM: The Global X MSCI China Materials ETF seeks to invest in large- and mid-capitalization segments of the MSCI China Index that are classified in the Materials Sector as per the Global Industry Classification System (GICS).

CHIQ: The Global X MSCI China Consumer Discretionary ETF seeks to invest in large- and mid-capitalization segments of the MSCI China Index that are classified in the Consumer Discretionary Sector as per the Global Industry Classification System (GICS).

CHIR: The Global X MSCI China Real Estate ETF seeks to invest in large- and mid-capitalization segments of the MSCI China Index that are classified in the Real Estate Sector as per the Global Industry Classification System (GICS).

CHIS: The Global X MSCI China Consumer Staples ETF seeks to invest in large- and mid-capitalization segments of the MSCI China Index that are classified in the Consumer Staples Sector as per the Global Industry Classification System (GICS).

CHIU: The Global X MSCI China Utilities ETF seeks to invest in large- and mid-capitalization segments of the MSCI China Index that are classified in the Utilities Sector as per the Global Industry Classification System (GICS).

CHIX: The Global X MSCI China Financials ETF seeks to invest in large- and mid-capitalization segments of the MSCI China Index that are classified in the Financials Sector as per the Global Industry Classification System (GICS).

Please click the fund name above for current fund holdings and important performance information. Holdings are subject to change.

Image sourced from Shutterstock

This post contains sponsored advertising content. This content is for informational purposes only and not intended to be investing advice.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.