Zinger Key Points

- Chinese indices have lost a third of their value in the last year

- Political, not economic, concerns are weighing most on China's equity markets

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

Chinese stock markets resumed their sell-off, falling sharply on Tuesday despite recent efforts by the government to slow the pace of the decline.

Hong Kong‘s Hang Seng index fell 2.3% while the Shanghai Composite shed 1.8%. Property stocks were among the biggest fallers.

Hang Lung Properties HLPPY was the worst-performing stock, down 8.4%, while Longfor Properties LGFRY shed 6.3%.

Shares in what was once China’s leading property developer China Evergrande remained suspended from trading at HK$0.16 after falling around 21% on Monday following a court liquidation order.

Short Selling Ban

Promises of government support helped lift the markets a little last week, and the Hang Seng made a notable 4.2% recovery.

On Monday, the news of Evergrande’s eventual demise — having been a zombie stock for several years — may have already been priced into the markets, as the response from investors was muted.

Some believed that a ban on short selling announced on the weekend, may have slowed the selling on Monday, but it resumed with gusto on Tuesday.

The short-selling ban was instigated by the China Securities Regulatory Commission, halting the lending of shares to traders who take bearish positions on stocks whose prices lose value.

Also Read: Evergrande Liquidation’s ‘Snowball Effect’: What’s Next For China’s Troubled Real Estate Sector?

Investors Flee

However, analysts believe the bulk of the selling isn’t coming from hedge funds and other alternative investment firms that are most likely to use shorting strategies. Much of the sell-off is plainly down to investors who believe that now is the time to exit and put their investments elsewhere.

Indeed, one area of the Chinese market which has flourished in recent days is exchange-traded funds tracking foreign markets, according to data from Reuters, with prices on some funds rising 30%-40% above asset values.

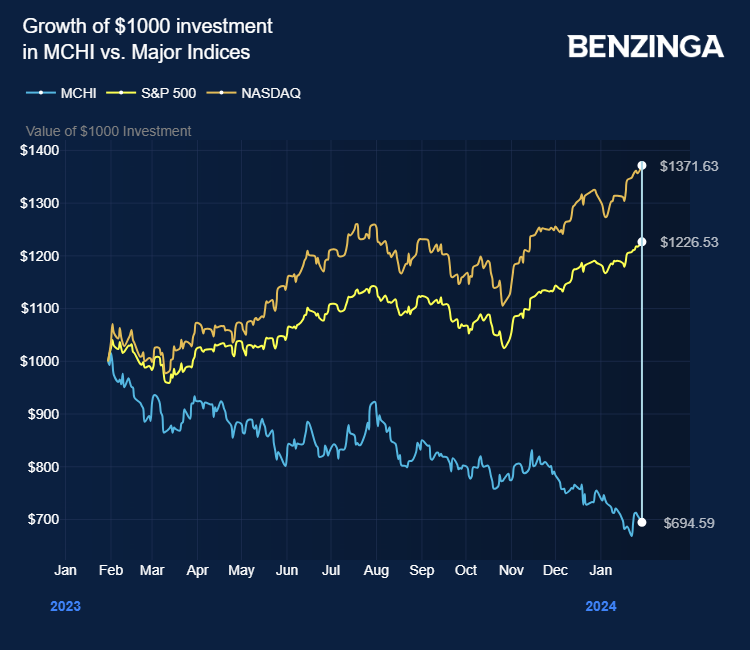

Certainly, for U.S.-listed ETFs tracking Chinese markets, the traffic is all one-way, with fund flow data on the iShares MSCI China ETF MCHI showing net outflows of $473.3 million in the past month. Hardly surprising for a fund that’s lost a third of its value in the past year.

The main problem isn’t the economy. Growth, while not in the double digits of the country’s “economic tiger” years, remains reasonably robust.

Most market analysts put the problems down to politics and China’s trade skirmishes with the U.S. and other western countries, and its ever-deepening internal struggle to sustain the relationship between the Communist Party and the capitalist economy.

Tim Seymour, founder and CIO at Seymour Asset Management, told Benzinga last month that he’d become more cautious on China and that “sentiment is as low as I’ve ever seen it.”

He looked at growing state control through so-called “golden share” acquisitions of companies such as Tencent TECHY and Alibaba BABA.

"Think about Tencent and Alibaba — the pressure is coming from within and not with U.S. investors, and this is part of the problem," he said.

Now Read: Alibaba Springs Back To Life As Co-Founders Scoop Up Shares: ‘It’s Jack Ma — Hot For His Stock’

Photo via Shutterstock.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.