President Trump talks about Bitcoin and he and some other politicians call for a strategic Bitcoin reserve. Plus, we have another week of tech stock obliteration. It’s not that earnings were bad; but rather, that expectations and valuations were so high. Intel INTC is the exception. Their earnings report was bad. We also have lots of negative macro news leading Jerome Powell to talk openly about that expected September rate cut. DKI has been saying “higher for longer” for almost three years. We’re going to need to switch that to “sooner rather than later”. Right or wrong, rate cuts are coming!

This week, we’ll address the following topics:

-

New economic data is not positive.

-

President Trump and a Bitcoin BTC/USD Strategic Reserve. Can this solve part of our fiat debt problem?

-

FOMC (Federal Reserve Open Market Committee) meeting. Everyone wave goodbye to “higher for longer”.

-

The Bank of England cuts rates. Central banks easing everywhere but Japan.

-

Bank of Japan raises rates…to .25%. Now solidly above zero!

-

Another terrible week for the Magnificent 7 market leaders. Apparently, AI spending is not unlimited.

I also want to take another moment to recognize DKI Interns, Andrew Brown and Alex Petrou. These two young people have allowed me to put much of the 5 Things on autopilot while they’ve taken over most of the heavy lifting including selecting topics, contributing thoughtful writing and analysis, and creating insightful graphs and images. When they started working on The Five Things, they each had their strengths and weaknesses. Their outstanding attitude and hard work have changed that. Now, they just have strengths. Great job Alex and Andrew!

Ready for another week of tech stock obliteration? Let’s dive in:

-

New Economic Data Is Not Positive:

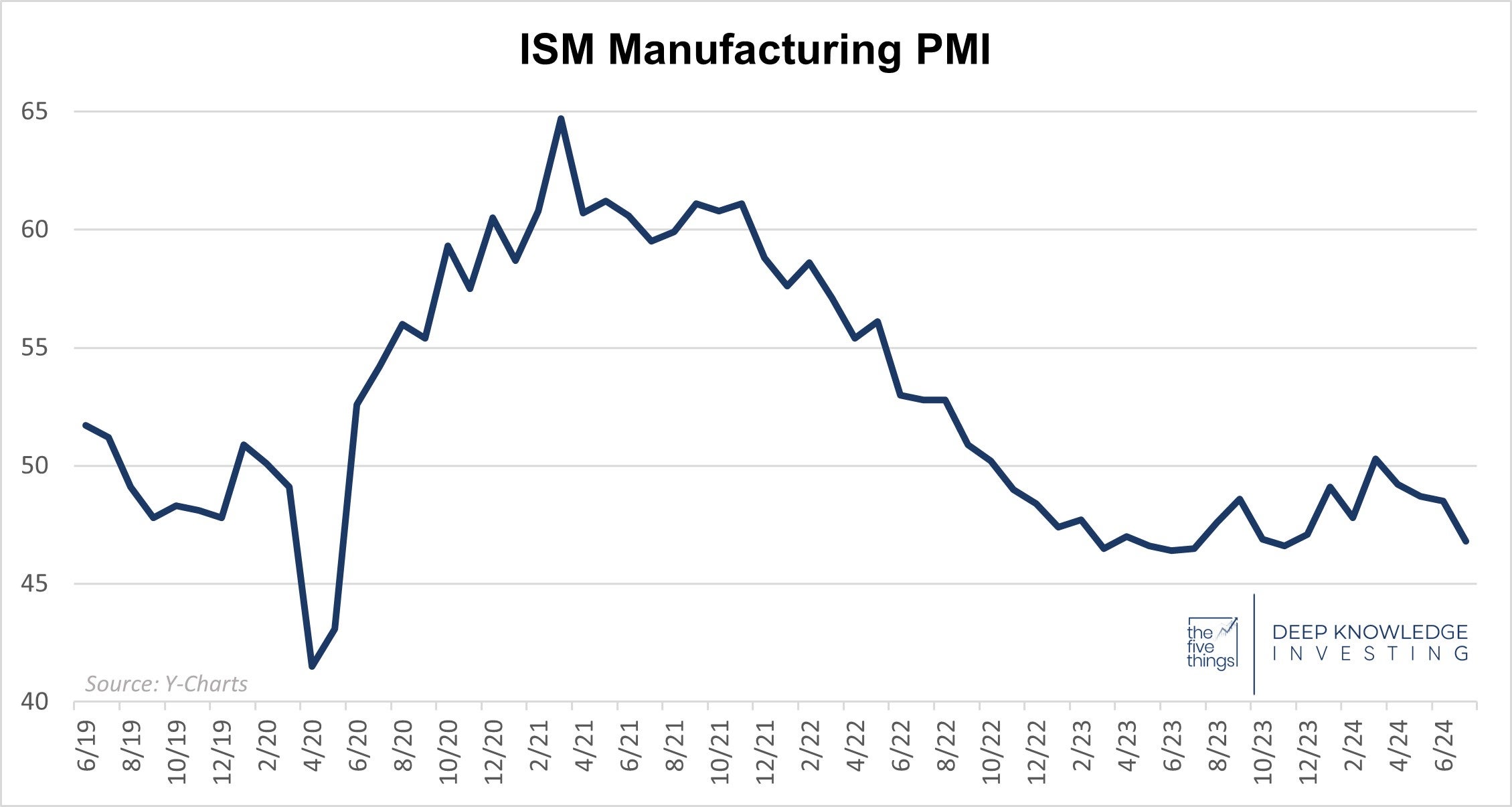

Last week’s employment data painted a dramatic picture for the U.S. economy. July non-farm payrolls increased by only 114,000, a significant miss from the expected 175,000 and a sharp drop from the revised June figure of 179,000. The unemployment rate rose to 4.3%, higher than the anticipated 4.1%. New unemployment claims rose to a staggering 249,000 adding to a weakening employment environment. Wage data provided no respite, with average hourly earnings growing by only 0.2% month-over-month and 3.6% year-over-year, with recent wage gains falling short of expectations and short of inflation. The ISM Manufacturing PMI fell to 46.8 in July from 48.5 in June, far below the expected 48.8, signaling a deepening contraction in the manufacturing sector.

That recent trend is not encouraging. The private sector is struggling.

DKI Takeaway: the market reacted swiftly and negatively to these developments. The US Dollar Index declined while the yield on the 10-year Treasury fell to 3.85%. Despite (or because of) significant government stimulus, the private market economy is struggling so much that the Federal Reserve is likely to cut rates sooner rather than later. While DKI thinks that might not be the right move, it doesn’t change the fact that the pivot to lower rates is coming.

-

President Trump and a Bitcoin Strategic Reserve:

On July 27th, 2024, Donald Trump made his appearance in Nashville, carrying on the torch from RFK who addressed the Bitcoiners one day earlier. After a brief delay, due to the secret service being understandably thorough, President Trump kicked off his speech. RFK had set the bar high, promising to move seized Bitcoin to the Treasury and planning to buy and hold 4,000,000 BTC in strategic reserve (out of a final total of 21MM). The crowd buzzed with anticipation, eager to hear what Trump would say to the Bitcoin community. “On Day 1, I will fire Gary Gensler,” Trump declared, causing the crowd to erupt in cheers. Gensler is unpopular among the Bitcoin crowd for delaying approval of the popular Bitcoin ETFs for years. Trump also promised to forgo any idea of a CBDC and followed this by announcing the creation of a Bitcoin and crypto presidential advisory council, tasked with developing transparent regulatory guidance. “Rules written by people who love your industry, not hate your industry,” he assured.

Photo: Intern Alex photographed President Trump. Laser eyes available to all Bitcoiners!

DKI Takeaway: While President Trump stopped short of committing to a Bitcoin purchase for the Treasury, he did vow to transfer existing seized Bitcoin to the Treasury as a strategic move. In opposition to the preferences of both Trump and RFK, the U.S. government's Bitcoin holdings have decreased by $2 billion since his statement. Though Trump's technical knowledge of Bitcoin might not match RFK's, his overall approach was undeniably bullish for Bitcoin. DKI has been negative on all fiat currencies so we’re in favor of holding hard assets like gold and Bitcoin. DKI also believes the Central Bank Digital Currencies (CBDCs) embody everything wrong with fiat currency combined with an insidious social credit score. We approve of these specific policy ideas.

-

FOMC Meeting:

At the latest FOMC meeting on July 31, 2024, Chair Jerome Powell struck a cautious yet optimistic tone about the U.S. economy. He highlighted progress towards the Fed's goals of maximum employment and stable prices, with unemployment steady at 4.1% (then) and decreasing inflation metrics (disinflation). Powell suggested a rate cut could happen as soon as September, though for now, the Fed kept rates at 5.25%-5.5% and continued reducing securities holdings (quantitative tightening). Aggregate economic activity remains strong with recent reported GDP growth at 2.8% and continued robust consumer spending, despite mixed results in some sectors. While inflation has eased, it’s still well above the 2% target, and underreported, prompting the Fed to stay vigilant. Powell’s remarks on potentially cutting rates before inflation hits 2% were notable, as was his new nod to the Fed’s other mandate; full employment.

RIP “Higher for longer”. Long live “Sooner rather than later”.

DKI Takeaway: Powell’s clarity on considering a September rate cut marked a shift, signaling a more dovish outlook than we’ve seen previously this cycle. I believe the private market economy is struggling and being crowded out by government stimulus, which keeps inflation elevated. Inflation experienced by families remains high, and cutting rates now risks a resurgence which would be a disaster for the Fed and for low-income Americans. Congressional spending cuts would help more than rate cuts, but that’s not going to happen. While my opinion on what should happen might differ, Powell’s mention of a September cut suggests the Fed is likely to follow through on that. A 25bp cut in September is probable but won’t drastically change the economy before the November election. “Higher for longer” just became “sooner rather than later.”

-

Bank of England Rate Cut:

The Bank of England cut interest rates to 5%, marking its first reduction since March 2020, following a narrow vote by its monetary policy committee (MPC). The MPC was divided, with a 5-4 vote requiring Governor Andrew Bailey to cast the deciding vote. The cut was influenced by reduced inflation around the Bank’s 2% target for two consecutive months, despite long-term concerns over persistently high inflation. Governor Bailey highlighted reduced inflation by claiming it was due to the fading impacts of global shocks such as COVID-19 and the war in Ukraine coupled with years of relatively higher interest rates. He stressed the importance of cautious rate cuts to ensure inflation remains low, avoiding drastic or rapid reductions. While the rate cut will offer some relief to borrowers, it is not expected to lead to significant decreases in borrowing costs in the near term. This decision follows a sharp decline in inflation from a peak of 11.1% in October 2022 to the current 2%, driven mainly by easing energy prices.

People keep complaining about too-high rates. I think the problem was caused by more than a decade of too-low rates.

DKI Takeaway: The Bank of England followed other central banks, including the European Central Bank (ECB) and the Bank of Canada, which have also reduced interest rates. These cuts reflect a broader trend among central banks to ease monetary policy as global inflationary pressures have begun to subside and fears of a global recession increase. As the cutting cycle has begun globally the US Federal Reserve remains the most hawkish which has supported the dollar against other fiat currencies. The Bank of England’s newly dovish stance caused the pound to fall to slightly against the dollar.

-

Bank of Japan Raises Rates:

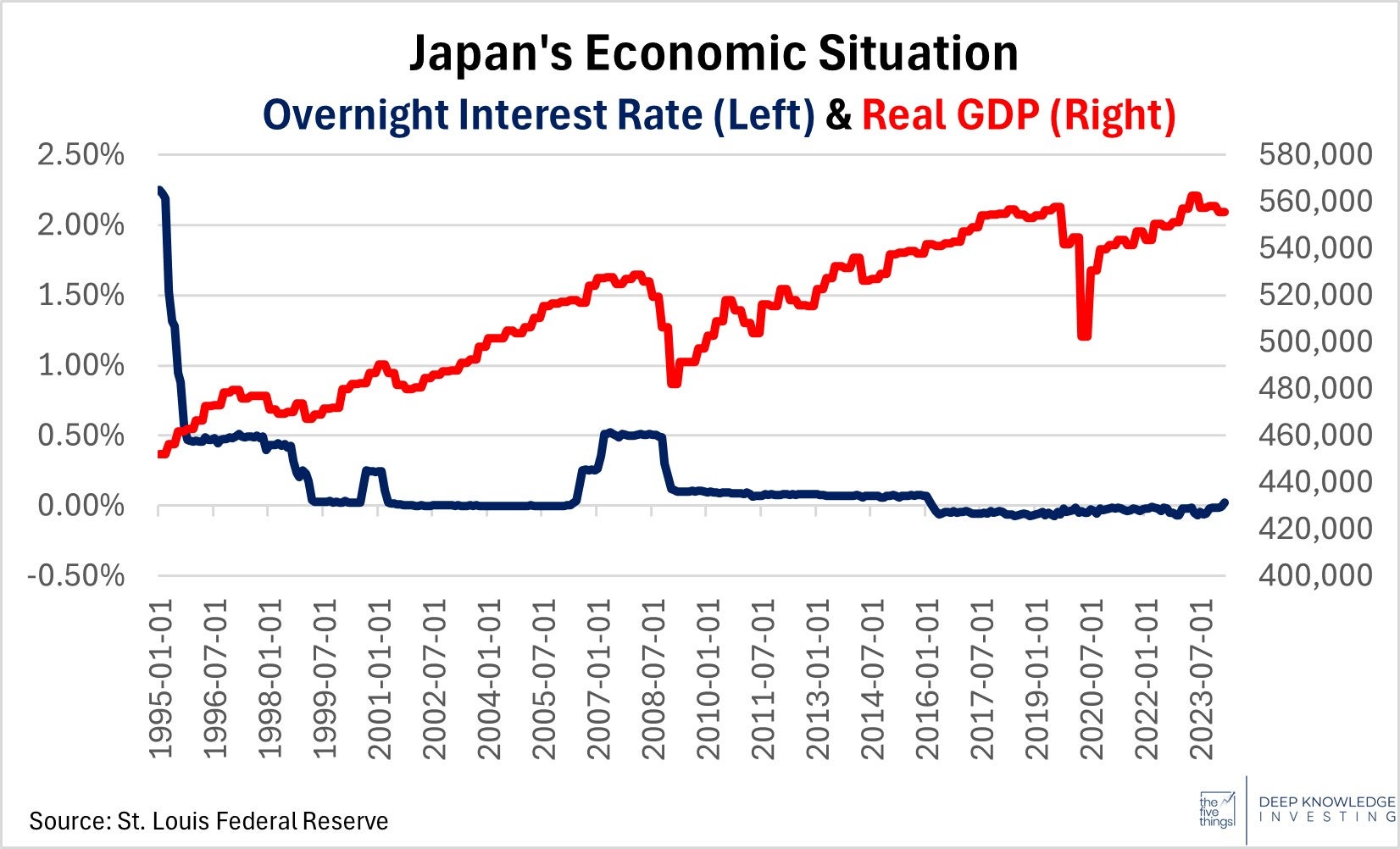

The Bank of Japan (BOJ) announced this week they will raise interest rates to 0.25% from the previous range of 0.0% to 0.1%. This decision follows three consecutive months of core inflation growth. Meanwhile, the Federal Reserve's signal of potential rate changes in September has weakened the dollar and comparatively strengthened the yen. The yen is up on the new rate hike, the U.S.’s coming cuts (sooner rather than later), and the $36.8 billion currency intervention by the BOJ throughout July. Due to rising inflation, Japanese bankers signaled a more hawkish stance, indicating they might raise rates further, but they are not ruling out additional rate cuts this year.

Where is the significant economic increase from negative rates?

DKI Takeaway: The BOJ faces a challenging situation with GDP decreasing in Q1 while inflation rises. Their 2016 attempt to boost the economy with negative interest rates did not address the underlying issue, leading to a debt-to-GDP exceeding 260%. Looking at the chart above, Japanese GDP grew from 520 to only around 550 in the 16 years since they last cut rates to zero. Although the U.S. also has a growing debt-to-GDP, its economic growth allows it to manage higher rates temporarily. If the BOJ continues to raise rates, their interest expense will significantly increase, consuming a larger portion of GDP and leading to more inflation-causing currency creation. Japan is trapped where neither higher nor lower interest rates will solve their problem. I would reduce spending and implement significant government cuts, like Milei's approach in Argentina. We should try that here in the US as well.

-

Another Volatile Week for the Magnificent 7:

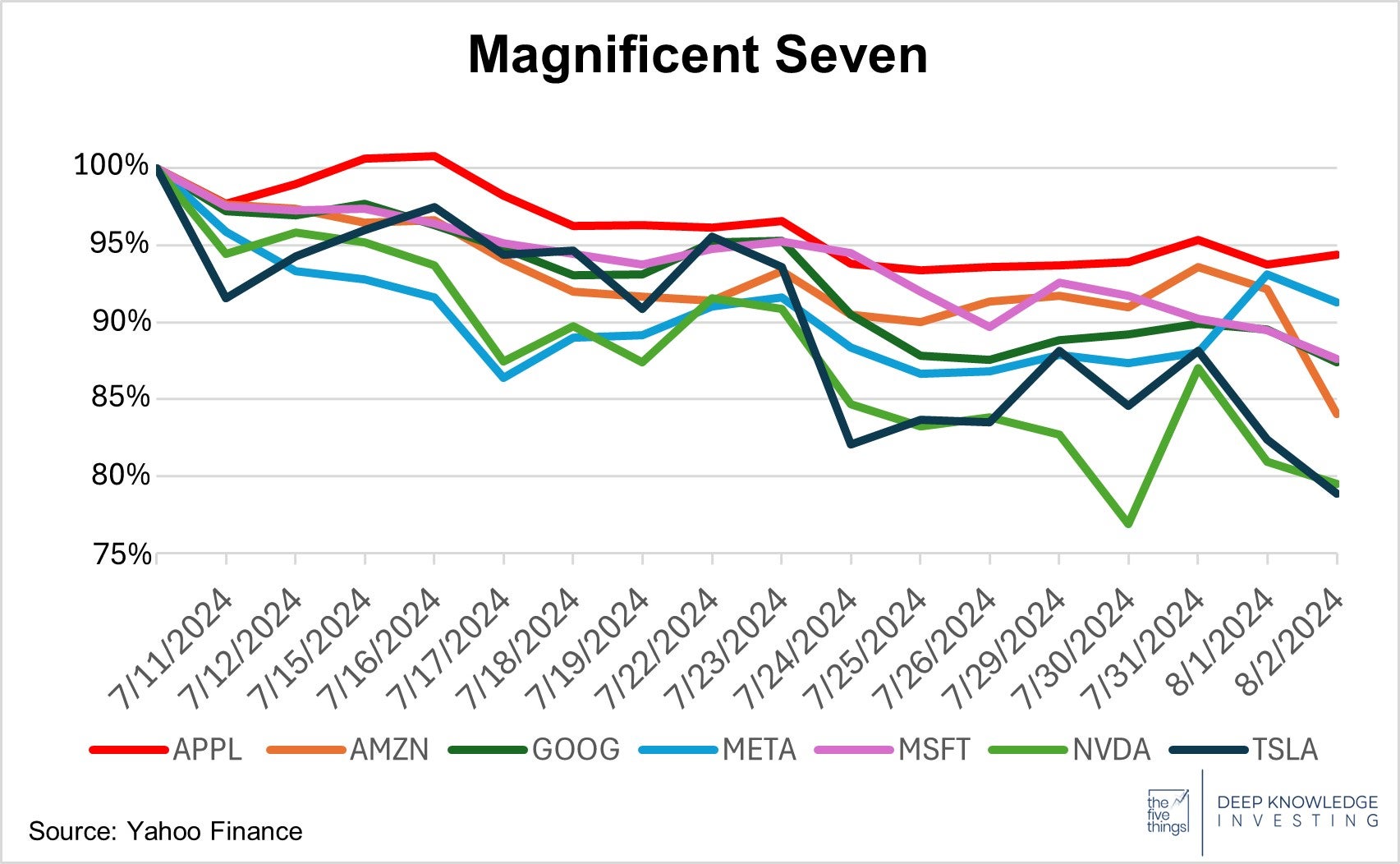

For the third consecutive week, DKI is covering the Magnificent 7 (Mag 7). Following more earnings reports, these stocks and US equity indexes continue to plunge. Meta META began the week with strong earnings, reporting a 22% year-over-year increase in quarterly revenue. Their significant investment in AI is starting to yield results. Apple AAPL reported a 5% increase in top-line revenue, with the iPhone contributing 46% of sales. However, sales in China remain disappointing and iPhone unit sales aren’t growing. The final Mag 7 earnings report for the week came from Amazon AMZN. They missed the revenue target and experienced slowing growth in retail, though they saw strong growth in Amazon Web Services (AWS) and advertising. After Amazon’s disappointing earnings their stock plummeted Friday morning. Intel, which is not part of the Mag 7, experienced a terrible day as its earnings fell short of expectations, and it announced both a dividend cut and layoffs. This caused the stock to drop over 25% on Friday. Intel has faced adversity; losing customers and alienating others with product quality problems.

Nvidia NVDA has led the market for the last year, but is now down 20% in a few weeks.

DKI Takeaway: Most of the Magnificent 7 hasn’t had bad earnings reports. However, when your stock and your sector is priced for perfection, anything less than perfect can cause stocks to fall. The market is starting to worry about these companies spending tens of billions of dollars on AI projects for uncertain future gain. In turn, market participants then worry that even a slight slowdown in AI related GPU orders will reduce the growth rate at Nvidia. Economic data is adding to market wide frenzy. As Powell has signaled a likely September rate cut, the market fears he might have acted too late due to the drop in manufacturing activity and weaker employment numbers. DKI has been saying all year that if we got rate cuts sooner than expected, it would be due to a weak/recessionary economy, and that outcome wouldn’t be good for the stock market.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.