Zinger Key Points

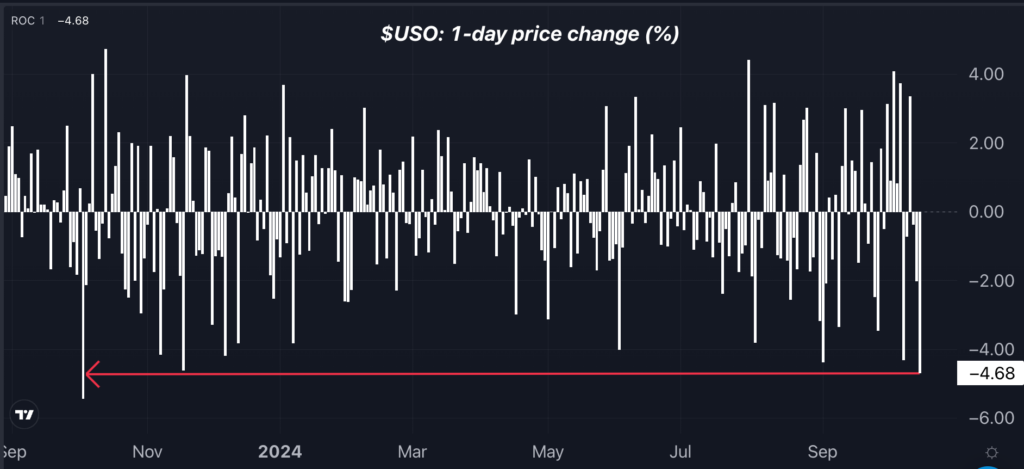

- WTI crude plunges over 5%, falling to $70 per barrel, marking its worst one-day drop in more than a year.

- Israeli PM Netanyahu’s reassurance of avoiding strikes on Iran's oil assets eased fears of supply disruptions in the Middle East.

- Pelosi’s latest AI pick skyrocketed 169% in just one month. Click here to discover the next stock our government trade tracker is spotlighting—before it takes off.

Oil prices took a sharp dive on Tuesday, tumbling over 5% in morning trading in New York, as geopolitical tensions in the Middle East slightly eased after Israeli Prime Minister Benjamin Netanyahu reportedly pledged that Iran's crude oil infrastructure would be spared from any potential retaliatory strikes.

West Texas Intermediate (WTI) crude, the U.S. benchmark, tracked by the United States Oil Fund USO, nosedived to $70 per barrel, down more than 5% as of 10 a.m. ET. This marks the steepest one-day decline in over a year.

The selloff followed a Monday report from The Washington Post that said that Netanyahu assured the Biden administration that Israel would avoid targeting Iranian oil and nuclear facilities in any retaliatory military actions.

The assurance suggested a narrower scope of potential conflict, reducing fears of widespread supply shocks in the global oil market.

Market analysts had previously warned that an Israeli strike on Iran’s oil infrastructure could send crude prices skyrocketing by $20 per barrel, highlighting concerns that Tehran would retaliate by attacking oil installations throughout the Gulf region, potentially triggering a broader energy crisis.

Crude Suffers Worst Drop In Over 1 Year As Middle East Supply Fears Recede

Energy Sector Tanks: US Oil Giants Lead Declines

The immediate reaction in the markets was swift: U.S. energy stocks plunged, while airlines and cruise lines — typically sensitive to fuel prices — enjoyed a sharp relief rally.

The energy sector was one of the biggest losers on the day. The Energy Select Sector SPDR Fund XLE, which tracks major U.S. energy companies, slid 2.8%, setting up for its worst day since late April.

АРА Corporation APA, Diamondback Energy, Inc. FANG and Valero Energy Corporation VLO were the worst performers within the XLE ETF, with declines of about 4%.

Companies involved in upstream exploration and production were hit even harder, with the SPDR S&P Oil & Gas Exploration & Production ETF XOP falling 3.1%. Talos Energy Inc. TALO, Kosmos Energy Ltd. KOS and Crescent Energy Company CRGY each tumbled by over 4%.

Downstream oil service providers also struggled, with the VanEck Oil Services ETF OIH dropping 3.6%. Major oilfield services companies like Schlumberger N.V. SLB and Halliburton Company HAL both fell about 3%, while Transocean Ltd. RIG underperformed, down 5%.

Airlines And Cruise Lines Rally: Lower Fuel Costs, Strong Earnings Expectations Lift Sentiment

While energy stocks suffered, sectors reliant on cheaper fuel prices thrived. Airlines and cruise lines, in particular, were among the best performers within the S&P 500 as the prospect of lower oil prices offered some relief.

Norwegian Cruise Line Holdings Ltd. NCLH surged 4.3%, while Carnival Corp. CCL jumped 5.3%.

Goldman Sachs recently raised its price target on Royal Caribbean Cruises Ltd. RCL from $195 to $220, anticipating strong earnings momentum. Similarly, NCLH saw its price target lifted from $22 to $24.

In the airline space, American Airlines Group Inc. AAL rallied 3.5%, United Airlines Holdings Inc. UAL gained 1.2%, reaching its highest level since February 2020, and Southwest Airlines Co. LUV rose 1.3%.

Read Next:

Photo via Shutterstock.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.