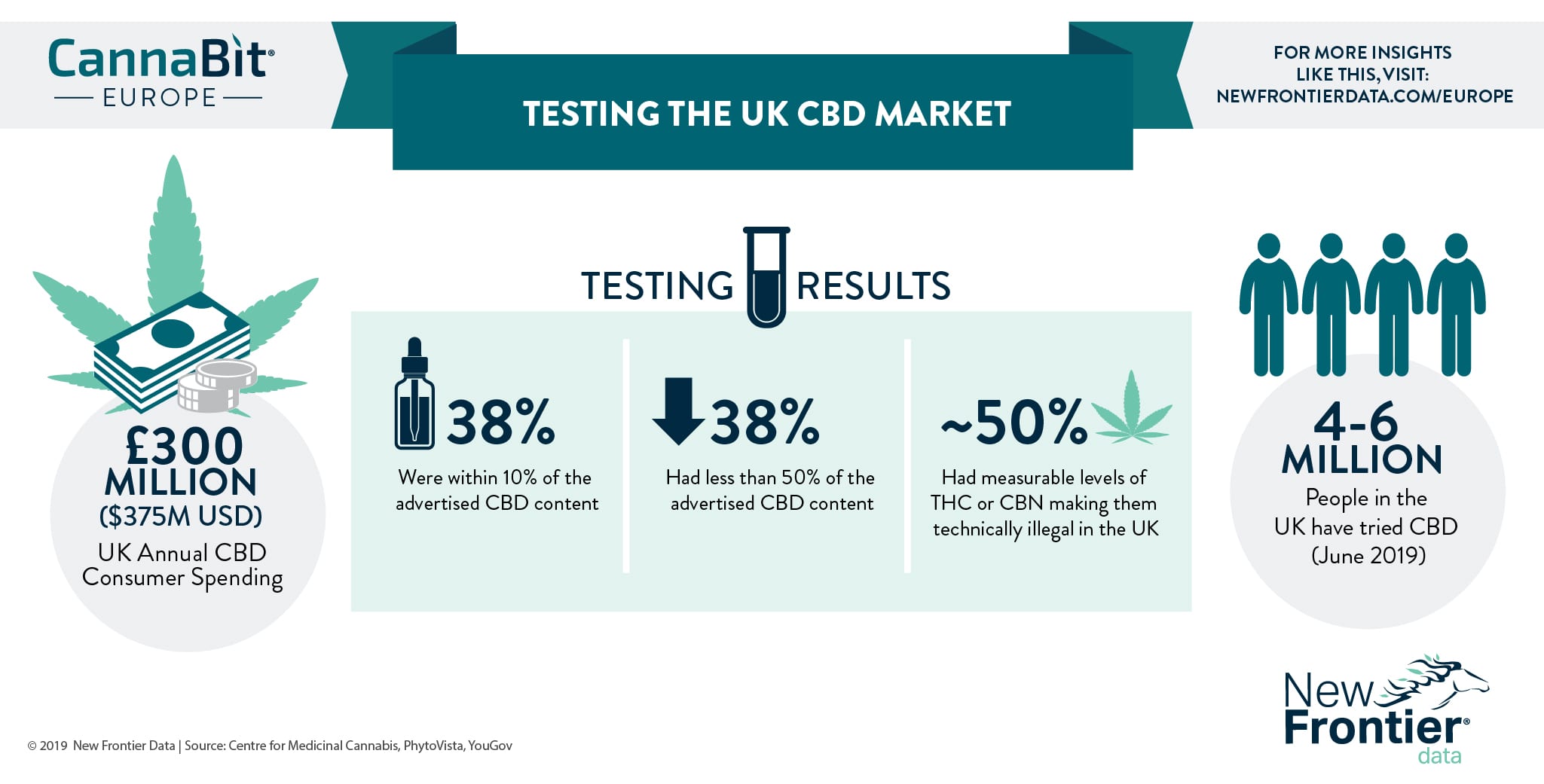

Research has demonstrated that the UK CBD market is a lot larger than original estimates. Reliable research commissioned by the London based Centre for Medicinal Cannabis puts a £300M ($375M) value on the current UK annual consumer spending. It is forecast that this market is growing in double digits each year and will hit £1B per year by 2015.

Uncertainty in the industry surrounding CBD products – due to recent EFSA Novel Foods classification updates (link to previous blog post) – has not dampened the UK CBD market. CBD is legal in the UK and not classed as a controlled substance, unlike THC. The vagueness of the laws governing CBD in the UK has given rise to a profitable, competitive and largely unregulated sector offering a diverse range of retail products.

Any product containing CBD that is used for medicinal purposes is classed as a medicine in the UK and must have a product license, CBD products must therefore avoid making any medical claims or face enforcement by the MHRA.

This legality around medicinal claims contradicts what people use the product for. A sizeable proportion of regular CBD users are deriving – or claiming to experience – a medicinal or therapeutic benefit from the CBD they buy. Most UK consumers of CBD products make their purchases online, despite their wide availability in High Street pharmacies, health food stores, and supermarkets.

The UK's strengths in pharmaceuticals means it is likely to play an important role in the development of pharma-grade CBD. There has been a steep rise in the number of studies globally into CBD's therapeutic potential with 1 in 10 of these studies underway in the UK.

A clear signal that under-regulation is a problem for consumers was the results of a series of blind tests on popular CBD oils on the UK market. The biggest issues related to the accuracy of labels; the presence of controlled substances and some contaminants; and in one example from a high street pharmacy, the complete absence of any cannabinoids.

Only 38% of the products tested were within 10% of the advertised CBD content and 38% of products had less than 50% of the advertised CBD content. Almost half of the selected products had measurable levels of THC or CBN thus making them technically illegal in the UK. One product even had 3.8% ethanol which is over the 3.4% threshold that would qualify it as an alcoholic beverage.

It is illegal for UK farmers to process the flowers and leaves of hemp – a necessary step to produce CBD. The result is that all CBD on the UK market is cultivated and processed in other European countries, such as Bulgaria, the Netherlands, Poland, and Czechia. UK hemp farmers can only watch consumers spending hundreds of millions of pounds on products that are 100% imported.

A change to the law would make hemp a far more profitable crop in the UK. There was overwhelming support from three quarters of respondents to a YouGov survey when asked whether UK hemp farmers should have the freedom to process the flowers and leaves of hemp crops grown in the UK to supply CBD.

Testing information for data

The first major third-party testing exercise to be undertaken of CBD products in the United Kingdom was commissioned for this report. In total, 30 oil products available in the UK (both on and offline) were selected for the blind testing exercise using PhytoVista – a reputable UK-based laboratory.

- The exercise was designed to verify the range of quality of those CBD products being sold today, and to determine where the areas of concern might be. Those areas were defined as health and safety, consumer rights, and criminal law.

- The results are highly revealing and provide a good overview of the true nature of the CBD products being sold in the UK. They reveal a wide range in terms of quality, and some concerning poor practice in a minority of cases. The best products are of very high quality and are good options for today's consumers, but a larger group of products present issues in one area or another.

- The biggest issues related to accuracy of labelling, the presence of controlled substances and some contaminants, and — in one example from a High Street pharmacy — the complete absence of any cannabinoids. Highlights:

- Only 11/29 (38%) of the products were within 10% of the advertised CBD content, and 11/29 products (38%) had less than 50% of the advertised CBD content. One product had 0% CBD.

- Almost half (45%) of the selected products had measurable levels of THC (mean content 0.04%) or CBN (mean content 0.01%), and thus technically illegal within the UK.

- One sample had ZERO cannabinoid content – this was a High Street pharmacy product (30 ml) retailing for £90.

- One product had 3.8% ethanol (3.4% qualifies as an alcoholic beverage)

- Dichoromethane was detectable in 7 products (3.8-13.1 ppm) and cyclohexane was found in one product (27.9 ppm). However, such percentages of solvents and heavy metals are still below the permitted daily dose levels in pharmaceutical products, though above food limit safety levels.

Other data

Two new surveys conducted in May and June 2019 by Dynata and YouGov indicates that between 8- 11% of UK adults respectively – approximately 4-6 million people – have tried CBD.

Those who had consumed cannabis to help alleviate symptoms of any kind were significantly more likely than the group as a whole to have used CBD products in the last year – almost 6 times more likely.

Overall, 7% of the population have used cannabis for medicinal purposes in the past year, rising to 41% among those who have used CBD in the past year.

And support for legalisation of cannabis increases from 47% among the total population to 75% among past year CBD users.

The size of the UK CBD market is more than 5x larger than an estimate by the Cannabis Trades Association of 250,000 users rather than 1.3 million, a market larger than the total UK Vitamin D (£145M) and Vitamin C markets (£119M) combined.

The post Value of UK CBD Market Greater Than That of Vitamin C & D Combined appeared first on New Frontier Data.

Image Sourced From Pixabay

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Cannabis is evolving – don’t get left behind!

Curious about what’s next for the industry and how to leverage California’s unique market?

Join top executives, policymakers, and investors at the Benzinga Cannabis Market Spotlight in Anaheim, CA, at the House of Blues on November 12. Dive deep into the latest strategies, investment trends, and brand insights that are shaping the future of cannabis!

Get your tickets now to secure your spot and avoid last-minute price hikes.