Cannabis legalization advocates often tout the plant's potential to boost state coffers. Among the case studies they cite are Illinois, which reported $52 million in marijuana tax revenue for the first half of 2020; Colorado, which collected more than $244 million from January to August; and California, which is expected to bring in $479 million in pot tax revenue for the year.

With so many businesses struggling throughout 2020 due to the COVID-19 pandemic, it makes sense to legalize weed to address dwindling government funds — right?

Wrong, according to a new study from Anderson Economic Group.

Indeed, the coronavirus pandemic has taken a toll on state budgets across the country, sending local leaders and lawmakers scrambling to find solutions and supplement revenues. But "legalizing recreational cannabis is not a panacea for the immediate shortfalls most states are facing," AEG's Andrew Miller and Kaitlin Lynch wrote in a report published Tuesday.

'Significant Time Lag'

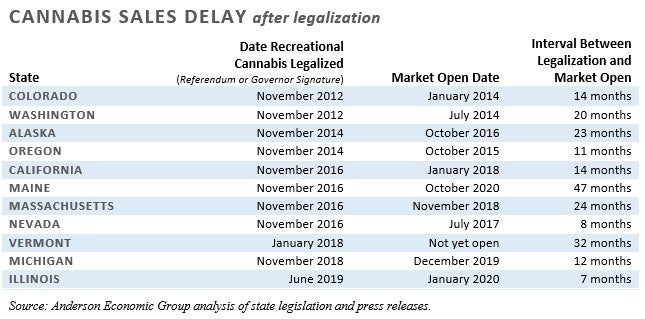

Today, 33 states allow medicinal marijuana use, and they generate tax revenue in their own right. Yet there is often a significant time lag between legalization and the first actual cannabis sales.

“It can take a year or more for states to establish regulatory agencies and for cannabis cultivators and dispensaries to obtain licenses and set up shop," Miller wrote in the report. "States don’t begin collecting cannabis tax revenue until that process is complete.”

To illustrate this, AEG spotlighted 11 states that allow legal recreational use: Colorado, Washington, Alaska, Oregon, California, Maine, Massachusetts, Nevada, Vermont, Michigan and Illinois. In each market, see chart below:

Nevada had the shortest wait — eight months — from legalization to the "market open date."

Maine had the longest wait: 47 months.

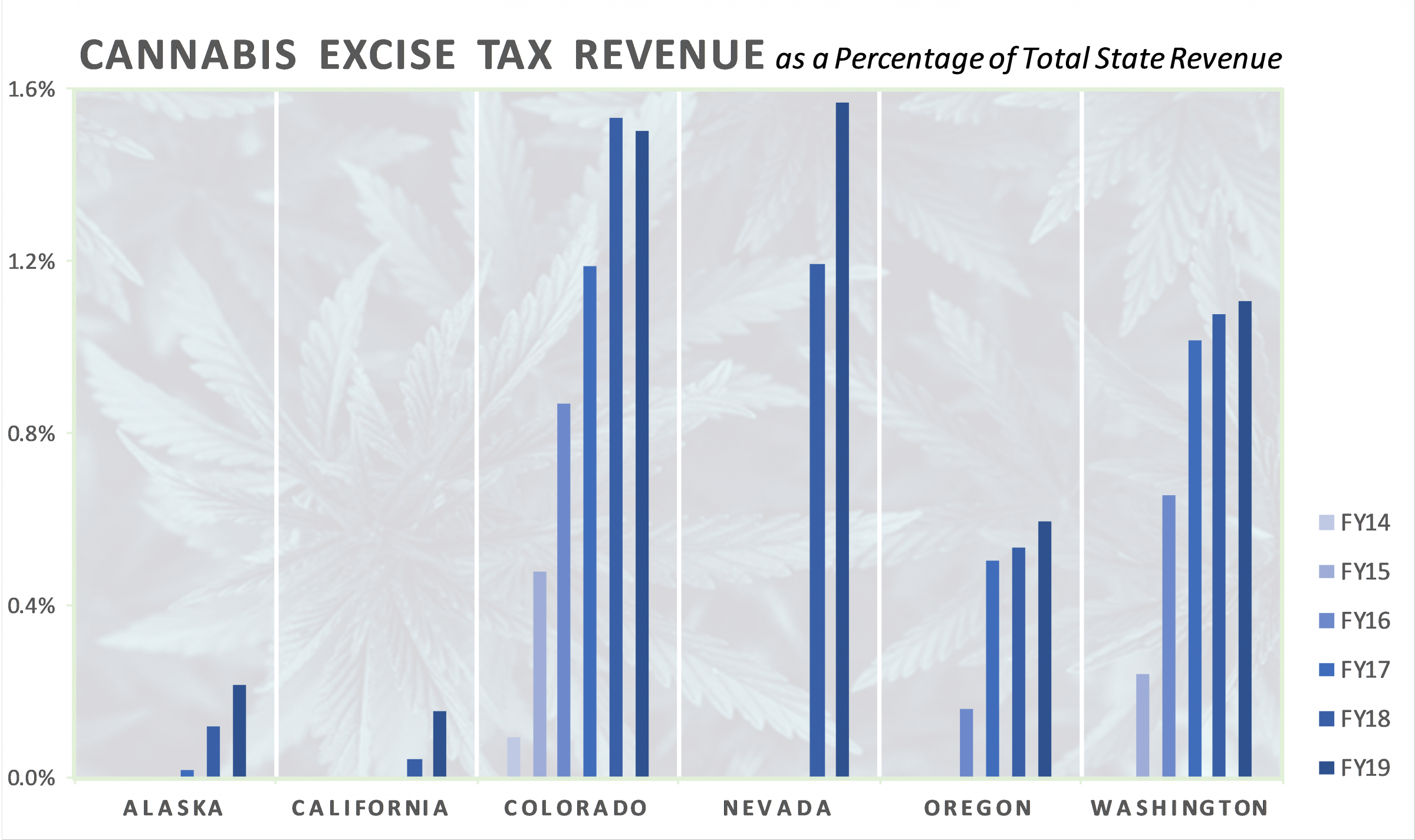

AEG also went a step further to explain how cannabis tax dollars make up just a small slice of overall revenue. See graph below:

Alleviating The Budget Strain

The findings in AEG report are likely not what many cannabis advocates want to hear.

One commentator in Arizona, for example, wrote last week that one "proven source to help alleviate the budget strain" is marijuana legalization, citing The Smart and Safe Arizona Act as the answer to reducing Arizona’s $700-million budget deficit.

Law.com recently published an editorial that said New York could earn billions from legalizing cannabis.

And Charles Gormally, co-chair of the Brach Eichler LLC cannabis practice group, told Benzinga in June that a regulated New Jersey marketplace would lead to reduced law enforcement expenses, new jobs and millions of dollars of new tax revenue.

David Hess, the co-founder of investment firm Tress Capital, shares a similar sentiment.

"Whereas several years ago some debate was possible, there is now indisputable data that state legalization equals job creation and tax revenue," Hess said. "Cannabis is simply one of the few sectors that governments can identify where with the flick of a legal switch, revenue and employment can be found."

But Miller and Lynch's report advises policymakers in not-yet-legal states — Arizona, Arkansas, New Jersey, South Dakota, Pennsylvania, Montana, North Dakota, Virginia, New York, New Hampshire, Florida and New Mexico — to look for other options if they believe cannabis could make for a speedy economic recovery.

"Even when markets are fully operational, cannabis taxes generally constitute a small portion of state revenues overall," the report stated. "Furthermore, legalization can reduce alcohol and tobacco tax revenues as some consumers switch to cannabis, meaning that not all cannabis tax revenue is truly 'new' revenue."

Related Links:

Newsom Revises California's Budget, Expects Millions Less In Cannabis Tax Revenue

COVID-19's Impact On The Cannabis Industry Proves That National Legalization Is Near

Michigan Marijuana Market Has $3B Potential, Says State's Top Cannabis Regulator

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Cannabis is evolving – don’t get left behind!

Curious about what’s next for the industry and how to leverage California’s unique market?

Join top executives, policymakers, and investors at the Benzinga Cannabis Market Spotlight in Anaheim, CA, at the House of Blues on November 12. Dive deep into the latest strategies, investment trends, and brand insights that are shaping the future of cannabis!

Get your tickets now to secure your spot and avoid last-minute price hikes.