National retail sales figures for July included a small segment called “miscellaneous store retailers,” in which the U.S. Department of Commerce included the no-longer-so-small cannabis dispensaries.

With sales at the nation's miscellaneous store retailers increasing by 3.5% in July from June to a record $14 billion — at a time when total retail sales lagged — the Wolf Street Report looked at one state and concluded that the boom was partly driven by cannabis retail sales.

The report's author, Wolf Richter, used California's cannabis market, currently the world's largest, as an example and this is what he found out.

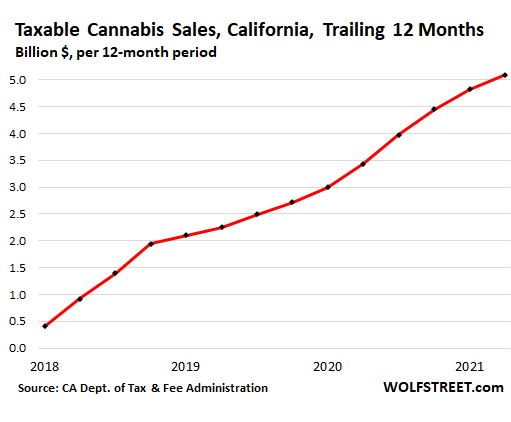

California’s taxable cannabis sales jumped by 11.2% in the second quarter from the first quarter to $1.4 billion, according to the California Department of Tax and Fee Administration (CDTFA) on Friday. Legal sales had soared by 24.4% since the second quarter 2020 and by 108% since the second quarter 2019.

The CDTFA obviously only tracks taxable weed sales and its reports do not include medical marijuana sales, which are not taxable, nor do they include black-market marijuana sales, which are apparently off the charts and often outpace sales in the legal market.

That said, the legal market, in operation since January 2018, is booming.

What we’re seeing here is the growth of the new business of legal recreational cannabis with taxes collected in three areas: excise tax, cultivation tax and cannabis sales tax.

Over the past 12 months, sales of taxable cannabis reached $5.1 billion in California, up by 48% from the same period a year earlier. This chart shows the trailing 12 months for each quarter. “There are not many retailer segments out there with this kind of growth pattern,” noted the Wolf Report.

Cannabis, like alcohol and tobacco products, is an ideal target for heavy taxation. This most likely keeps the black market chugging along and encourages people to get medical marijuana recommendations to benefit from the fact that MMJ is not taxed. Yet, there are still thousands of consumers who walk into cannabis shops every day and buy weed, “hence the red-hot growth of taxable marijuana sales despite the heavy taxes."

With medical and recreational cannabis retailers classified by the North American Industry Classification System (NAICS) as part and parcel of the “miscellaneous store retailers” and if sales at these “miscellaneous” shops keep up their red-hot sales, imagine how things will look when the industry is fully legalized?

“When this industry becomes legal under federal law, the big businesses that have already started circling it will pile into it in a big way. And then maybe, cannabis retailers will get their own NAICS code,” wrote Richter in the Wolf Street Report.

But in the meantime, with or without their own designation, thousands of legal cannabis shops are raking in dollars that are helping to prop up the country's retail economy.

Photo by Damian Barczak on Unsplash.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.