Zinger Key Points

- The report comes as congressional leaders aim to finalize a cannabis banking and an expungement bill.

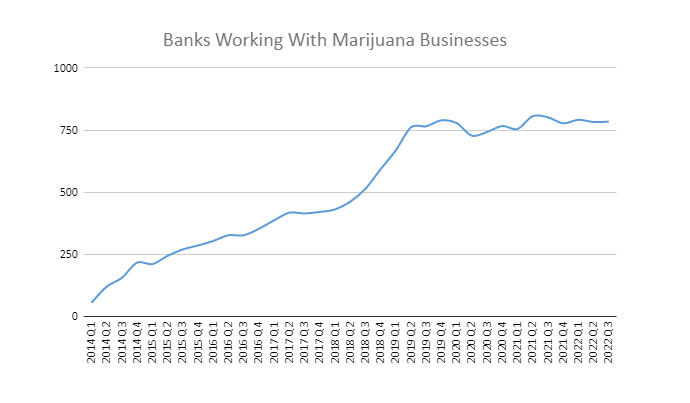

- 784 financial institutions filed requisite Suspicious Activity Reports (SARs) for marijuana-related business (MRB) clients.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

Ever wonder how financial institutions work with cannabis businesses?

A new comprehensive report, released by the Financial Crimes Enforcement Network (FinCEN), provides up-to-date details and a state-level breakdown.

FinCEN, a division of the U.S. Department of the Treasury, is offering new and expanded data on the state of banking in the marijuana industry under the prohibitionist status quo.

See Also: Biden Praises Oregon Gov For Cannabis Pardons

Meanwhile, congressional leaders are working to finalize a cannabis banking and an expungement bill, hoping to pass during the lame-duck session.

What Does The Data Say?

Image by Marijuana Moment

Additionally, starting this quarter, FinCEN is providing information on the types of SARs it has received and which states it came from. That includes marijuana-related SAR data from “non-depository institutions,” which are defined as “financial institutions from casino/card club, money services business, securities and futures, housing government-sponsored enterprise, insurance, and loan or finance company industries.”

“The new metrics were developed using a modified methodology to improve accuracy and efficiency, as well as provide metrics on non-depository institution filers which were not captured in the previous Marijuana Banking Report,” a FinCEN spokesperson told Marijuana Moment. “The updated format now contains metrics on depository and non-depository filers that are submitting MRB SARs and includes additional metrics on regulators and filer states.”

Marijuana Businesses by States: Data shows wide disparities between the number of cannabis-related reports filed by banks in markets across the country. However, this does not reflect the number of banks that work with the industry or the number of cannabis businesses within any given state.

Image By Marijuana Moment

FinCEN says the product is intended to "only provide metrics on SAR filing trends, rather than a deeper analysis.”

Days ago, the FinCEN recently received a letter signed by House Representatives Barbara Lee and Earl Blumenauer requesting data on financial services offered to minority cannabis businesses. Lee and Blumenauer hope to better understand the barriers faced by minority marijuana entrepreneurs, who often cite a lack of access to necessary capital and financial services to enter the legal industry.

Marijuana Banking Expert Weighs In

Robert Baron, an expert in cannabis banking and a Certified Anti Money Laundering Specialist (CAMS), told Benzinga that a simple solution to support the industry would be to update the guidance that underpins the ability to bank cannabis that was issued in 2014 by the FinCEN.

“This will empower bankers to leverage advanced technology and automation while preserving limited and valuable resources to conduct effective Anti-Money Laundering (AML) due diligence that mitigates the real risks posed to the U.S. financial system by bad actors and illicit finance schemes," said Baron, who is also the chief experience officer at StandardC.

Get your daily dose of cannabis news on Benzinga Cannabis. Don’t miss out on any important developments in the industry.

Image sourced from Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Cannabis is evolving—don’t get left behind!

Curious about what’s next for the industry and how to stay ahead in today’s competitive market?

Join top executives, investors, and industry leaders at the Benzinga Cannabis Capital Conference in Chicago on June 9-10. Dive deep into market-shaping strategies, investment trends, and brand-building insights that will define the future of cannabis.

Secure your spot now before prices go up—this is where the biggest deals and connections happen!