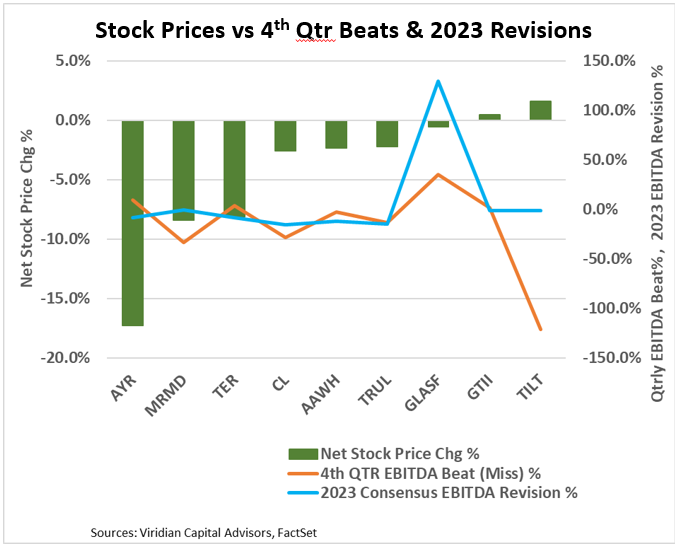

The graph displays the results from 4th qtr earnings releases for the nine U.S. Cultivation & Retail sector companies reported through 3/17/23.

The green bars display the percentage stock price change from two days before the release to two days after, minus the percentage change in the MSOS ETF price for the same period.

The orange line depicts the percentage beat or miss from consensus 4th qtr. EBITDA estimates.

The blue line shows the percentage revisions of consensus 2023 EBITDA estimates from the beginning of March through March 17, 2023.

We have long believed that revisions of estimates for the year matter more than quarterly beats or misses, and the data supports our hypothesis.

For example, AYR AYRWF was the worst stock performer despite beating quarterly EBITDA estimates by 9.7%, partially because of an 8.7% downward revision in 2023 EBITDA estimates.

Similarly, TerrAscend TRSSF had an 8.1% net stock drop despite beating the 4th qtr. EBITDA estimates by 3.4% in part because analysts revised 2023 EBITDA estimates downward by 8.4%.

Tilt Holdings TLLTF is the most dramatic example. The company had 4th qtr consensus EBITDA estimates of $1.9M but had an actual loss of $.4M, a 119% shortfall. Despite this significant percentage miss, TILT had the best relative performance of the group as analysts only revised the company’s 2023 downward by 1.4% to $10.6M.

Investors should pay less attention to quarterly beats or misses and focus on the longer term. Downward revisions of more than 8% in March for five of the nine companies on the chart are noteworthy.

The Viridian Capital Chart of the Week highlights key investment, valuation and M&A trends taken from the Viridian Cannabis Deal Tracker.

The Viridian Cannabis Deal Tracker provides the market intelligence that cannabis companies, investors, and acquirers utilize to make informed decisions regarding capital allocation and M&A strategy. The Deal Tracker is a proprietary information service that monitors capital raise and M&A activity in the legal cannabis, CBD, and psychedelics industries. Each week the Tracker aggregates and analyzes all closed deals and segments each according to key metrics:

-

Deals by Industry Sector (To track the flow of capital and M&A Deals by one of 12 Sectors - from Cultivation to Brands to Software)

-

Deal Structure (Equity/Debt for Capital Raises, Cash/Stock/Earnout for M&A) Status of the company announcing the transaction (Public vs. Private)

-

Principals to the Transaction (Issuer/Investor/Lender/Acquirer) Key deal terms (Pricing and Valuation)

-

Key Deal Terms (Deal Size, Valuation, Pricing, Warrants, Cost of Capital)

-

Deals by Location of Issuer/Buyer/Seller (To Track the Flow of Capital and M&A Deals by State and Country)

-

Credit Ratings (Leverage and Liquidity Ratios)

Since its inception in 2015, the Viridian Cannabis Deal Tracker has tracked and analyzed more than 2,500 capital raises and 1,000 M&A transactions totaling over $50 billion in aggregate value.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Cannabis is evolving – don’t get left behind!

Curious about what’s next for the industry and how to leverage California’s unique market?

Join top executives, policymakers, and investors at the Benzinga Cannabis Market Spotlight in Anaheim, CA, at the House of Blues on November 12. Dive deep into the latest strategies, investment trends, and brand insights that are shaping the future of cannabis!

Get your tickets now to secure your spot and avoid last-minute price hikes.