Zinger Key Points

- States earned record-breaking $4 billion in cannabis tax revenues in 2023 alone, funding vital services and programs.

- MPP report details economic boosts from cannabis, including job and business growth.

- Tax structures and their impacts vary across states, offering key insights for future policies.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

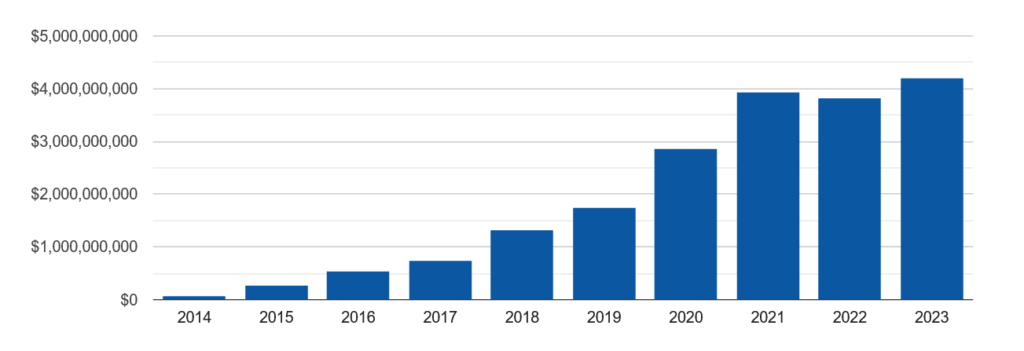

Marijuana Policy Project (MPP) released a comprehensive report showing that states with legalized adult-use cannabis have collectively generated over $20 billion in tax revenue through the first quarter of 2024. This revenue has been instrumental in funding essential public services and fostering economic development across the country.

Record Revenues: Analyzing Structures And Impacts Of State Cannabis Taxes

According to the report, 2023 was a record-breaking period for cannabis tax revenue, with states accumulating more than $4 billion from adult-use cannabis sales alone – the highest in any single year.

The report comprehensively analyzes each state’s tax structure and its effectiveness in leveraging the economic benefits of cannabis legalization. It provides a detailed breakdown of tax revenue, including both excise taxes specific to cannabis and standard sales taxes applicable to cannabis sales. Notably, the report excludes revenue from medical cannabis, focusing strictly on adult-use markets.

As states continue to benefit from record-breaking cannabis tax revenues, it’s essential to explore the future impact of this growing industry. Join top executives, investors, policymakers, and advocates at the 19th Benzinga Cannabis Capital Conference in Chicago on Oct. 8-9. Get your tickets now before prices surge by following this link.

Key Insights From MPP's Report:

- Economic Growth: States with legalized cannabis have seen a surge in job creation and small business development, attributed to the burgeoning cannabis industry.

- Revenue Allocation: Significant portions of cannabis tax revenue have been allocated to public health programs, education and infrastructure projects.

- State-by-State Performance: The report details variations in tax structures and revenue performance across states, underscoring successful strategies and areas for potential improvement.

Notable State Revenue Figures from 2023:

- California: $1.08 billion – A robust market with a mature regulatory framework.

- Illinois: $552 million – Rapid market growth since legalization.

- Michigan: $473 million – Strong sales continue to exceed expectations.

- Washington: $532 million – Consistent revenue growth with high consumer demand.

The MPP's analysis indicates that while all participating states have benefited financially, the degree of economic impact varies based on factors such as population size, tourism, regulatory frameworks and market maturity.

Cannabis Legalization Fuels Jobs And State Programs

"State-legal cannabis sales continue to provide significant economic benefits. With over $20 billion generated in adult-use cannabis tax revenue since the first sales began, the legal cannabis industry is providing much-needed funding for crucial services and programs in states across the country," said Karen O'Keefe, MPP's director of state policies in a press release.

"Additionally, the implementation of adult-use cannabis markets has spurred significant job growth, creating hundreds of thousands of new employment opportunities, along with thousands of new small businesses,” noted O'Keefe.

As DEA moves forward with the rescheduling of cannabis and more states consider legalization, the report suggests that lessons learned from early adopters could guide future regulatory and taxation strategies to maximize economic benefits.

Read also: New Tax Rules In Cannabis: What Are The Consequences DEA Rescheduling?

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Cannabis is evolving—don’t get left behind!

Curious about what’s next for the industry and how to stay ahead in today’s competitive market?

Join top executives, investors, and industry leaders at the Benzinga Cannabis Capital Conference in Chicago on June 9-10. Dive deep into market-shaping strategies, investment trends, and brand-building insights that will define the future of cannabis.

Secure your spot now before prices go up—this is where the biggest deals and connections happen!