By Todd Harrison via Cannabis Confidential (July 16)

Former President Donald Trump selected Sen. J.D. Vance (R-OH) as his running mate in the 2024 presidential election, a choice that could have implications for cannabis policy if the ticket is elected given Trump's mixed record and Vance's opposition to certain modest cannabis reform proposals in the Senate.

Vance, who was elected in 2022, doesn't have an extensive cannabis policy record, but his limited actions and comments on the issue indicate that he's aligned with Trump on one key issue: He backs the rights of states to set their own marijuana laws. He has also said that he's against incarcerating people over low-level possession.

- Click here to get Cannabis Confidential delivered to your inbox daily.

Veteran Move

A Senate committee is urging the U.S. Department of Veterans Affairs (VA) to explore medical marijuana as an alternative to opioids for veterans, and it's asking the agency to consider allowing its doctors to formally recommend cannabis to their patients in light of the Biden administration's rescheduling push.

The appropriations legislation was approved by the Senate panel just days after a GOP-led House committee passed its versions, with reports that include sections critical of the marijuana rescheduling move and raising concerns about impaired driving and intoxicating hemp-derived cannabinoids.

New York High Rise

New York's adult-use cannabis market is starting to show signs of life in 2024. The state's licensed dispensaries reported $261M in sales from January through June, or roughly $43 million per month. This puts New York on pace to top $520 million in adult-use sales this year but with the ramp, the state will likely eclipse $700 million.

Pay-To-Play

After Governor Ron DeSantis vetoed a bill that would severely limit and regulate their industry, hemp executives across the state pledged $5 million in donations to the Republican Party of Florida, according to CBS News Miami.

“We know nothing in life is free and neither was this veto." ← the WhatsApp message group known as Save Florida Hemp.

Stocks & Stuff

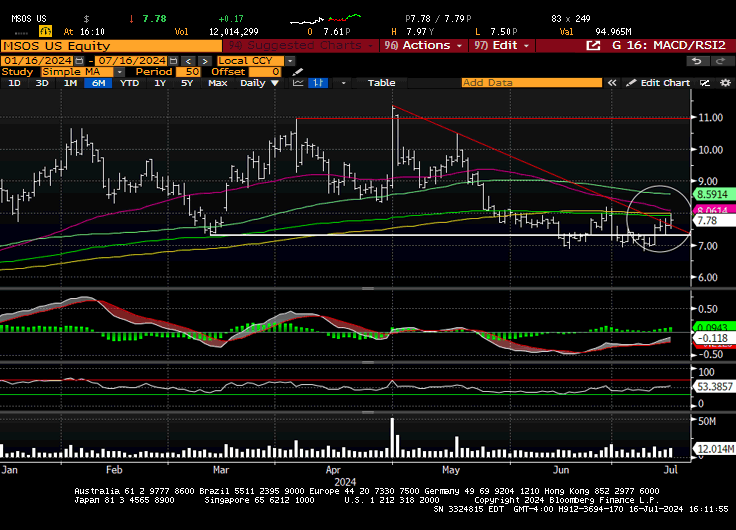

It was an active day in Cannaland. After reclaiming its March lows last week, the U.S. cannabis ETF set a at triple-lindy resistance slightly above the $8 level. MSOS couldn't quite mount that hump, but finished the session better than 2%.

Below, we'll top-line today's price action, de-spackle the wall of worry, check on some early flow, take attendance on banking, and see why all drugs are not created equal.

All that and more, just scroll down.

SPY -1.25%↓ QQQ -2.66%↓ IWM -0.63%↓ MSOS 0.39%↑ ETF Notional: $98M

Top Stories

- Where Trump's Vice Presidential Running Mate J.D. Vance Stands On Marijuana

- Senate Committee Pushes VA To Consider Medical Marijuana As Opioid Alternative For Military Veterans

- New York on Pace to Sell $520M of Cannabis in 2024; Could Crack $700M

- Congress Accidentally Legalized Weed Six Years Ago

- Hemp execs pledge millions to Republican Party of Florida, texts reveal

- Pennsylvania Governor Signs Budget Bill Excluding Marijuana Legalization Provision He Requested, But With 280E Tax Relief For Industry

- Nearly $11M transferred to agencies from Missouri's adult-use canna program

- European cannabis companies start IPO planning as US considers looser rules

- Czech Republic Will Pursue Full Adult-Use Commercial Cannabis Market

- U.K. Cannabis Cannabis Clinics See Rise in Patients

Industry News

- Ascend Wellness gets Commitments for $235M Private Placement

- Curaleaf joins marijuana multistate operators pivoting to hemp-derived THC

- The Senate marijuana banking bill got one new cosponsor for a total of 36.

- The House marijuana banking bill got one new cosponsor for a total of 127.

Pop Quiz 📝

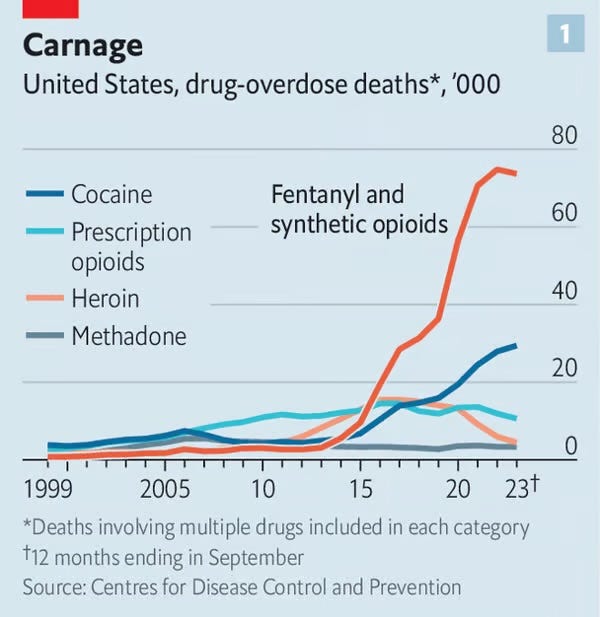

One drug isn't on this list—can you spot it? (hint: it rhymes with fannabis)

Pregame (written 8:00 AM)

After early weakness yesterday morning on the kneejerk reaction to the unfortunate events of the past weekend—and a likelier path to a Trump victory in November—U.S. cannabis stocks clawed back those losses to finish Monday more-or-less flat.

The initial softness wasn't a shocker given the recency bias surrounding Trump 1.0 and Jeff Sessions but "Dems Good, GOP Bad" has been a misnomer the last four years and I'd argue that misperceptions persist despite the reasons I articulated in May.

I’ve been sniffing at other catalysts that could move our space and one stands out: a pro-pot pivot by the other presidential candidate.

That seems plausible for a populist: 91% of the country is supportive of legalization in some form, and the removal of that uncertainty (should the GOP win in Nov.) would be enough to pull some (many) of the fence-sitters into the arena.

That timing isn’t knowable, nor are there guarantees it'll happen, but yesterday we saw reports the Trump campaign will accept crypto, we know that states’ rights is a traditional GOP flex, and it’s not like the Dems haven't left themselves exposed.

And then there are the swing states—Ohio, Florida and Pennsylvania—which will matter in November, polling off the charts and in the process of flipping green.

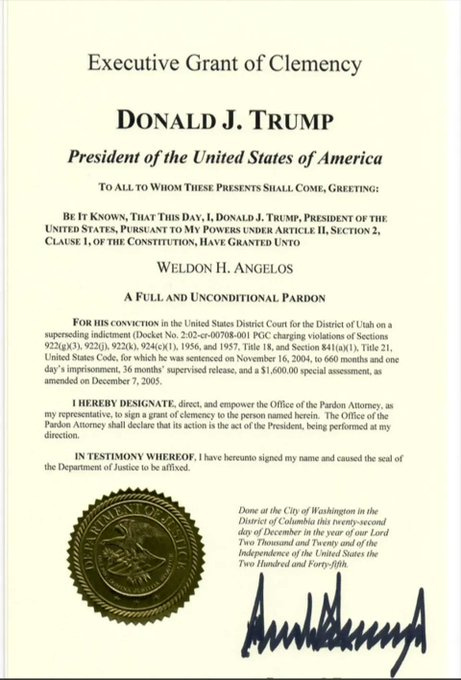

Either way, I know one man who's "a firm believer in mercy and second chances," and that's my friend Weldon Angelos, who was pardoned by Trump in December 2020 after serving thirteen years (of a 55-year sentence) for selling $900 worth of weed.

Digestion

Yesterday's late spurt was attributed to the selection of JD Vance as the V.P. That may not have been as good for canna as RFK Jr. or Vivek, but it was much better than Gov. Glenn Younkin would have been. JD is for states’s rights and criminal justice, he voted no on SAFER (as is) and is an uptick vs. the last GOP VP.

Of course, the money shot is: what does Trump think, and when would those policy planks be made public? I don't know how the weekend will alter those plans but given his new "unity" platform, one could argue there is only one substance in the history of mankind has united civilizations throughout the centuries.

Today's Fray

It was characteristically quiet this morning, that was until just before 10:00 AM when someone bought 8000 October 10 calls and someone else devoured 3000 Sept 10s.

MSOS did nothing for four hours until the ETF began to lift shortly after 1PM, when it added 6% in two hours, trading as high as $7.97. I could almost hear Adam Rich blurt, "Eight is Enough" as the ETF paused, waffled, and closed below that level.

1. Timing/ viability of S3.

The comment period is over in six days; we’ll either get an ALJ hearing or move to a final rule. Don’t have much color on that part of the process so as always, we’ll see.

2. Intoxicating hemp loophole (Farm Bill).

Likely punted to next congress’ and while we expect the alcohol/ farming lobbies to advocate to adjust, not eliminate the loophole, states will continue to shape their own policies, much as they did for legal cannabis.

3. GOP post-election opposition.

This is a biggie and it’s why it’s difficult to gauge how the events of the weekend will shape policy/ timing. We have a high degree of confidence that, at the very least, DT will support states’ rights and SIII, but we have also heard that he may be supportive of banking and exchange-listing (read: good business), as well as clemencies.

4. Custody/ banking/ listing (liquidity)

John Sullivan of Cresco noted that when he asked lawmakers about the likelihood of cannabis banking, they said, “talk to us when it is schedule IIII (ie lame duck), which suggests that SIII, SAFER and the Garland Memo are all still in play, as of now.

5. Federal guidance? (Garland)

We expect the Garland Memo to be released once the final rule is published but we know of no set timeline and it'll depend on what the ALJ does.

6. Pricing pressure/ normalization over time.

Everyone knows that canna prices will normalize lower over time and unit volume will increase but we expect absorption (breadth) to manifest as older demographics age out and science continues to validate the wellness; wider consumer adoption.

7. Sales trends in mature states.

In addition to the increased absorption over time, its worth noting that due to the onerous tax codes and over-regulation, cannabis companies were forced to tamp down on growth initiatives in order to keep the lights on. As 280e goes away, the offenses should head back on the field.

8. Redundancy of state siloed supply chains.

The only cannabis sector in the United States was created by the states for the states, which is something that many of them will defend for their jobs and tax revenues; and while west coast COGS are lower, we don't view interstate commerce as a death knell for MSOs as there will always be demand for high-quality indoor grown canna.

9. Growth (FL? PA?)

Florida is on the ballot, PA, if it wants to get on the ballot, has a small window later this session and there are three other states (ND, SD, AR) with canna initiatives on the ballot. But to those who say, “there are only so many more states,” we would point to the absorbtion and demographic trends.

10. Macro/ political volatility

On July 11, 2020, I wrote, “don’t sell the winners. Come back in a few years, no matter what happens to the broader tape.” I certainly didn’t expect our space to melt (on the lack of custody and a dearth of federal movement + state-level delays) as the market went on a moonshot, but here we are.

IDK when the broader tape will slip, be it gravity, math or a constitutional crisis, but I believe that given our names have been in a financial boot camp for over five years, many of them have become lean, mean, fighting machines.

I suppose we’ll see when our catalysts hit but we remain of the view that this ongoing process will lurch ahead in the next several months, slowly, and then all at once.

AGP on U.S. cannabis

‘We expect a final rescheduling rule before the election. It would be the most notable reform in decades and will likely be the first of several federal dominoes (Garland & SAFER) that'll allow for custody, institutional ownership and acquisitions from CPG.'

Stems & Seeds

Will Cannabis be the new Ibuprofen?

Marijuana Use Linked To Better And More Frequent Sex, Study Finds

Housekeeping

As Stripe debates whether my Substack actually violates their services agreement as a "cannabis-related business" (scoffs), I’ve decided to take some time off from the daily recaps this summer and write when there’s actually something to say.

Subscribers won't be charged and we'll revisit this at a later date, if it’s my decision to make, and I'll continue to focus on the intraday market stuff in real-time on X-subs.

Have a safe night and please enjoy responsibly.

If you'd like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice

Photo: Shutterstock

This article is from an external unpaid contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Cannabis is evolving—don’t get left behind!

Curious about what’s next for the industry and how to stay ahead in today’s competitive market?

Join top executives, investors, and industry leaders at the Benzinga Cannabis Capital Conference in Chicago on June 9-10. Dive deep into market-shaping strategies, investment trends, and brand-building insights that will define the future of cannabis.

Secure your spot now before prices go up—this is where the biggest deals and connections happen!