Zinger Key Points

- Six out of the top eight companies, including Green Thumb Industries, Curaleaf and Trulieve, reduced their cost of goods sold (COGS).

- Every week, our Whisper Index uncovers five overlooked stocks with big breakout potential. Get the latest picks today before they gain traction.

Most financial results for cannabis companies in the second quarter of 2024 are here, and they are revealing some interesting trends. One of them is that U.S. multi-state operators (MSOs) are getting better at cutting costs and efficiency in the supply chain.

It’s no surprise that MSOs have been navigating turbulent times, and showing remarkable resilience. Despite facing pressure from lower wholesale prices, growing competition in retail and extra taxation, most of these companies have managed to maintain, and in some cases, improve their costs performance.

Financial Details

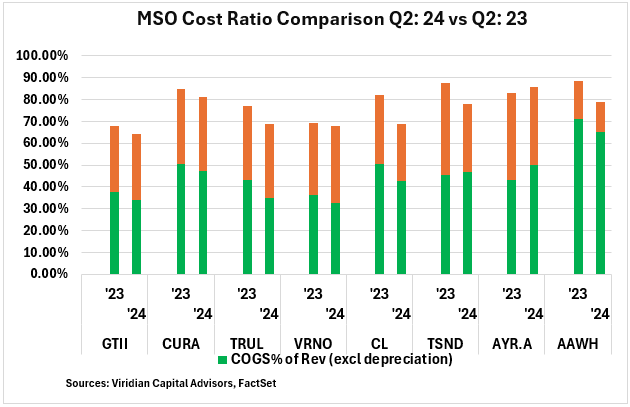

According to data analyzed by Viridian, six out of the top eight MSOs reduced their cost of goods sold (COGS) as a percentage of revenue compared to last year. This reduction shows that these companies are managing production costs more efficiently, even amid challenges. The comparison included Green Thumb Industries GTBIF, Curaleaf CURLF, Trulieve TRUL TCNNF, Verano VRNOF, Cresco Labs CRLBF, TerraAscend TRSSF, AYR AYRWF and Ascend Wellness AAWH. However, AYR and TerrAscend saw an increase in their COGS, indicating they face more significant operational challenges than their peers.

Additionally, six of these eight leading MSOs also reported lower selling, general and administrative (SG&A) expenses relative to their revenues in Q2 2024 compared to Q2 2023. This trend reflects how these companies are tightening their belts, becoming more disciplined in spending and better at efficiency in the supply chain. The reduction in selling expenses likely results from market conditions. As new markets in Ohio and New York expand, these companies expect to benefit from increased sales, which should further improve their financial performance in the latter half of the year.

Read Also: Cannabis Stocks: Canadian Companies Outperformed American Counterparts Last Week

Understanding MSOs And Their Role In The Cannabis Industry

MSOs, companies that manage cultivation, processing and retail facilities across multiple states, have become essential players in the U.S. cannabis market due to the country's unique legal framework.

Because cannabis remains illegal at the federal level, businesses must navigate a complex web of state-specific regulations, rules and prices. MSOs are designed to handle this challenge, allowing them to expand operations across state lines while complying with varying laws. This strategy helps MSOs reach a broader consumer base and achieve economies of scale, driving down costs and increasing efficiency. However, it also increases operational expenses, as compliance with state-by-state regulations adds significant costs.

Recent Q2 reports show that most MSOs are focused on cutting expenses. The potential rescheduling of cannabis could significantly improve their financial performance by reducing the overall tax burden.

- Read Next: U.S. Dollar Soars: How Does This Threaten Your Cannabis Investments? Confidential Insights

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.