AT A GLANCE

- Beef supply could tighten in the coming year due to falling domestic production and lower carcass weights, while pork production is expected to rise in 2023

- Hog markets are typically more sensitive to international politics and trade flow disruption since exports comprise a greater share of U.S. pork production than in beef

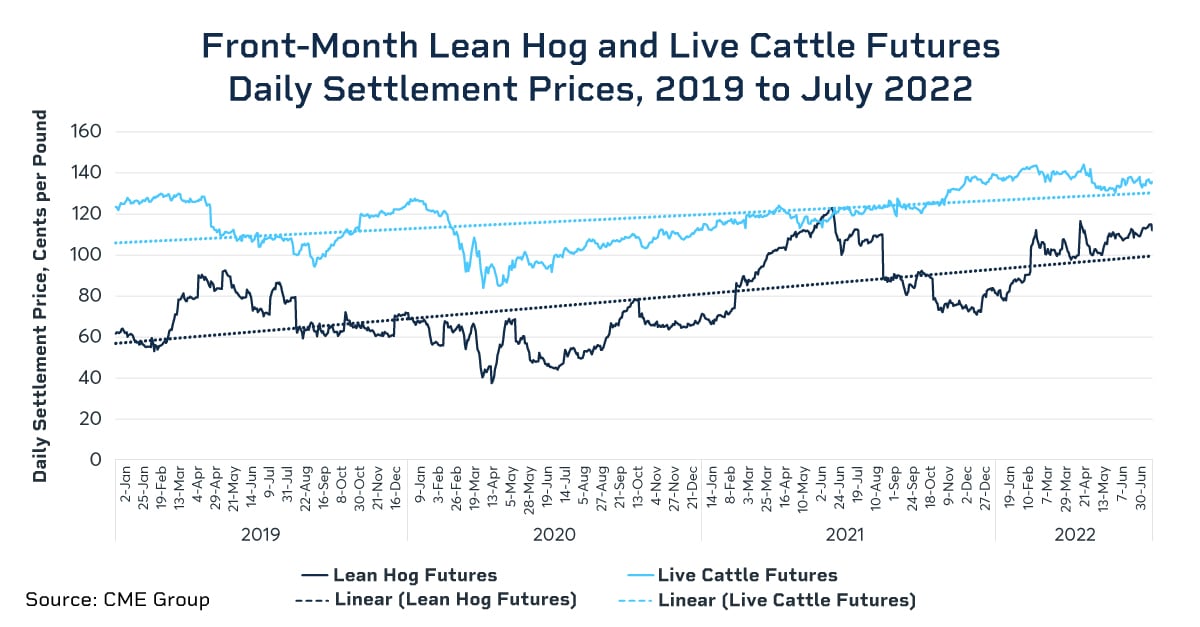

The differing supply-demand dynamics of the domestic pork and beef markets are reflected in the divergent forward curves of CME Lean Hog and Live Cattle futures. The USDA predicts tighter beef stocks in 2023, while production of hogs and pork is expected to rise next year. Other differing fundamentals influence the unique volatilities and export profiles of the two product sectors.

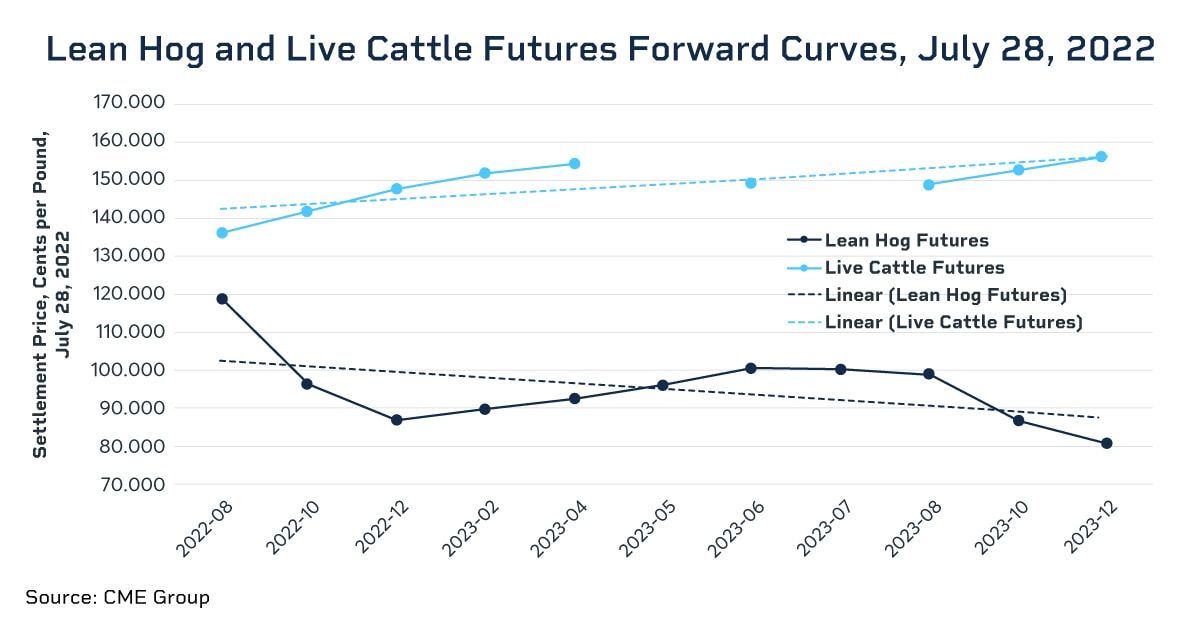

Forward Curves Diverge

The figure below shows settlement prices for each contract month that form the forward curves of Lean Hog and Live Cattle futures on trade date July 28, 2022. At 80.750 cents per pound, December 2023 Lean Hogs futures settled 32% below the front-month instrument (119.125, August 2022), while December 2023 Live Cattle futures (at 156.300) settled 15% above the front-month instrument (136.175, August 2022).

Scan the above QR code for more expert analysis of market events and trends driving opportunities today!

The downward-sloping forward curve of Lean Hog futures illustrates backwardation, a condition potentially indicative of lower future demand and/or higher future supply of an asset. Backwardation can thus signal lower spot prices over time. In short, the asset may be cheaper in the future than it is today. In a market in backwardation, demand for the asset in the near-term is greater relative to supply than for that asset in the long-term.

Alternatively, the upward slope of the Live Cattle forward curve illustrates contango, which potentially indicates higher future demand and/or lower future supply of an asset.

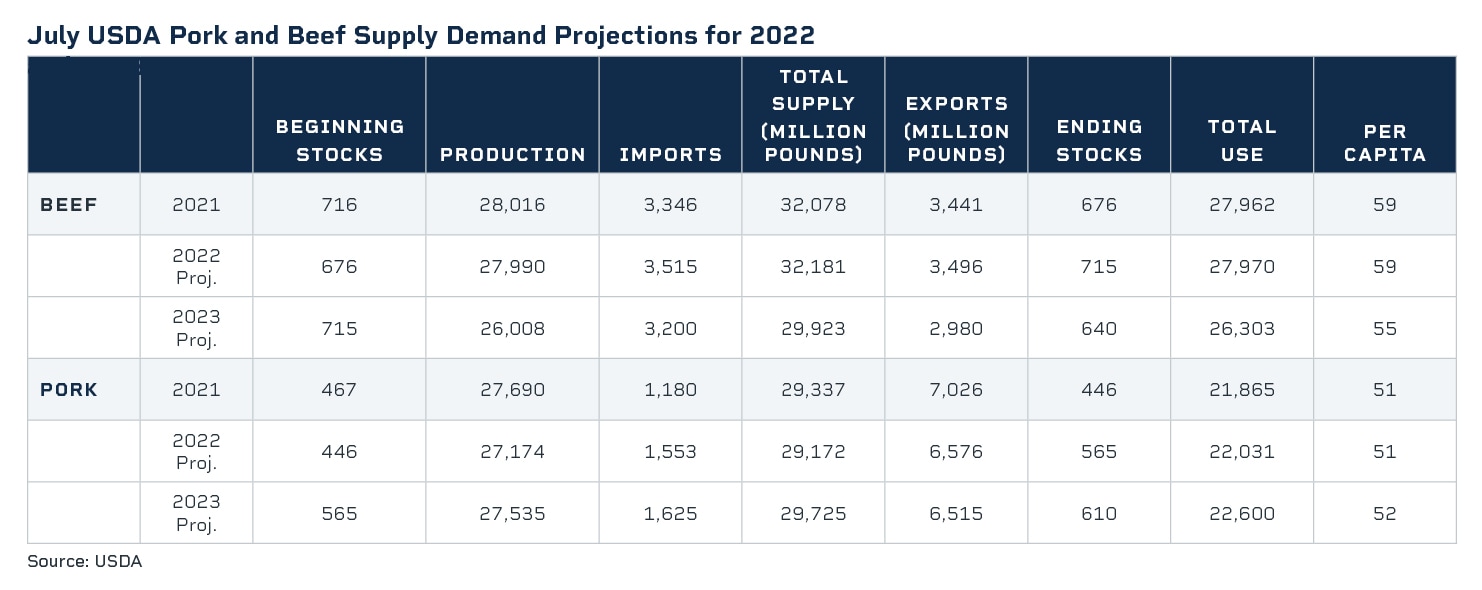

The divergent forward curves of Live Cattle and Lean Hog futures are indicative of opposing expectations of supply-demand dynamics in the coming year. The current USDA consensus for 2023 is that pork production will be 1.3% higher than in 2022, while beef production will decline by over 7% year-over-year from 27,990 million pounds in 2022 to 26,008 in 2023, continuing a downward trend since 2021.

According to the July WASDE report from USDA, beef production will decline in Q4 2022 into 2023, due in part to lower carcass weights. The report also espouses raised expectations of pork exports from strengthening international demand, though total pork exports next year are still projected to fall short of 2022. Accordingly, backwardation in the Lean Hog futures forward curve suggests that the market believes the expected increase in production will outweigh any growth in export demand.

Persistent Fundamentals in Flux

Supply-demand expectations in 2023 for pork and beef coincide with high macroeconomic uncertainty in global agriculture. Supply chains are complicated, weather is increasingly unpredictable, labor supply is tight, input costs are high, interest rates are increasing, feedstocks are expensive, and the politics shaping the future are ever complex.

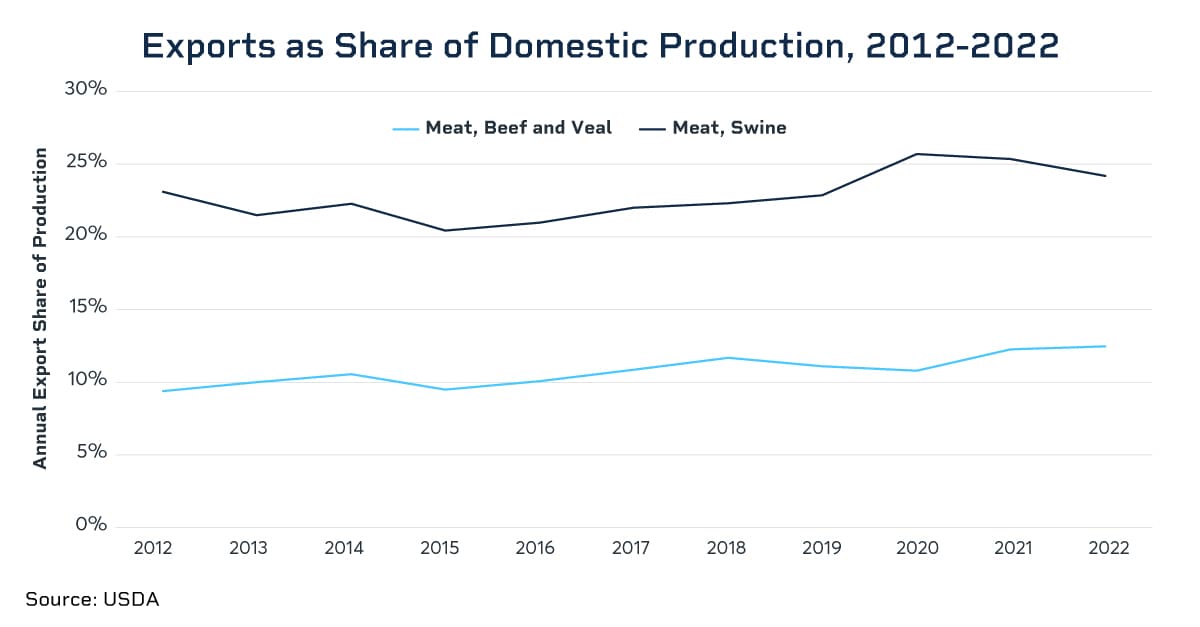

These fundamentals, however, influence hog and cattle markets differently. Exports comprise a greater share of domestic pork production than in beef, making pork (and thus hog) markets typically more sensitive to international politics and trade flow disruption. The figure below shows the export share of domestic production of pork vs. beef and veal annually over the past decade. From 2012 to 2022, between 20% and 26% of pork produced in the United States was exported, compared to only 9% to 12% of beef and veal.

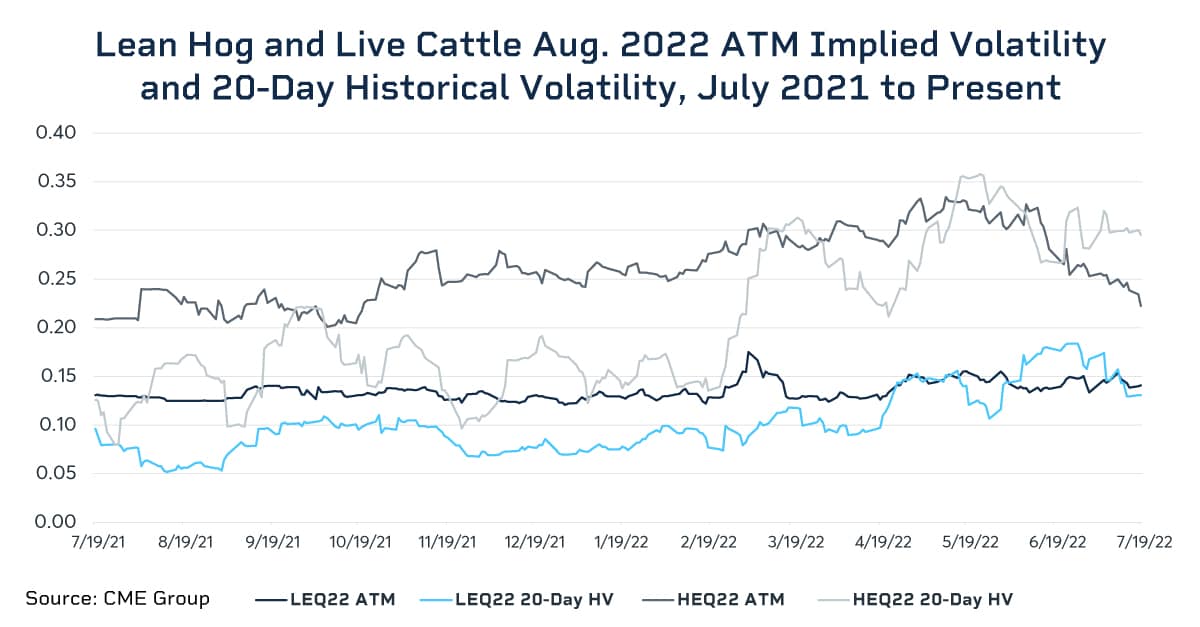

Dependence on international markets makes livestock prices sensitive to a variety of factors; disease, for example, when present in one market can quickly send ripples globally. African Swine Fever (ASF), which has been present in international hog markets, has caused noteworthy trade disruption in recent years. A significant share of U.S. domestic pork is exported to China where phytosanitary policy and national demand can change quickly. These factors underlie the Lean Hog complex’s higher volatility relative to the Live Cattle complex, as seen in the figure below.

The Year to Come

The market appears to be expecting tightening supplies of beef in the coming year due to falling domestic production and lower carcass weights. Pork production and supplies, conversely, are expected to rise in 2023, year-over-year, according to the USDA. Exports for pork, which comprise a greater share of domestic production than for beef and veal, are also expected to fall in 2023 over 2022. Differing fundamental factors will continue to contribute to independent forward curves, export profiles, and historical volatility among Lean Hog and Live Cattle markets into next year.

This post contains sponsored advertising content. This content is for informational purposes only and not intended to be investing advice.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.