Intel Corporation INTC — often viewed as the leader among the manufacturers of chips that power PCs, laptops and gaming devices — is slowly and steadily ceding market share to its closest rivals, namely Advanced Micro Devices, Inc. AMD and NVIDIA Corporation NVDA. Here's a take on where their rivalry stands.

Intel

Intel is slowly shifting from being a PC-centric company to a data-centric one.

PC-centric businesses accounted for 52.2% of Intel's revenue in 2018, while data-centric businesses accounted for the remainder.

The former comprises its platform products such as CPUs, chipsets, systems-on-chip and adjacent products such as modems, Ethernet and silicon photonics.

Intel's data-centric businesses include the data center group, IoT Group, non-volatile memory solutions group, programmable solutions group and all other businesses, including Mobileye.

Intel has waded into the memory, autonomous driving and 5G sectors as well.

Source: Intel

AMD

AMD manufactures semiconductor components used in a variety of electronic products and systems. It makes CPUs used in computers and graphic processing units, or GPUs — programmable logic chips that help render images, animations and video.

Related: Stock Wars: GM Vs. Ford Vs. Tesla. Vs. Toyota

Nvidia

Nvidia focuses on markets in which GPU-based visual computing and accelerated computing platforms provide tremendous throughputs for applications.

Based on the markets to which Nvidia caters, its businesses are categorized into gaming (roughly 48% of first-quarter 2020 revenue), professional visualization (about 12% of first-quarter revenue), data center (about 28.6% of first-quarter revenue) and automotive (roughly 7.5% of first-quarter revenue). Its two reportable segments are:

- GPUs: This segment focuses on GPUs, which accounted for roughly 87% of the total revenue in the fiscal year that ended in January.

- Tegra processors: This segment integrates an entire computer on a single chip, incorporating GPUs that endow supercomputing skills for autonomous robots, drones and cars, as well as for game consoles and mobile gaming and entertainment devices.

See also: It Could Be An Epic Day For These Chip ETFs

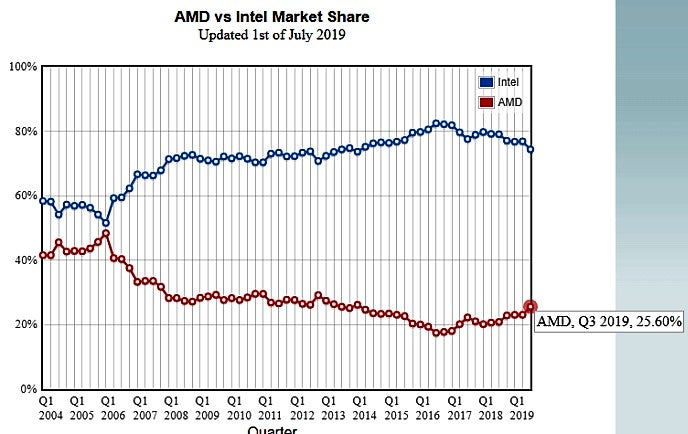

Market Share

CPUs: Although Intel still wields the clout in the market for CPUs, AMD's market share has been on an upward trajectory since troughing in the second quarter of 2007, according to a Techquila report.

Source: Techquila

AMD's fortunes began to take a turn for the better with the introduction of the Ryzen line of microprocessors in 2017.

The recently released Ryzen third-generation processors based on the 7nm Zen 2 architecture have helped AMD make serious inroads into the Asian market, where rival Intel has strong positioning.

AMD's chips had a share of 53.36% of the overall market in Asia just a few days after the launch of the Ryzen 3000 products, Tech Radar reported, citing South Korean retailer Danwa.

GPUs to Cloud Platforms: Nvidia enjoys a near-monopoly in GPUs sold to cloud platforms such as Amazon.com, Inc. AMZN AWS, Microsoft Corporation MSFT Azure and the Alphabet Inc GOOGLGOOGL Cloud Platform.

As of May 2019, the major players had the following market shares, according to Liftr Cloud Insights:

- Nvidia: 97.4%

- AMD: 1%

- Xilinx, Inc. XLNX: 1%

- Intel: 0.6%

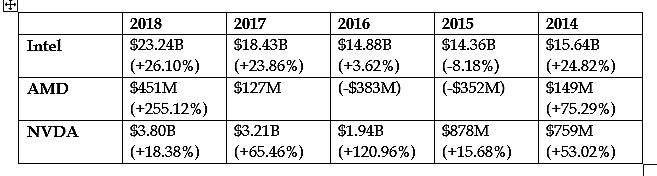

5-Year Revenue Comparison

5-Year Operating Income Comparison

5-Year GAAP EPS Comparison

Fundamentally, Nvidia has been a consistent performer, generating strong revenue and earnings growth over the past five years.

AMD's performance has been commendable in recent years, especially after 2017.

Mirroring the top-line performance, Nvidia's operating profit grew 400% from 2014 to 2018 compared to Intel's 48.59% growth.

AMD, which posted operating losses from 2015-2016, recorded 255% year-over-year operating profit growth in 2018 compared to Intel's 26% and Nvidia's 18.4% growth rates.

Stock Analysis Through Ratios

*AMD does not pay any dividends.

The price-earnings — or P/E — ratio is a basic valuation metric that compares the stock price to EPS growth. A higher P/E ratio reflects investor expectations for higher EPS growth and usually suggests an overvalued stock.

On a P/E basis, Intel appears undervalued, trailing its peers as well as S&P 500 companies.

AMD, though appearing pricey in terms of its P/E ratio, looks like a more affordable buy when considering its forward P/E.

In terms of the PEG ratio, which weighs the stock price against expected five-year earnings growth, AMD appears to have an edge.

Nvidia is overvalued among the three chipmakers from a future earnings growth perspective.

High-growth tech companies usually refrain from rewarding shareholders in the form of dividends, since they plow back most profits into their business, chasing more lucrative investment opportunities. With this thinking in mind, Intel tops the list with a dividend yield of 2.51%, while AMD does not pay a dividend.

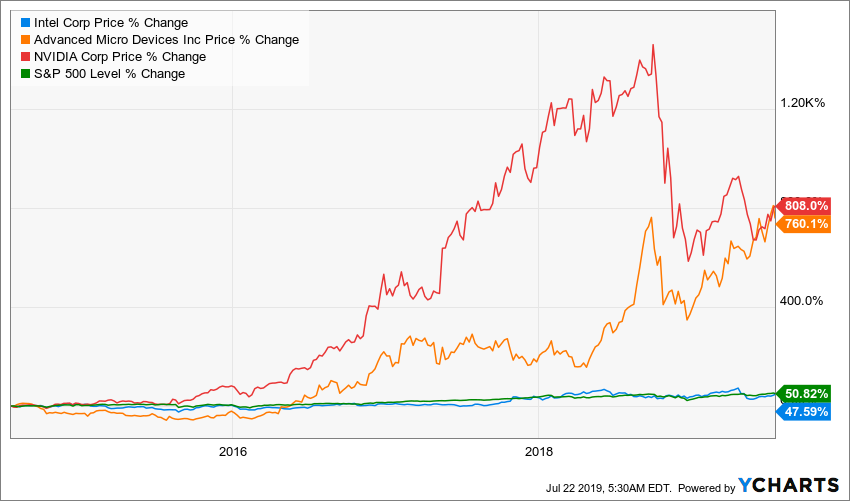

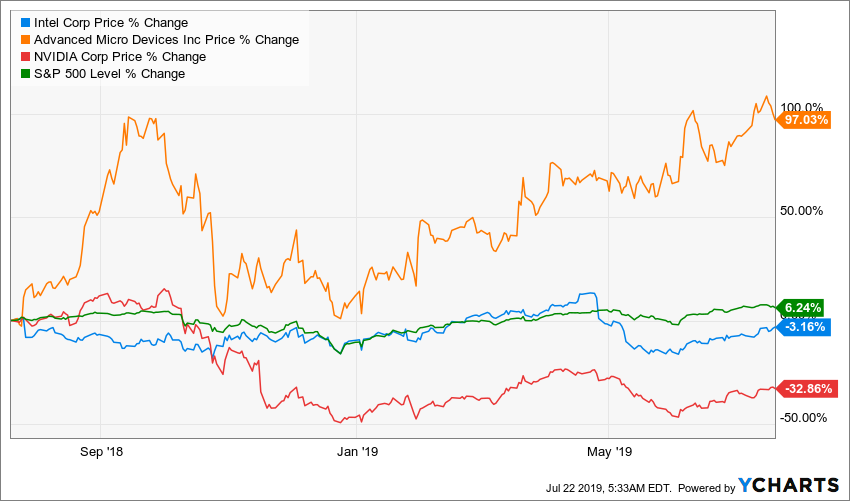

Stock Take

Source: Y Charts

AMD is a runaway winner in terms of its stock performance over the past five years, as well as its one-year return.

The valuation has stretched so much so that analysts have downgraded the stock, citing its pricey nature, despite the company's product momentum and market share gains against Intel.

Nvidia generated a negative return of 32.86% over last year, while Intel recorded a negative return of 3.16%.

In contrast, an investor in AMD would have nearly doubled their investment over the last year.

From a longer-term, five-year perspective, Nvidia leads with an 801% gain compared to AMD's 760.1% and Intel's 47.59%.

Conclusion

From the fundamental perspective, AMD has taken a giant leap forward thanks to its staggering revenue and operating income growth of late.

Even as AMD is pushing ahead with its strong product momentum, Intel is lagging due to the inordinate delay in its 10nm technology.

The company is persisting with its 14nm iterations this year, something that's expected to hurt its competitiveness as it strives to make inroads into emerging areas such as data centers, autonomous driving, AI, 5G and IoT.

Nvidia has also lagged behind, especially after the crypto-mining craze faded.

Although AMD was also hit by the drop-off in crypto mining chip sales, it managed to stay afloat and flourish due to its newest products, helping it make serious inroads into the CPU market. Notwithstanding a stretched valuation, AMD is a name to watch in the chip space in the years to come.

Photo courtesy of Nvidia.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.