The following post was written and/or published as a collaboration between Benzinga’s in-house sponsored content team and a financial partner of Benzinga.

Speculation is at the heart of the cryptocurrency market. Obviously, price speculation is present across all assets, but most thriving cryptocurrencies have survived largely thanks to speculation about their anticipated applications and promised potential.

Of course, this speculative quality has also been at the heart of the volatility in the crypto market. Bad actors and shady token schemes flood the space, new blockchain or contract technology is overhyped or undelivered, financial markets struggle to figure out what crypto means for them, all lead to the kinds of massive spikes and dips that the market has come to be known for.

While 2020 might not calm the crypto market down, it does promise to deliver some important developments that will help the new asset mature and provide a sense of how it might become a core feature in the future of finance.

Based on ongoing and upcoming trends in the cryptocurrency market and through conversations with industry veteran and co-founder of cryptocurrency tracking and tax software company Accointing Alex Lindenmeyer, we’ve compiled a list of five of the most notable cryptocurrency events, trends and developments that are likely to shape the digital asset market through 2020.

The Halvening

The most concrete event that will take place in 2020 is the Bitcoin halving in May, which will reduce the number of bitcoins rewarded for successfully mining a block in the digital ledger by half, from 12.5 to 6.25 BTC. Even though it sounds dramatic, it’s happened twice before and each event saw some interesting price action. In the months surrounding the 2012 halving, bitcoin price went from less than $10 to more than $100 while in 2016 the currency surged from $400 before the halving to more than twice that by the end of the year.

At its face, halving introduces new scarcity to the market and bitcoin traders are already anticipating similar supply-side price growth as the past two halvings. However, traders shouldn’t forget that demand is also necessary in driving price. As bitcoin mining becomes less lucrative, the number of miners competing for a block will fall as will the hash rate necessary for mining until an equilibrium is reached.

Of course, expectations might be all that’s required to see an effect. “There are arguments for and against a price increase, the main argument against it being that the majority of people are expecting it,” said Alex. “What I know for certain is that there will be a lot of volatility due to speculation.”

The halving is aimed at stabilizing the supply of bitcoins as it approaches full saturation and there are no more bitcoins to be mined. After that, well, bitcoins may become rarer and more valuable than gold, or Satoshi Nakamoto could create more bitcoins to be mined so the coin’s price can continue to be moderated, or it could gradually lose value to more abundant or practical digital currencies like Bitcoin Cash, which forked off from the original Bitcoin in 2017 for just that purpose. Ultimately, the world’s first cryptocurrency still needs to decide whether its scarcity alone defines its value.

Enter Libra

The flipside of this is libra, the asset-backed stablecoin that Facebook, Inc. FB announced earlier this year, although it won’t be available until at least the summer of 2020, if and when it clears the necessary regulatory hurdles. In any event, a lot of uncertainties remain about the new stablecoin that has backing from the likes of Uber, Vodafone, Coinbase and even a member of the Kushner family. Part of these uncertainties prompted other interested parties like Mastercard Inc. MA, eBay, Inc. EBAY and Paypal Holdings, Inc. PYPL to bow out of the cryptocurrency altogether.

However, the one certainty around libra is that it will have a potential user base of nearly 170 million in the U.S. alone. Thanks to Facebook’s omnipresence, their adoption of libra and its associated Calibra wallet will mean that users of the social network, many of whom have never touched a cryptocurrency, might suddenly be paying their Uber drivers with the stuff.

Accointing’s Co-founder viewed the issue as a matter of bringing an air of legitimacy to cryptocurrency, saying, “Stablecoins are hugely important to the space. For adoption, it is important to be able to easily switch between a store of value and a stable currency you can use daily. Furthermore [libra] will broaden the understanding that money doesn’t have to come from countries. Alone, the discussion around Libra this year just got people thinking about cryptocurrencies.”

Depending on how well this model is adopted—and pending the already massive scrutiny from government regulators—libra could well mark the point at which cryptocurrency goes mainstream, and other tech and finance companies will certainly follow.

The Feds Step In

Of course, that government scrutiny thing is ultimately a large missing piece of the puzzle. 2019 revealed a growing awareness on the part of federal agencies that cryptocurrency (and technology in general) is beginning to become less a component of society and more of the core element of it. The Federal Reserve revealed recently the U.S. central bank is mulling over a potential digital analogue for the greenback. Meanwhile, the IRS has firmed up its guidance on reporting cryptocurrency transactions for the coming tax season.

Now with one of the biggest and most controversial tech companies in the world getting in on the cryptocurrency game, the cryptocurrency industry will likely see local and national governments pay closer attention to the digital currencies, for good or ill. For his part, Alex sees the current outlook on guidance and regulations in cryptocurrency as mostly benign.

“If you look at tax rulings overall, they haven’t been terribly against crypto [...] they are being extremely progressive, with countries like Singapore, Switzerland, and Portugal making great strides for crypto.” said Alex, “Their policy is undefined, but the government still wants us to pay taxes. I’m just hopeful that next year we will get a lot more clear guidance, specifically on airdrops, and staking,”

While most of the current legislation has been encouraging, ongoing experiments may cut both ways for the larger cryptocurrency market. Supportive regulations like those highlighted by Alex promise to foster growth and increase transparency throughout the industry. On the other hand, highly restrictive regulations like those coming out of China could mean increased turmoil for digital assets.

The Market Consolidates

Turmoil might be a characteristic feature lower on the cryptocurrency food chain. Because, despite flattening in 2018 as the price of bitcoin fell, the number of cryptocurrencies in the market surged to more than 2300 through 2019, according to the latest account from CoinMarketCap.

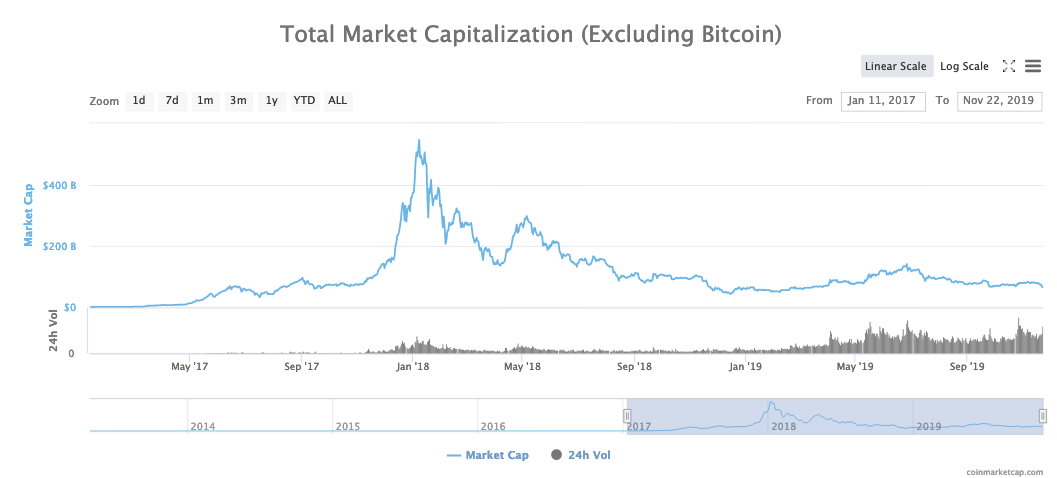

Unfortunately, fewer than a third of coins trade more than $100,000 of volume in a day. Meanwhile, more than a third are valued at less than a tenth of a penny. The result is that there are more coins in the cryptocurrency market now than ever before, but the total amount of capital has flatlined throughout 2019.

While a potential upswing in cryptocurrency interest from mainstream finance might contribute to a subsequent increase of capital, it’s unlikely to trickle down to the very smallest coins. What’s more, as greater scrutiny comes to the market, regulatory burdens and increased transparency among the larger players will likely root out those just trying to make quick coin. In any case, the market has probably reached a saturation point, and the number of available coins is unlikely to grow through 2020.

Crypto And Fintech Hook Up

The overarching theme of all of these trends is that cryptocurrency is growing up, becoming mainstream and finally finding actual use cases, rather than just hypothetical ones. With the introduction of libra, the problem isn’t explaining why cryptocurrency will be valuable and necessary soon but making it valuable and necessary now—do or die.

There are obviously questions about how transactions will be implemented across an array of ledgers or how anonymized transactions can be regulated. Part of this will come in the consolidation of the industry and the continued struggle for interoperability between wallets and ledgers. However, most of these questions will likely be answered by whoever tries first, and financial technology companies are by far the most eager to fill that role.

Explaining how he stated Accointing, Alex said bluntly, “Honestly, the answer is quite simple: there was a need for it and the current tools didn’t cut it for us. The crypto ecosystem needed a platform that can be an investor’s backend system—tracking, management and taxes all in one.”

This necessity of innovation has been an evident trend throughout major areas of the cryptocurrency market. Libra itself is (or was) stacked with members from various fintech companies. Meanwhile, fintech unicorns like Plaid and Chime have reached their valuations largely from investments by companies in the finance industry like Visa Inc. V and Goldman Sachs Group Inc. GS that are curious about digital assets, but terrified of the uncertainty that surrounds them.

The point is, 2020 will be a put-up-or-shut-up moment for cryptocurrency. Either coins start to prove their merit, or they will start to disappear.

The preceding post was written and/or published as a collaboration between Benzinga’s in-house sponsored content team and a financial partner of Benzinga. Although the piece is not and should not be construed as editorial content, the sponsored content team works to ensure that any and all information contained within is true and accurate to the best of their knowledge and research. This content is for informational purposes only and not intended to be investing advice.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.