12:00:23 GMT, December 1, 2020. This is the time and date set aside for Ethereum 2.0’s genesis block - representing the biggest upgrade to Ethereum’s network since its inception, and possibly the largest for any established cryptocurrency. But what does the arrival of 2.0 mean for investors?

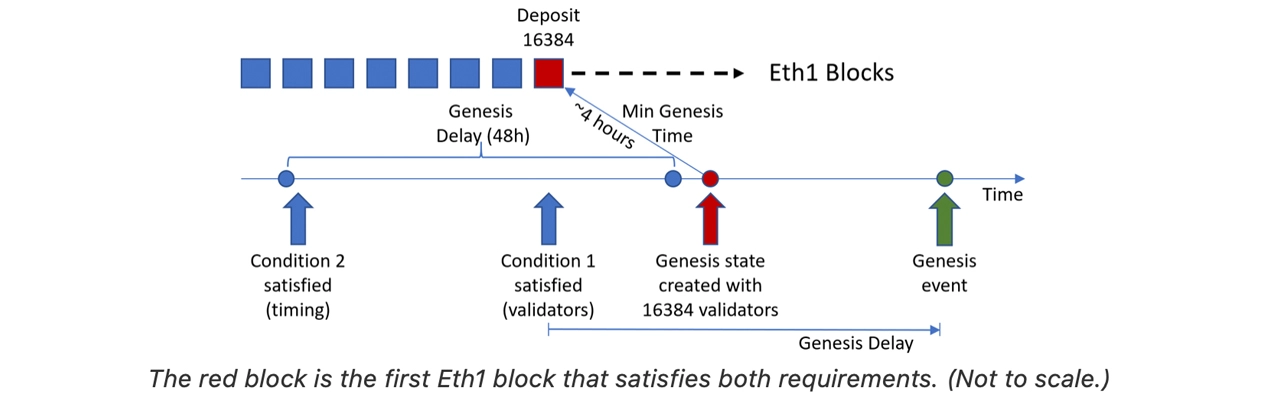

In early November, the Ethereum Foundation commenced the first process of the long-awaited Ethereum 2.0 upgrade specifications, detailing the rules of the genesis phase 0. The phase stated that around 524,288 ETH needed to be pledged with at least 16,384 validators to invoke the proof-of-stake process.

(Image: Bitcoin.com)

(Image: Bitcoin.com)

On November 24 it was confirmed that the deposit milestone had been reached and the genesis process - as detailed in the diagram above - was ready to begin.

The arrival of ETH 2.0 has been welcomed as a momentous achievement for the network, with Ethereum 2.0 R&D member Hsiao-Wei Wang saying: “Thanks to all the Eth2 teams and the community that wrote the history. And thanks to the Ethereum critics who made us stronger. Don’t forget to update your Eth2 client in a couple days.”

But what is Ethereum 2.0? And will its development affect the price of ether in the coming weeks? Let’s take a look at the wider ramifications of the hotly anticipated arrival of 2.0:

What Is Ethereum 2.0?

Ethereum 2.0, otherwise known as Eth2 or simply ‘Serenity’ is an upgrade to the Ethereum blockchain. This upgrade promises to boost the speed, efficiency and scalability of the Ethereum network in order to leverage a better rate of transactions while easing bottlenecks.

The move is set to greatly benefit Ethereum and the many projects that operate on Ethereum’s blockchain, which is more advanced and usable than Bitcoin’s older blockchain framework.

Ethereum’s 2.0 update is set to launch over a series of phases, with the first set to roll out on December 1, 2020. Significantly, Ethereum 2.0 will use a proof of stake (PoS) mechanism, which flies in the face of its original proof of work (PoW) consensus.

Transitioning Towards Proof Of Stake

When it comes to the Ethereum blockchain, it’s essential to validate transactions in a way that upholds the effectiveness of decentralization. Like many cryptocurrencies, Ethereum currently uses a consensus mechanism called proof of work.

This allows miners to use computer hardware processing power to solve rich and elaborate mathematical problems and verify transactions. The first miner who solves a mathematical equation adds a new transaction to the record on the distributed ledger. Subsequently, they are rewarded with cryptocurrency.

However, this process can be heavily draining when it comes to the energy consumption of the miners’ hardware.

Proof of stake is a much more efficient way for transactions to become validated in order to verify a transaction when compared to PoW. Validators simply propose a block based on how much crypto they hold, and how long they’ve held it for.

Fundamentally, this process is much healthier for the environment, due to the significantly lower levels of energy being consumed by PoS verification. Furthermore, PoS also means that there won’t be as much computing power needed for users to secure the blockchain.

How 2.0 Affects ETH Holders

The cryptocurrency landscape is livening up in the wake of bitcoin’s push towards surpassing its all-time high. If you’ve invested in Ethereum and are simply happy to hold, trade or use your currency on decentralized apps, you don’t need to make any changes in order to prepare for Ethereum 2.0. Simply continue using your favorite crypto exchanges to buy and sell ETH or other currencies that run on Ethereum’s blockchain like usual.

However, if you’re interested in taking on the new Ethereum network there is certainly an opportunity for you to begin staking at the Genesis phase of the project instead of waiting for Phase 1.5.

For reference, staking is the process by which validators commit ETH to the Ethereum 2.0 blockchain as a means of proposing the development of new blocks. To become a fully-fledged Ethereum validator, however, ETH holders must stake 32 ETH into the official deposit contract developed by The Ethereum Foundation.

Room For Optimism

If you’re wondering whether your Ethereum holdings will be affected by the arrival of Ethereum 2.0, there may be some clear signs of market optimism among investors ahead of December 1.

(Image: Coin Telegraph)

According to the chart above, there is a significant correlation showing between the price of Ethereum and the total value staked into the ETH 2.0 update.

Ki-Young Ju, CEO of CryptoQuant recently said: “As the ETH 2.0 launch date approaches, it seems to be a growing correlation between $ETH price,” indicating that Ethereum holders may benefit from more market optimism as the update arrives.

Whether the arrival of Ethereum 2.0 and its more advanced capabilities make for a significant push in closing the gap in market dominance between ETH and the king of the jungle, Bitcoin remains to be seen. But it’s clear that Ethereum’s developers are actively seeking to take advantage of their more advanced framework and champion the greater usability of their blockchain.

Life after Bitcoin’s all-time high is entirely uncharted territory. With this in mind, mapping out Ethereum’s future may seem presumptuous. While 2.0 appears to be an ideal scaling opportunity for Ethereum, with long-term prosperity seeming significantly more secure given the improvements, but in the volatile world of crypto, all bets are off.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.