Volumes and open interest for CME Ethereum Futures reached a record high this week, according to data from crypto analytics platform Skew.

What Happened: Daily volume neared $240 million in a single day, and total open interest crossed $180 million. These were the highest observed levels since CME launched its Ethereum futures on Feb 8.

CME Ether futures had a record volume day this week pic.twitter.com/zchWxeA4O5

— skew (@skewdotcom) April 9, 2021

An associate from crypto asset fund Decentral Park Capital, Lewis Harland, highlighted that the all-time high in open interest on CME ETH futures was a sign that institutional demand for the cryptocurrency is growing.

Harland also commented on Ethereum’s “massive supply shortage” and what it could potentially mean for the asset’s price.

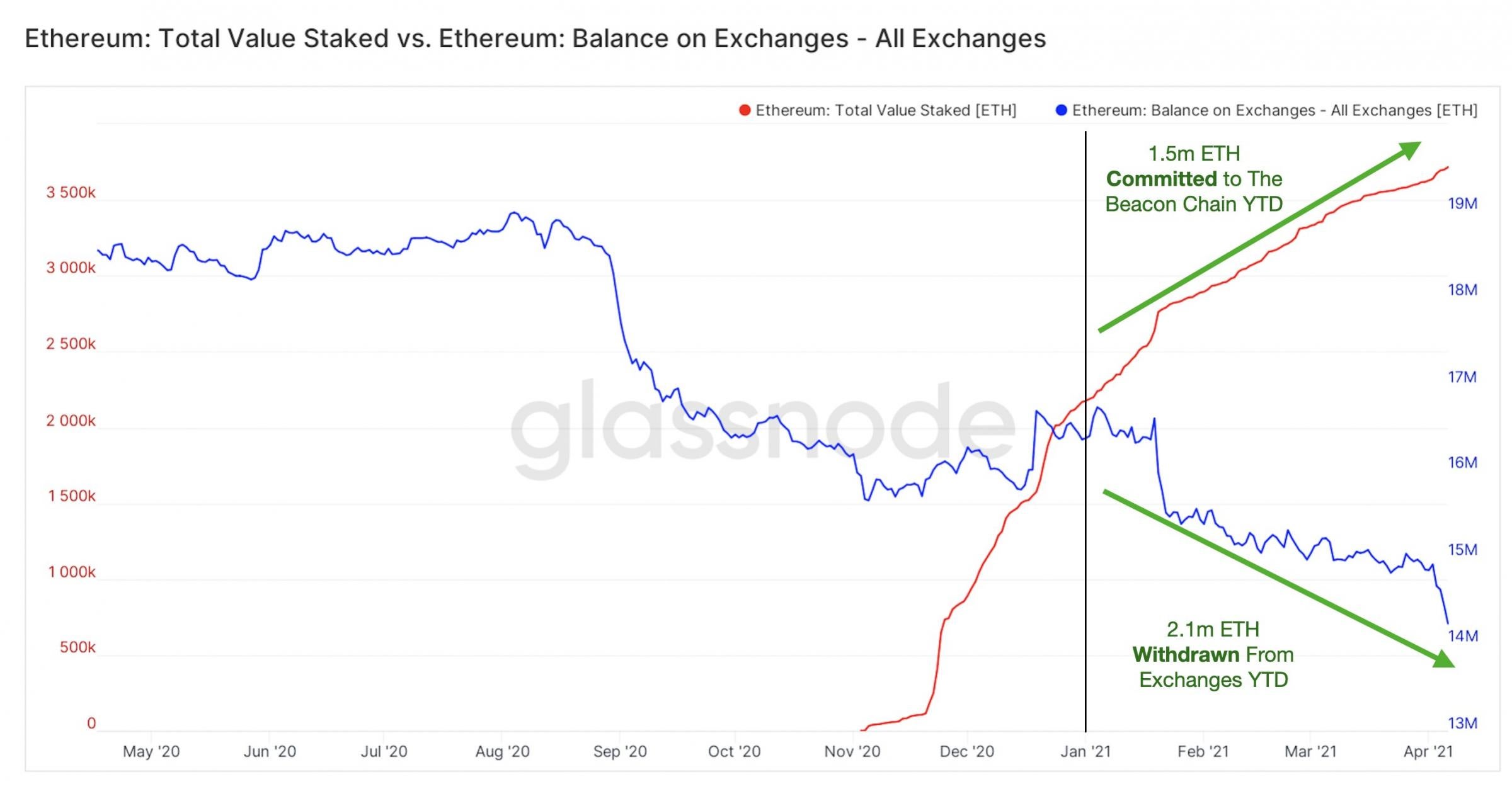

Why It Matters: In a chart depicting the total value of all Ethereum staked vs. balance on exchanges, Harland observed that so far, over 1.5 million ETH has been staked in the Beacon Chain. The Beacon Chain will introduce proof-of-stake to Ethereum as it transitions to ETH 2.0, and staking is a means by which users can keep the network “secure” in order to activate validator software.

In addition to the staked Ethereum, 2.1 million ETH has been withdrawn from exchanges, and that number has continued to fall.

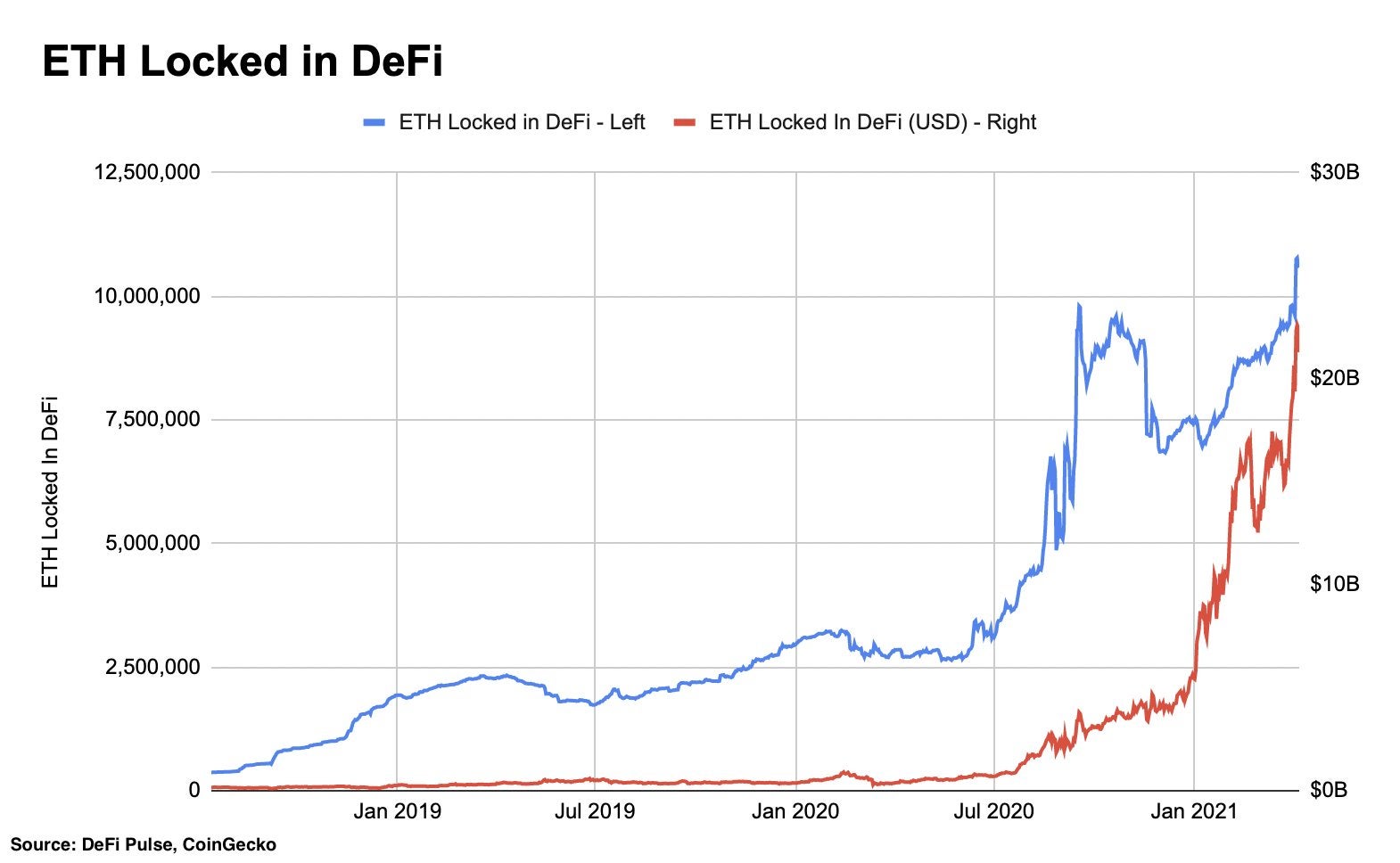

Finally, Harland observed that as of April 5, 10.7 million ETH amounting to $22.6 billion was locked in DeFi, and the current trend confirms that this number is likely to grow further.

If Ethereum’s supply continues to drop amidst rising demand from retail and institutional investors, the asset’s price could have a significant positive impact, according to market proponents.

Price Action: Ethereum was trading at $2,067 at the time of writing, up 1.72% in the past 24-hours. The second-largest cryptocurrency by market cap hit an all-time high of $2,151 earlier this week, according to data from CoinMarketCap.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.