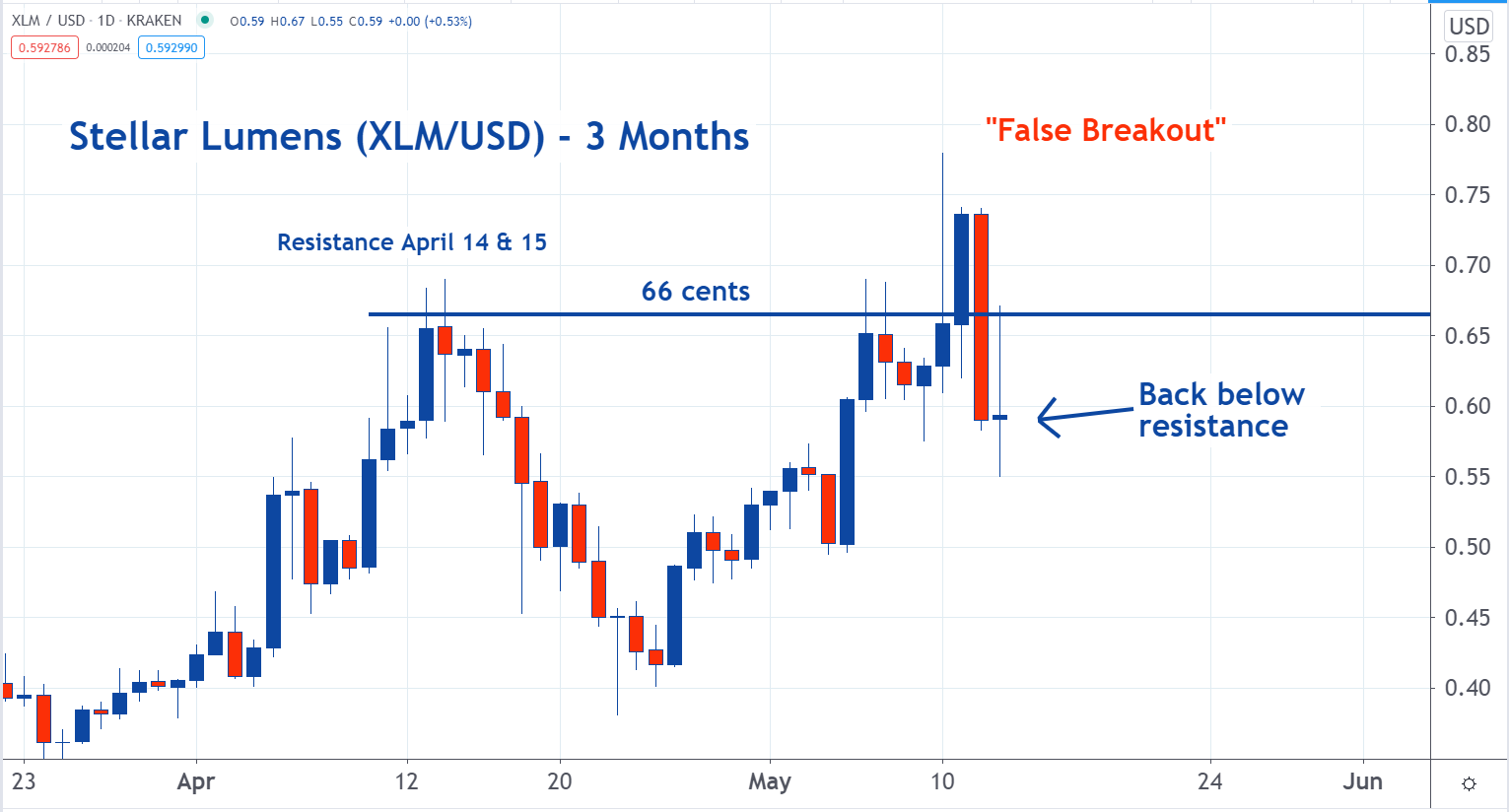

Stellar Lumens XLM/USD had a false breakout Wednesday and a big move lower followed.

False breakouts happen when it looks like a resistance level will break, but the buyers quickly run out of steam and the sellers overpower them.

A reason for this is the use of buy-stop orders. These are buy orders that are placed above the current market. Traders use these orders when they think a market may move higher, but don’t want to commit their money until the new trend forms.

For example, when XLM was trading around 60 cents, traders may have placed their buy stop orders at 67 cents. They can see that 66 cents had been resistance in April. They think that if XLM can break this level, it will continue to move higher.

An abundance of these buy orders was triggered when XLM hit 67 cents. This caused the rapid move higher, but other buyers didn’t come into the market like expected and a big move lower followed.

If XLM rallies, there’s a good chance it hits resistance at 66 cents once again.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.