This column does not necessarily reflect the opinion of the editorial board of Benzinga.

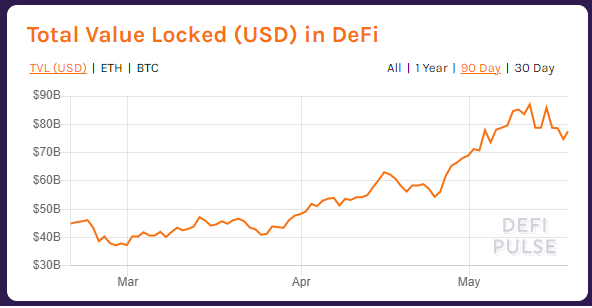

As decentralized finance continues to gain popularity, people are watching its adoption unfold, with multiple projects emerging alongside the market growing over 1000% since 2019. At the time of writing, the Defi market has a market capitalization of over 75 billion.

What Is DeFi?

Decentralized finance, or “DeFi,” is a term used for a movement whose main purpose is to replace centralized institutions such as banks, financial intermediaries, or financial institutions.

With this, it hands complete control to its end-users – taking full responsibility for its money and having access to financial products (such as loans) that otherwise would not be able to without having to rely on a third party.

What’s Driving DeFi’s Adoption?

Looking back to the financial crisis of 2008, it was exacerbated by corruption – with authorities and financial institutions attempting to cover problems from the public.

There is no coincidence that the same year Satoshi Nakamoto released the white paper “Bitcoin: A Peer-to-Peer Electronic Cash System.”

In it, he outlined a decentralized peer-to-peer protocol that could both track and verify digital transactions and generate a public ledger for anyone to see without the need for a third party.

With DeFi, applications are executed public on the blockchain - allowing independent auditing of code to ensure that decisions are made based on what was agreed on.

DeFi represents a more credible narrative to businesses and users because it has products that reveal transactions and better returns than its centralized counterpart.

What Does Ethereum Have To Do With DeFi?

Ethereum is an infrastructure that enables developers to build decentralized applications on its platform, self-regulated by smart contracts embedded into the platform

A smart contract is a code that is self-executing, where the buyer and seller can make a transaction directly with each other when predetermined conditions in the code are set.

Each one of these applications builds and flows liquidity into a decentralized finance ecosystem - with protocols with the highest TVL (total value locked), which includes MakerDao, Uniswap, and WBTC.

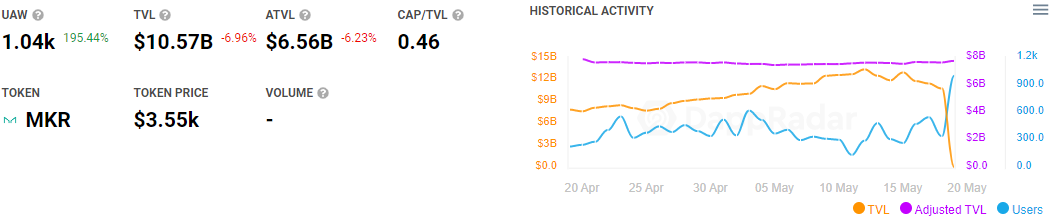

MakerDao’s TVL

MakerDao, currently holding the number one spot of the highest TVL out of all decentralized applications, is a decentralized application built on Ethereum to minimize the volatility of DAI, its stable coin.

DAI is a stable coin that has a more stabilized price compared to the USD – giving users the ability to hold money that retains its value against the deflationary USD.

To understand MakerDao’s full utility, it is important to understand MarkerDao’s utility and governance token, MKR.

MKR is an asset that has a volatile price since it is used as a recapitalization resource to pay collateralized debt positions to generate additional DAI. These collateralized debt positions hold collateralized assets that generate DAI, which creates more debt.

This debt stays locked and inaccessible until the owner pays it back in DAI. With MakerDao, the most important value is the collateral ratio, where the system liquidation point has its own minimum collateral ratio to avoid liquidations.

MarkerDAO is a leader in the lending and borrowing space due to its first-mover advantage and the amount of TVL locked.

MakerDao’s CPDs, Debt, And Collateralization Percent

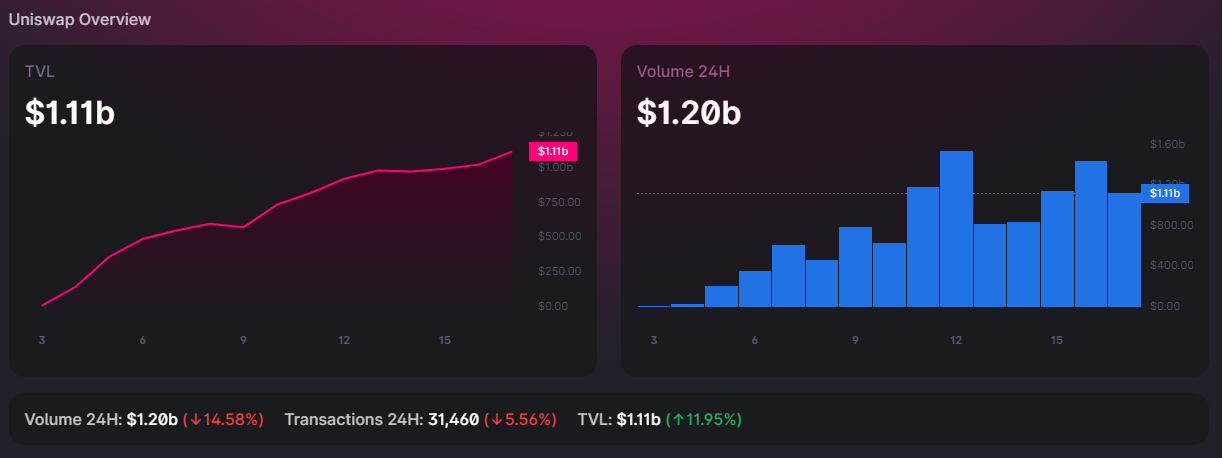

Ranked second, Uniswap is one of the core products of decentralized finance. Decentralized exchanges aim to solve problems that current centralized exchanges have, which include arbitrary fees and mismanagement.

Uniswap takes this problem and allows users to buy and sell liquidity, relying on its pricing mechanism called the “constant product market maker model.”

The thing that makes the constant product market maker unique is that the exchange’s liquidity relies on an equation, "x * y = k," where "x" and "y" represent Ethereum and decentralized applications built on the ERC-20 platform.

"K" is what keeps "x" and "y" constant. When someone buys an "x" token (price), the "y" (supply) of the token will decrease, and "k" is to keep the supply and demand constant.

It is a revolutionary protocol that allows users to trade without complying with any KYC and AML regulation, in addition, to self-regulate its liquidity.

WBTC, with the third-highest total valued locked, is essentially Bitcoin that is wrapped as an ERC-20 token on the Ethereum platform.

With this, users can take the value of Bitcoin and integrate it with decentralized applications.

This gives the open utility of the value of Bitcoin to coexist with Ethereum as a whole.

Ethereum’s Smart Contracts

Ethereum’s smart contracts function as a decentralized broker without the need for traditional financial middlemen.

Only second Market cap to Bitcoin, Ethereum builds a bridge between currency and utility.

Launched as a global computer, Ethereum can utilize business functions using its computational capacity. It was made to scale original blockchain technology.

Ethereum allows developers to build financial applications with these smart contracts, allowing the products to self-regulate with every economic transaction.

Decentralized Finance And The Reliance on Liquidity Pools

One of the decentralized finance’s most notable developments, liquidity pools, is an algorithmic-based protocol that self-regulates the application’s liquidity.

All entering and exiting liquidity in decentralized finance is necessary for its growth – the source of the liquidity, the ability to make trades with its liquidity, and price discovery are necessary for a financial market to mature.

These payments made inbound and outbound are only one piece of the puzzle to be fully decentralized.

It will need the other missing piece – liquidity – to build multiple financial layers on top of financial applications.

An example of a decentralized financial product, Uniswap, is a decentralized AMM (automated market maker) that has its functionality where liquidity for transactions is provided in the form of on-chain pools.

Trades are executed against these pools, where Uniswap utilizes a smart contract model to exchange liquidity without the need for intermediaries to exchange orders.

Uniswap’s Currently Total Value Locked

Another decentralized finance product, Aave, is a protocol is a system that takes its inbound and outbound liquidity for over-collateralization and liquidations to manage.

Users participate as deposit or borrowers – depositors earning passive income, while borrowers can borrow in an overcollateralized fashion.

To borrow, you will need to deposit an asset to use as collateral – and to borrow; it will depend on the value you have deposited and the available liquidity.

And this is all permissionless.

Other Use Cases Of DeFi Applications

One of the decentralized finance’s most common use cases is lending and borrowing platforms – but it does not stop there.

Decentralized finance has other use cases, which include data and analytics, insurance, asset management, and much more.

An example of a decentralized analytics application, The Graph, is a protocol built on Ethereum and a leader in analytics in the decentralized ecosystem, is a decentralized indexing protocol for data on the blockchain.

Developers build and publish APIs called ‘subgraphs’ over the GraphQL API. With the graph, anyone can use the platform to search for data through queries conveniently.

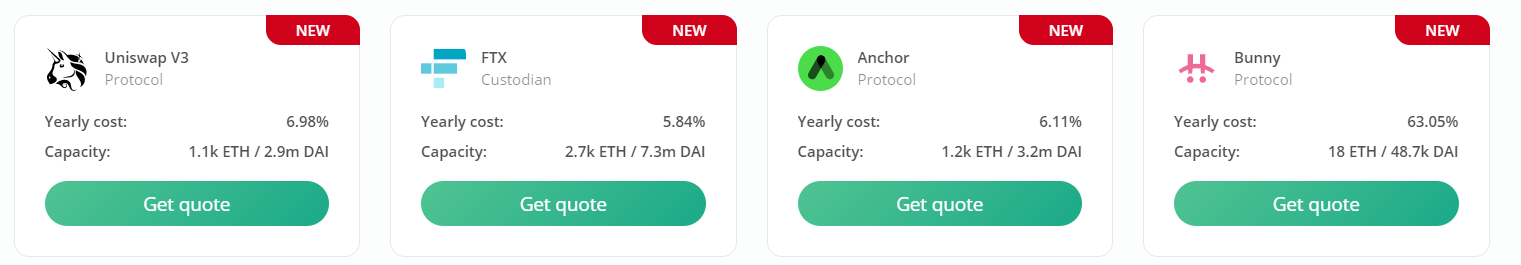

An example of an insurance platform, Nexus Mutual, is a protocol where users can purchase insurance coverage for smart contracts, stable coins, and centralized exchanges.

For Nexus Mutual, there are two ways claims are handled: automatically or using a multi-phase voting process.

For example, if a price of a stablecoin drops below a specified threshold, anyone with an active policy can make a claim and receive reimbursement up to their policy maximum.

Yearly Cost And Capacity Of Certain Insurance Protocols

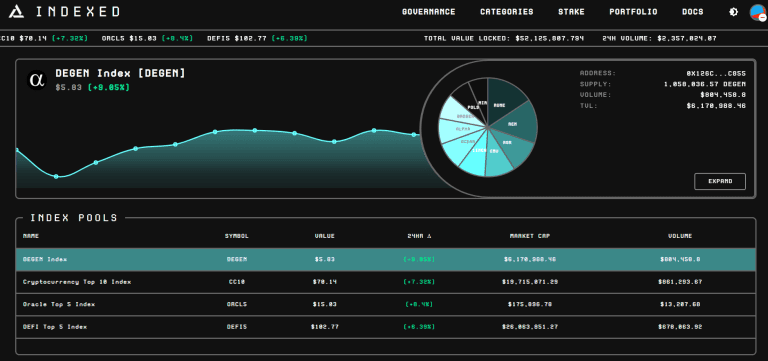

An example of an asset management platform, Indexed Finance, is a platform that is managed solely by the community designed to replicate the behavior of index funds – which have returned better returns than an actively managed fund in the stock market.

Indexed Finance Passive Portfolio Management

Indexed Finance is built on tokenized portfolios that double as AMMs.

The pool contract is designed to be able to radically change the position of its portfolio without needing to access external liquidity.

Indexed pools simplify asset management on Ethereum the way that index funds do for the stock market: by creating a single asset that represents ownership in a diverse portfolio that tracks the market sector the index represents.

DeFi As An Alternative To Tradition Finance

Financial services and products have been delivered by centralized authorities who acted as intermediaries, assessing the risk-return profile of investments and conducting cost-benefit analysis.

It is impossible to serve the whole world, relying strictly on KYC and AML protocols and government IDs.

Decentralized finance changes that, making it accessible through the whole world via the power of the internet.

Once you are connected, you can engage with dAaps applications, the very essence of the financial system built in a permissionless manner.

Bringing It All Together

Decentralized finance promises to offer a complete financial ecosystem without any central authority.

This would allow all users, regardless of their background, to use these financial services and products.

It does not only give users more control and autonomy over their money but also offers innovative services and products customized for the DeFi ecosystem’s growth.

*This article is written by Victoria Arsenova (Vaughan)

Victoria is a former CEO at Cointelegraph. She's also been a digital asset expert who has been in the indusry since 2013.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.