Bitcoin (BTC) approached the psychologically important level of $40,000 in the early hours of Monday buoyed by one of Tesla Inc TSLA CEO Elon Musk’s tweets and these four key factors.

Muskian Boost: The apex coin received a boost from Musk on Sunday night after he said that Tesla could resume BTC transactions provided there is a reasonable confirmation of clean energy use by miners.

At press time, over 24 hours, BTC traded 11.82% higher at $39,284.41. The cryptocurrency gained 8.71% over a seven-day trailing period.

See Also: How To Buy Bitcoin (BTC)

Taproot Lock-In: The Taproot soft-fork for the apex cryptocurrency has locked in with a threshold for 90% of all blocks signaling support for the upgrade crossed Sunday morning, as per Taproot.Watch. The soft fork is expected to improve both the privacy and fungibility of Bitcoin and is thought to be a significant upgrade.

Bullish On-Chain Signs: Bitcoin is trying to effect a turnaround, as per a DecenTrader report, first seen on Cointelegraph. The report however noted that the cryptocurrency has remained rangebound “between weekly support at $32,000 and near term resistance of the 200-day moving average at $42,000.”

See Also: As Crypto Market Plunges, Bitcoin, Dogecoin Bulls Preach 'Keep Calm And Hodl'

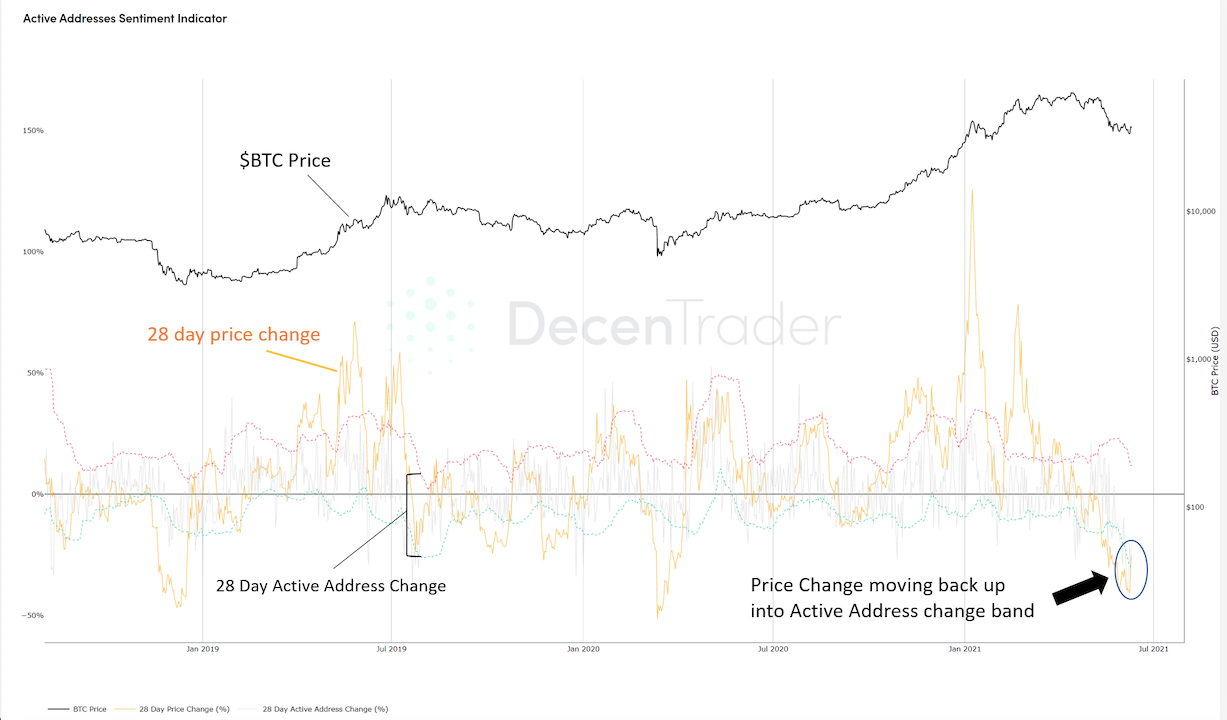

The report noted some on-chain signals that indicate a potential rebound in Bitcoin. DecenTrader pointed to the Active Address Sentiment indicator, which compares the 28-day change in price with the 28-day change in on-chain active addresses.

Active Addresses Sentiment Indicator, Courtesy DecenTrader

Active Addresses Sentiment Indicator, Courtesy DecenTrader

The indicator pitches a 28-day change in price, shown by an orange line, against a 28-day change in on-chain active addresses — shown by grey lines.

The movement of the orange line from below the dotted green line above the active address change line is a bullish signal, as per the report. This most recently happened on June 10.

Other on-chain metrics that indicate a turnaround may be in store are the Spent Output Profit Ratio (SOPR) and the Stock to Flow (S2F) Divergence.

SOPR indicates if Bitcoin wallets are selling at a profit or loss on any given day and there are indicators that in the last couple of days average wallets are selling at a profit, as per DecenTrader.

S2F chart gauges the futures BTC price by taking into account the amount of bitcoin already available in the market, which is the stock. The rate at which newly minted Bitcoin is entering the market is the flow.

Chart Indicating Times When Price Has Dipped Below S2F Line, Courtesy DecenTrader

Chart Indicating Times When Price Has Dipped Below S2F Line, Courtesy DecenTrader

DecenTrader pointed out that the price is trending below the stock to flow line and this has happened only four times in Bitcoin’s history. After each of these instances in 2012, 2013, and 2017, the price rebounded.

El Salvador Factor: Last week, El Salvador became the first country in the world to adopt Bitcoin. There are also plans to harness the energy from the country’s volcanoes to mine the apex cryptocurrency. Even so, Bitcoin has remained rangebound and under the $40,000 level during the course of last week. This could change as the impact of the Central American nation’s move begins to be felt.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.