Stonetoss's classic comic on Bitcoin volatility.

Bitcoin Attempts Another Breakout

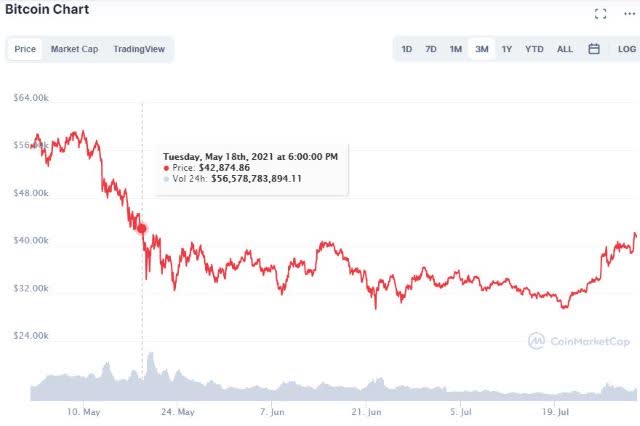

As I type this early Saturday, Bitcoin BTC/USD looks like it's attempting to break out of the range it has been stuck in since mid-May.

Chart via Coin Market Cap.

Here I'll post a hedged bet on Bitcoin breaking out, one with twice as much possible upside than it has possible downside. The underlying security is the Bitcoin miner Riot Blockchain, Inc. RIOT.

See also: Is Bitcoin a Good Investment?

Bad Timing On Our Part

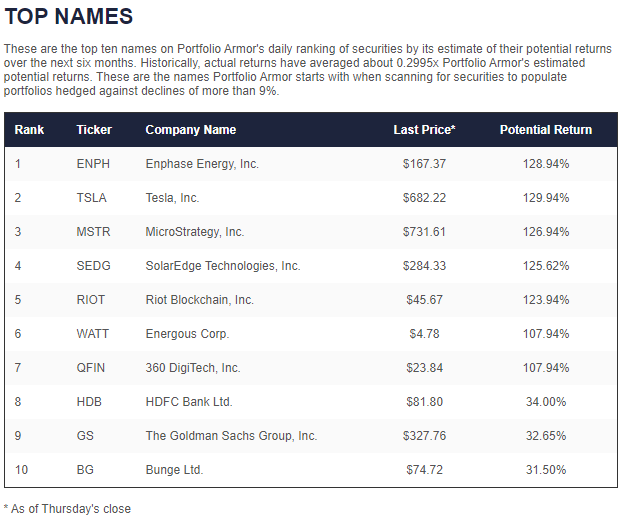

Riot Blockchain first hit our top ten names on February 25th of this year.

Screen capture via Portfolio Armor on February 25th, 2021.

That turned out to be bad timing on our part: RIOT is down 28% since. Nevertheless, it ended up on our top ten list again on Friday. That may prove to be better timing.

A Thought About Picks & Shovels Plays

Back in 2008, I purchased a few shares of an Australian company that made wear plates for mining equipment, particularly for iron ore mining: Alloy Steel International (AYSI). This was a picks & shovels play on the commodity boom then. Then the global financial crisis hit, and iron ore prices tumbled. Alloy Steel shares tumbled too, but the company stayed in business throughout the crisis, and remains in business today. Even when iron ore prices dropped, as long as it was still profitable to mine, miners needed wear plates on their equipment. And how much time before they needed to buy new wear plates wasn't determined by the price of iron ore, but the volume of iron ore processed.

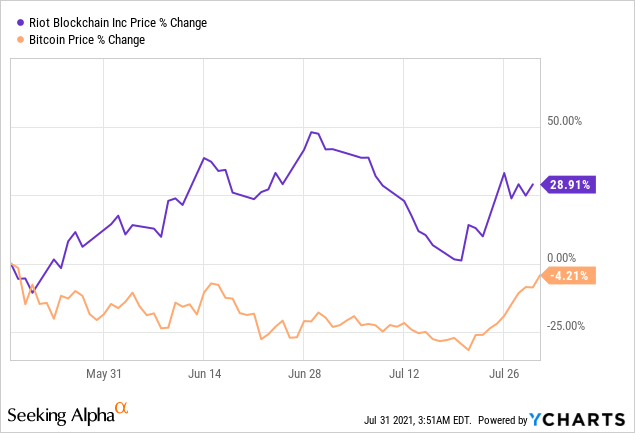

I was reminded of that by the performance of Riot Blockchain since Bitcoin has been range-bound. I wonder if there's a somewhat similar dynamic at work.

My sense from that price action is that Riot Blockchain can do well over the next several months even if Bitcoin doesn't successfully breakout above its range. Of course, if Bitcoin breaks decisively below the bottom of its recent range, RIOT shares will drop too, as they did in February. That's why we hedge. With that in mind, let's get to our hedged bet on a Bitcoin breakout.

A Hedged Bet On A Bitcoin Breakout

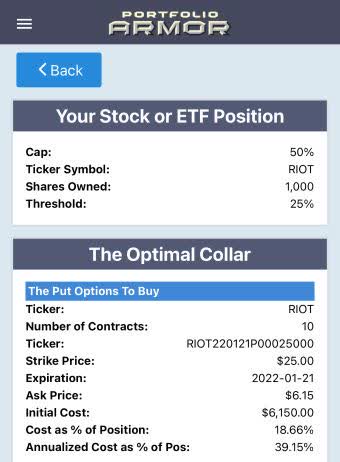

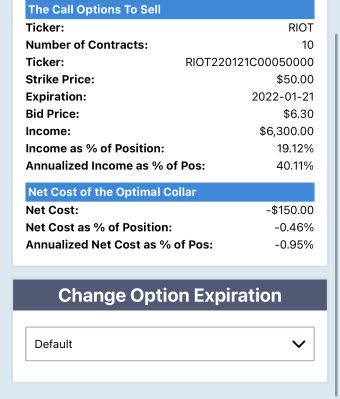

With the optimal collar below, your worst case scenario for a hedged RIOT position is a drop of 25% by late January, and your best case scenario is a 50% gain.

Screen captures via the Portfolio Armor iPhone app as of Friday's close.

Not only does this hedge offer 2x as much potential upside as potential downside, but it has a negative cost: you could have collected a net credit of $150 when opening this collar on Friday.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.