Major coins were in the green at press time on a 24-hour basis as the global cryptocurrency market cap rose 0.92% to $1.91 trillion on Wednesday night.

What Happened: Bitcoin BTC/USD was up 0.25% at $44,983.35 over 24 hours. For the week the apex cryptocurrency fell 1.69%.

The second-largest coin by market cap, Ethereum (ETH), traded 0.77% higher at $3,037.83 over 24 hours. On a seven-day trailing basis, ETH was down 4.46%.

See Also: How To Buy Ethereum (ETH)

Cardano ADA/USD — the third-largest coin at press time — shot up 12.3% over 24 hours to $2.16. ADA is up 17.86% over seven days.

Shiba Inu-themed Dogecoin DOGE/USD shot up 5.41% to $0.31 over 24 hours. For the week, DOGE rose 12.85%.

On a 24 hour-basis, the top gainer on Wednesday night was Voyager Token VGX/USD, which rose 35.47% to $4.14. Over seven days, VGX was up 6.03%.

The token which backs the namesake cryptocurrency brokerage service rose 34.83% and 34.01% against BTC and ETH, respectively.

Decentralized Finance or DeFi coins Terra LUNA/USD and Avalanche AVAX/USD continued their upward-march with LUNA and AVAX rising 27.48% and 30.91% to $30.29 and $29.76, respectively.

Over a seven-day period, LUNA and AVAX rose 85.13% and 74.55%, respectively. LUNA is now up 4,748% since the year began.

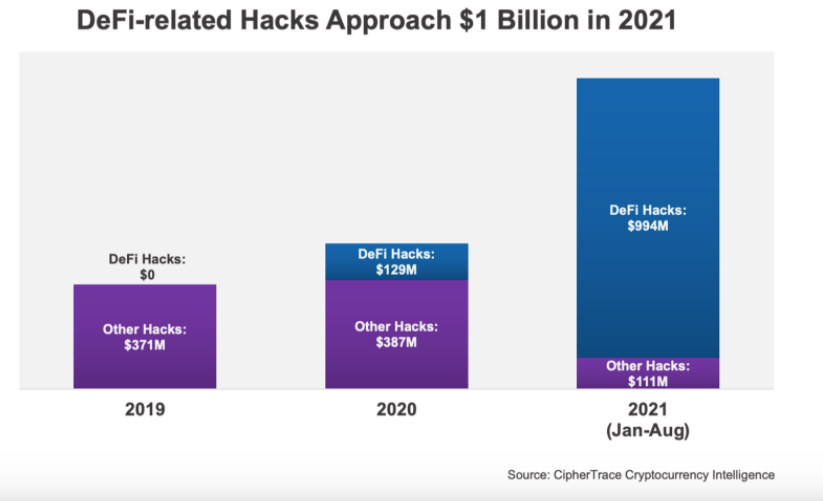

Why It Matters: The rise in DeFi coins comes despite the fact that hacks in the segment are approaching $1 billion for the year, as per Ciphertrace, a provider of blockchain analytics and cryptocurrency intelligence.

As per Ciphertrace’s latest Cryptocurrency Crime and Anti-Money Laundering Report, DeFi hacks continue to grow exponentially quarter over quarter and these hacks are getting more sophisticated as evidenced by the latest Poly network hack.

The Rise In DeFi Related Hacks, Courtesy Ciphertrace

The Rise In DeFi Related Hacks, Courtesy Ciphertrace

“DeFi-hack volume netted by criminals in 2021 make up $361 million. Today this number has nearly tripled as DeFi hacks now makeup $994 million, making up 90% of all of 2021’s hack volume which tops just over $1.1 billion.

On Tuesday, white hat hackers prevented a $350 million hacking that could have affected SushiSwap’s SUSHI/USD fundraising platform Miso, reported Coindesk.

On major cryptocurrencies, analysts are on the lookout for institutional movements. David Mercer, CEO of LMAX Group, an institutional exchange, said, “There is a wall of institutional money, and we could see exciting new entrants into the custodian, credit intermediation, and aggregation space,” reported CoinDesk separately.

As per Mercer, some institutional investors have raised their exposure to cryptocurrencies from a minority holding to a majority holding and despite the popularity of altcoins, he does not see them taking over from BTC.

The analyst expects the total market capitalization of cryptocurrencies to increase by $5 trillion within the next two years as major financial institutions set their sights on the arena.

Read Next: Dogecoin Fans Reach Walmart With Puppy Eyes, Calling For Adoption

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.