Ethereum Classic ETC/USD was trading over 34% lower at one point on Tuesday amid extreme volatility in the cryptocurrency market. Bitcoin BTC/USD and Ethereum ETH/USD declined about 19% and 23%, respectively, before bouncing.

To help bolster adaption across El Salvador, at 5 p.m. ET the country will airdrop $30 of Bitcoin into government-issued cryptocurrency wallets for each of its citizens who downloaded and registered for it.

The 3.3 million members of the Reddit Bitcoin community have also been summoned to each purchase $30 worth of Bitcoin to show support for El Salvador’s decision to make Bitcoin legal tender. Community member u/thadiusb calculated the event could amount to almost $100 million worth of Bitcoin being converted from local currencies.

Most altcoins such as Ethereum Classic are impacted by Bitcoin’s volatility and tend to follow the apex cryptocurrency's swings. If Bitcoin reverses course and heads back up toward the $51,000 level in the coming days it would have a positive effect on Ethereum Classic.

For technical traders the crypto should abide by support and resistance levels etched out on the chart regardless of which way Ethereum Classic moves next.

See Also: What's Going On With Crypto Today? Bitcoin Rejected At Major Resistance, Crashes Market

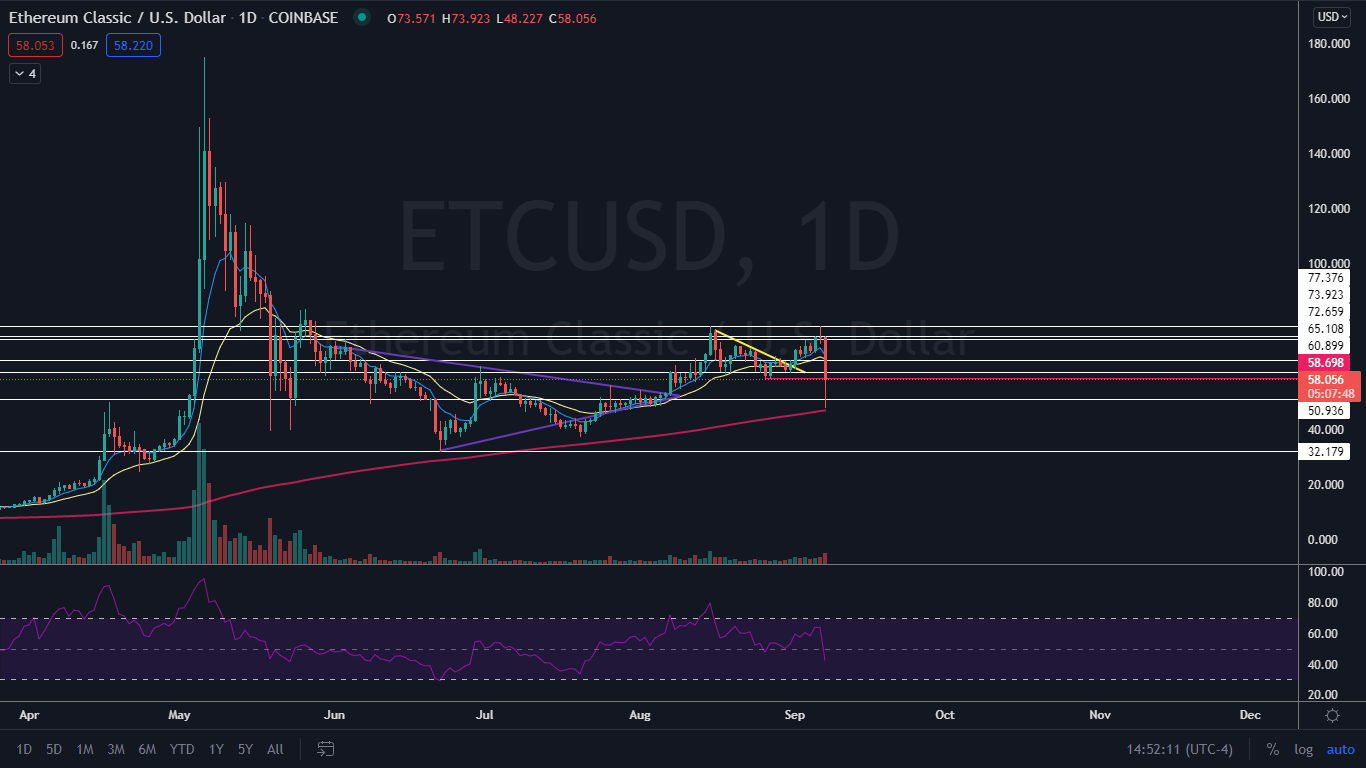

The Ethereum Classic Chart: When Ethereum Classic sold off on Tuesday it bounced and wicked from the 200-day simple moving average (SMA). Bullish technical traders used the area of support to buy the dip and after hitting the level, the crypto bounced up 20% higher.

The 200-day SMA is used as a bellwether to determine if the overall long-term sentiment in a stock or crypto is bullish or bearish. When Ethereum Classic is trading above the 200-day SMA sentiment is viewed as bullish while trading below the level indicates bearish sentiment.

Although the sell-off was caused by Bitcoin plummeting, Ethereum Classic had also created a bearish double top pattern just above the $77 level. The crypto initially hit the level on Aug. 15 and on Monday, when Ethereum Classic attempted to bust up through the level, it rejected and closed the trading day at $73.92.

Monday’s sharp decline paired with the bounce up caused Ethereum to print a bullish hammer candlestick with the long lower wick indicating there are buyers below the $58 level. There is also a support level in the form of price history at $58.69.

Bulls will want to see the crypto close the day above the level.

- Bulls also want to see big bullish volume to come in on Wednesday for Ethereum Classic to trade higher and confirm the hammer candlestick pattern. If Ethereum Classic can close above $58, it has room to trade back up toward the $60 mark.

- Bears want to see sustained selling pressure to drop Ethereum down toward lower support at the $50 area. If Ethereum loses the level as support it could fall back to the 200-day SMA.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.