Bitcoin BTC/USD traded largely flat Monday evening as the global cryptocurrency market cap rose 1.85% higher to $2.62 trillion at press time.

What Happened: The apex coin traded marginally in the red. It was down 0.05% at $57,739.04 over 24 hours. Over a seven-day period, BTC has risen 2.03%.

Ethereum ETH/USD rose 2.27% to $4,451.96 over 24 hours. The second-largest cryptocurrency by market cap has gained 8.10% over the last seven days.

Meme cryptocurrency Dogecoin DOGE/USD was up 4.18% at $0.22 over 24 hours. Over a period of seven days, it has fallen 1.59%.

Gains in rival Shiba Inu were steeper as it rose 9.13% to $0.00004372. The coin inched up 0.34% for the week.

The top 24-hour gainers as per CoinMarketCap data were Tezos, Stacks, Shiba Inu, and Polygon.

Tezos spiked 23.15% to $5.72, Stacks rose 14.29% to $2.22 and Polygon appreciated 10.62% to $1.84 in the period.

See Also: How To Buy Bitcoin (BTC)

Why It Matters: Bitcoin was up 7.8% at press time from the Friday lows of $53,576.74 showing a significant recovery from those levels as Omicron worries lessen.

On Monday, President Joe Biden addressed the Omicron variant of COVID-19 and told Americans not to panic and pledged there would be no going back to lockdowns, according to a Reuters report.

Pfizer Inc PFE CEO Albert Bourla said Monday that the company’s oral coronavirus drug will not be affected by the Omicron variant and said he was confident that the company will be able to deliver a new vaccine, if required, in less than 100 days.

“Bitcoin is a part of today’s broad risk rally that stemmed from easing COVID fears but will likely struggle to completely get its groove back until vaccine efficacy results in the coming weeks confirm highly vaccinated countries are going back to lockdown mode,” wrote Edward Moya, a senior market analyst with OANDA in an emailed note.

As per Moya, the cryptocurrency selloff was an “overreaction” and buyers are “quickly reemerging” as traders reassess the impact of the new coronavirus variant.

Meanwhile, the apex coin keeps flowing out of exchanges, an indicator that BTC is being moved for long-term storage.

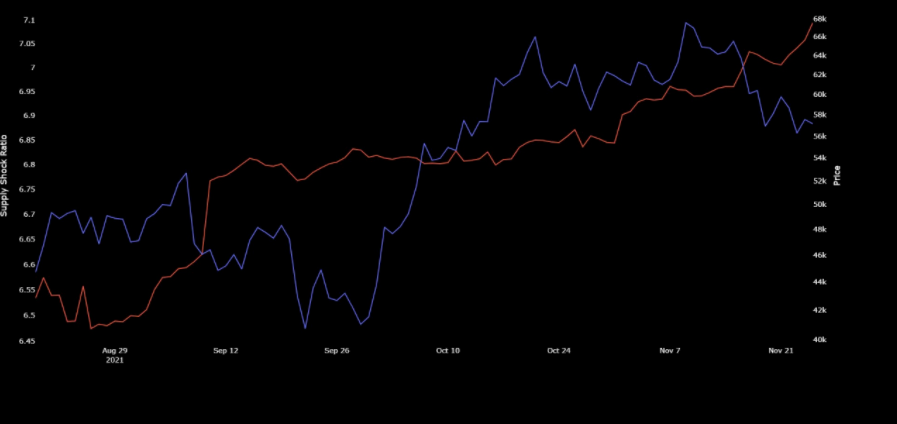

Maartunn, an analyst on CryptoQuant showcased a graph charting the Exchange Supply Ratio, which measures the ratio between available and unavailable supply on exchanges.

Chart Indicating Exchange Supply Ratio — Courtesy Maartunn

Chart Indicating Exchange Supply Ratio — Courtesy Maartunn

Currently, the price is down, the ratio is up. As per Maartunn, the price is expected to follow the ratio “sooner rather than later.”

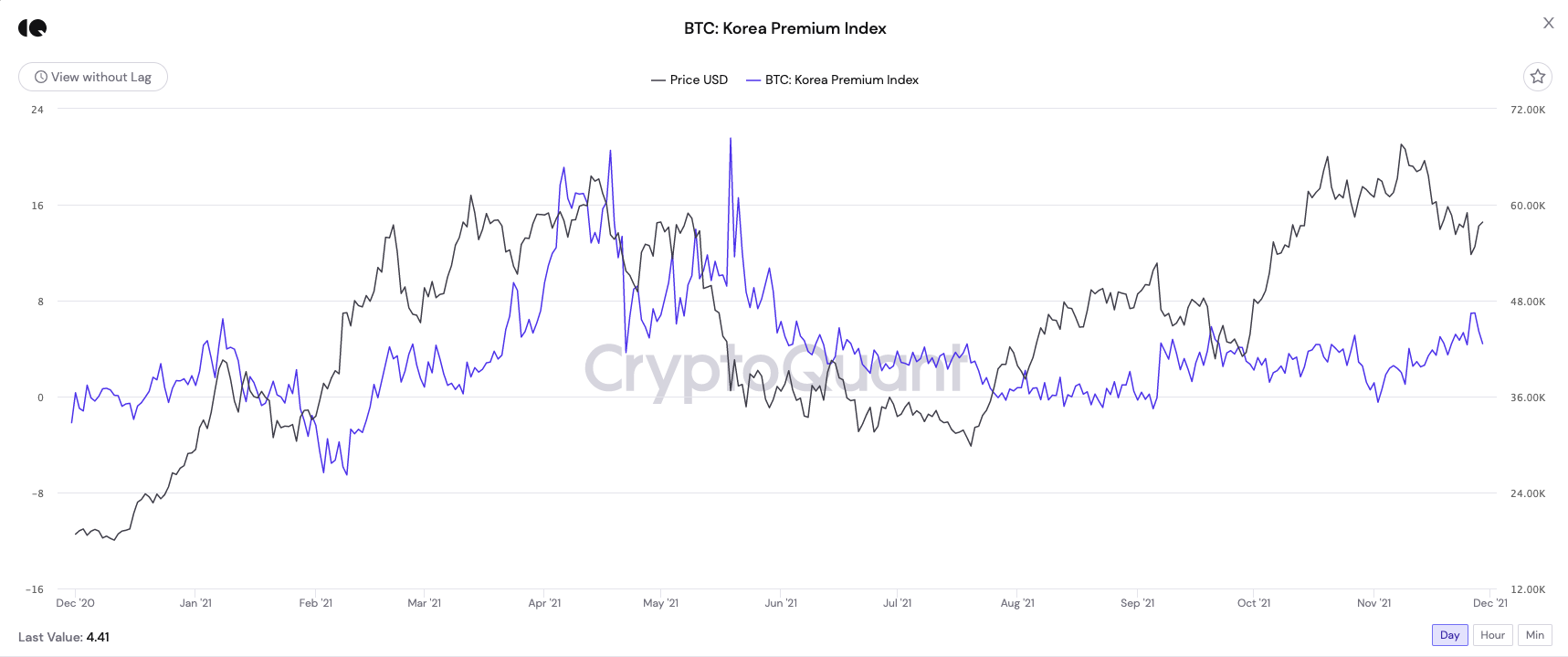

Meanwhile, the Korea Premium Index or so-called Kimchi premium which is a measure of the price gap between South Korean exchanges and other exchanges touched 7% on Sunday, which is the highest since May this year. Currently, it is hovering around 5%, an indicator that retail investors are participating in the cryptocurrency market, as per a CryptoQuant tweet.

Chart Tracking Kimchi Premium — Courtesy CryptoQuant

Chart Tracking Kimchi Premium — Courtesy CryptoQuant

Twitter handle “Sheldon The Sniper,” a cryptocurrency trader, said Monday that Ethereum will outperform BTC this next cycle based on the ETH/BTC chart.

ETH/BTC high time frame chart looks amazing $ETH to out perform $BTC this next cycle pic.twitter.com/DY4SXuj1Se

— Sheldon The Sniper (@Sheldon_Sniper) November 29, 2021

Read Next: Rich Dad Poor Dad Author Buys More Bitcoin And Ethereum To Combat Inflation

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.