Major coins plunged deep into the red Monday evening as the global cryptocurrency market capitalization dived 7.83% to $2.12 trillion.

What Happened: The apex cryptocurrency, Bitcoin BTC/USD, declined 5.41% to $47,206.52. For the week, it is down 6.88%.

Ethereum ETH/USD fell 6.75% to $3,830.54 over 24 hours. Over the last seven days, the second-largest coin by market cap has dropped 11.95%.

Meme cryptocurrency Dogecoin DOGE/USD was down 6.11% at $0.16 over 24 hours. It has fallen 11.39% over a seven-day period.

Shiba Inu lost 8.75% of its value over 24 hours and traded at $0.00003323 at press time. For the week, it has plunged 10.84%.

Stablecoins saw significant appreciation at press time. In terms of top gainers over 24 hours, Revain and OKB were the two tokens that saw the most gains, as per CoinMarketCap data.

Revain shot up 22.68% to $0.01144, while OKB gained 1.25% to $27.34 in the period.

See Also: How To Buy Bitcoin (BTC)

Why It Matters: Data released last week indicated that inflation rose a shocking 6.8% in November, which is the fastest such rise since 1982. The number came in above the 6.7% estimate by economists.

This week, the decision on interest rates in the United States along with projections by the Federal Open Market Committee will be closely watched by the market. Investors will be on the lookout for the pace of tapering and whether the dollar can gain some consequential strength.

Contrary to its perceived status as an inflation hedge, Bitcoin experienced a “rapid drop,” digital asset data provider Kaiko Research said in a note seen by Benzinga.

Craig Erlam, a senior analyst at OANDA, noted that the apex coin is again trading below the $50,000 mark and is “struggling to find any bullish momentum when the price does rebound.”

“Perhaps central banks collectively paring back tightening expectations will get the crypto community excited again this week,” Erlam wrote in an emailed note.

A Christmas stock market rally could lift the spirits of Bitcoin, GlobalBlock analyst Marcus Sotirio said. Sotiriou noted that Bitcoin has reached a “historical milestone.”

“90% of the maximum 21 million Bitcoin has been mined into supply. This means that only 10% (2.1 million Bitcoin) is left to enter the supply, with the last Bitcoin being mined in 2140.”

The analyst is bullish on Bitcoin in the long term. He wrote, “I think Bitcoin’s scarcity will lead to a supply shock for Bitcoin to help it overtake gold’s market cap over the next 10 years, which is around $10 trillion. This means Bitcoin has the potential to rise to a price of $500,000 in the future.”

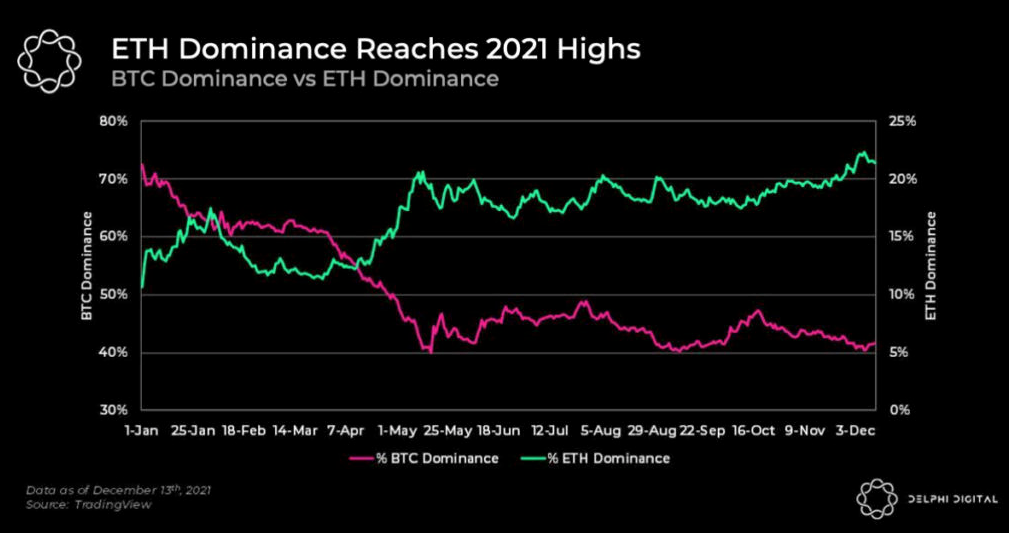

Meanwhile, Ethereum’s dominance is on the rise, while Bitcoin’s is significantly lower than what it was at the beginning of the year, as per Delphi Digital.

“ETH’s dominance went from ~11% at the start of the year to ~21% today. BTC dominance on the other hand started at ~73% and is at ~42% today,” the cryptocurrency research firm noted.

Chart Showing Ethereum's Rising Dominance In 2021 — Courtesy Delphi Digital

Chart Showing Ethereum's Rising Dominance In 2021 — Courtesy Delphi Digital

Delphi Digital attributed the rise of Ethereum to 2021 being the “year of smart contracts,” with another reason being market optimism.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.