Bitcoin BTC/USD and Ethereum ETH/USD traded in red on Monday evening as the global cryptocurrency market cap decreased 0.5% to $2.4 trillion.

What Happened: BTC was down 2.16% at $49,745.50 over 24 hours. For the week, the apex cryptocurrency has risen 7.1%

The second-largest cryptocurrency by market cap, ETH, traded 2.48% lower at $3,972.01 over 24 hours. For the week, it has risen 2%.

Dogecoin DOGE/USD traded 4.4% lower at $0.18 over 24 hours. For the week, the meme coin is up 10.6%.

DOGE-Rival Shiba Inu (SHIB) was down 0.3% over 24 hours at $0.000037 over 24 hours. Over the last seven days, it has shot up 20.9%.

A notable mover among major cryptocurrencies was Cardano (ADA), which shot up 1.7% at press time to $1.48. The cryptocurrency has soared 21.3% over the week.

The top three gainers over 24 hours, according to CoinMarketCap data, were SushiSwap (SUSHI), Immutable X (IMX), and Ravencoin (RVN).

SUSHI spiked 15.3% to $9.31, IMX was up 12.3% at $5.28, and RVN rose 11% to $0.109 in the period.

See Also: How To Buy Bitcoin (BTC)

Why It Matters: Bitcoin moved beyond the $52,000 level on Monday but could not sustain the upward momentum. Cryptocurrency markets have not seen the same euphoria that traditional markets are experiencing at year-end.

Both the S&P rose, and the NASDAQ rose nearly 1.4% to close at 4,791.19 and 15,871.26, respectively.

Bitcoin volumes remained muted on Monday. The 24-hour trading volumes of Bitcoin amounted to $24.3 billion, which were comparable to Sunday’s $20.9 billion, as per CoinMarketCap data.

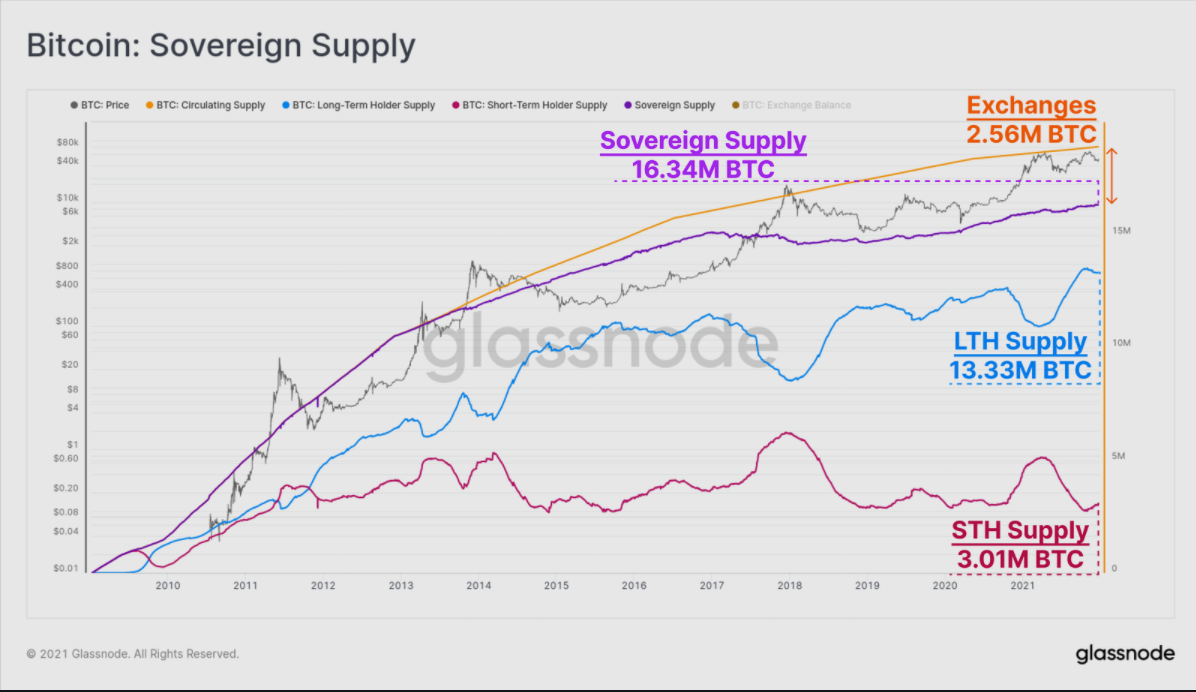

Bitcoin’s sovereign supply, which is the number of coins held outside of exchanges, touched an all-time high of 13.34 million BTC, according to Glassnode.

Bitcoin Sovereign Supply — Courtesy Glassnode

Bitcoin Sovereign Supply — Courtesy Glassnode

In terms of proportion, Long-term Holders (LTH) have seen ownership stake increase by 4.8% to 74.8% of sovereign supply. Short-term Holders’ (STH) ownership has fallen from 28% in January to 25.2% in the current month, as per the on-chain analysis firm.

“Such on-chain [behavior] is more typically observed during Bitcoin bear markets, which in hindsight are effectively lengthy periods of coin redistribution from weaker hands, to those with stronger, and longer-term conviction,” noted Glassnode.

Meanwhile, Amsterdam-based cryptocurrency trader Michaël van de Poppe said Monday that Cardano is close to “bottomed out” on Twitter.

$ADA is close to bottomed out. pic.twitter.com/xmo1q2hAvg

— Michaël van de Poppe (@CryptoMichNL) December 27, 2021

In a separate tweet, Van de Poppe said 2022 “will be absolutely massive” but warned of a “big crash to flush everyone out.”

2022 will be absolutely massive.

— Michaël van de Poppe (@CryptoMichNL) December 27, 2021

Big runs everywhere, and potentially, later in the year, a big crash to flush everyone out.

Trade it wisely.

Have a plan. Have targets. Hit those targets and start taking profits.

Execute it well.

Read Next: Holes In El Salvador's Bitcoin Wallet? Users Claim Funds Are Missing

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.