Curve Dao Token CRV/USD traded 13.5% higher over 24 hours at $6.62 at press time early Tuesday.

What’s Moving? The token associated with a decentralized exchange for stablecoins has shot up 28.2% over a seven-day period.

CRV rose about 16.4% against both Bitcoin BTC/USD and Ethereum ETH/USD over 24 hours, as per CoinMarketCap data.

CRV has shot up 72% over the last 30 days and has gained 141.2% over a 90-day time frame. Since 2022 began, CRV is up 7.7%.

See Also: How To Buy Curve Dao Token (CRV)

Why Is It Moving? CRV moved against the prevailing trend at press time when all major coins traded in the red. The global cryptocurrency market cap was down 1.5% at $2.2 trillion.

Although Curve was not among the most mentioned coins on Twitter at press time, It was included in the list of 10 coins that have the most Twitter reach, according to Cointrendz data.

CRV added 7.3 million new Twitter followers in the last 24 hours on the Jack Dorsey co-founded social media platform, while Bitcoin and Ethereum, the coins with the most reach, added 73.7 million and 29.5 million followers, respectively.

Curve was the top protocol on Ethereum in terms of total value locked. According to Defi Llama, a total of $21.4 billion is locked into the protocol.

A tweet by Defi Llama tracked the progress of Curve to the top spot through 2021.

TOP 10 Protocols on @ethereum

— DefiLlama.com (@DefiLlama) January 3, 2022

Jan 1st 2021 - Presenthttps://t.co/OuEHG0mIdd pic.twitter.com/1ql5Uid80F

Curve’s automated market maker rewards its liquidity providers with CRV, which has resulted in a so-called “war” with various protocols bribing voters and rewarding veCRV holders with their respective native tokens, according to a Delphi Digital note.

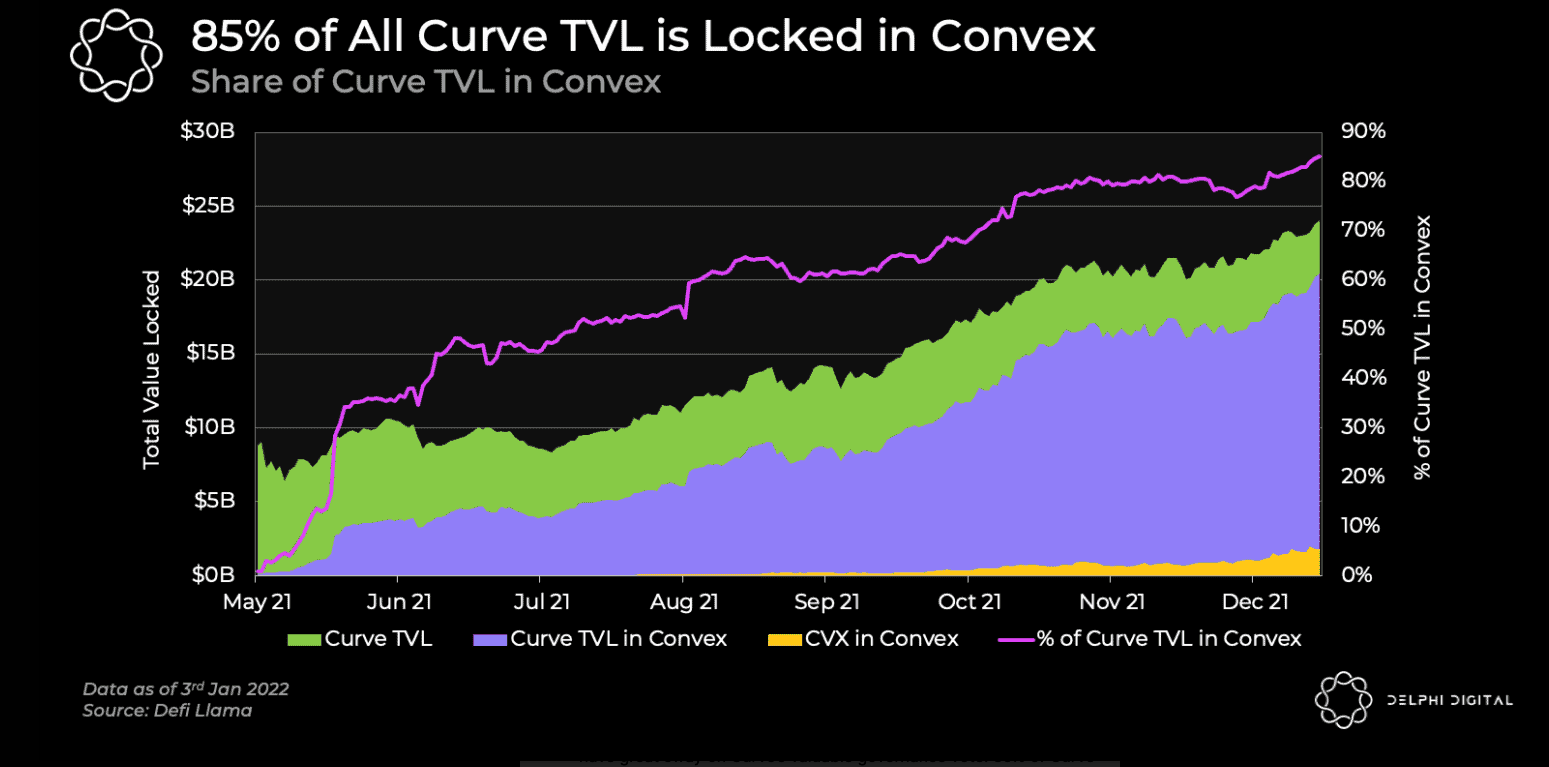

The war has seen DeFi platform Convex (CVX) emerge as having a “great sway” on Curve’s valuable governance vote, said Delphi Digital.

Share Of Curve TVL In Convex — Courtesy Delphi Digital

Share Of Curve TVL In Convex — Courtesy Delphi Digital

“Convex is now the single largest owner of veCRV at 47% of the total supply. This gives them the most governance power to decide where CRV incentives should be distributed.”

The dominance of Convex has in turn led to protocols bribing holders of vlCVX. vlCVX is Convex’s token that can harness underlying VeCVX governance.

“This has been a rather lucrative practice for vlCVX holders who have received ~$2.75 worth of bribes per locked CVX since the Sep. 21 last year.”

Protocols, the chief being Frax Finance (FRAX), have also taken to hoarding CVX tokens in order to incentivize liquidity, as per Delphi Digital.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.