Bitcoin BTC/USD and other major coins flashed red Thursday evening as the global cryptocurrency market cap decreased 1.4% to $2 trillion.

What Happened: The apex coin traded 1.9% lower at $42,866.44 over 24 hours. It has dropped 8.7% so far this week.

Ethereum ETH/USD was down 4.6% at $3,383.90 over 24 hours. Over a seven-day trailing period, it has fallen 8.5%.

Dogecoin DOGE/USD declined 0.64% to $0.16 over 24 hours. Over the last seven days, it has lost 7.5% of its value.

DOGE-rival Shiba Inu (SHIB) rose 0.9% to $0.000031 over 24 hours. It has plunged 9.3% over a seven-day period.

Cardano (ADA) was among the top gainers at press time. The cryptocurrency rose 2.8% to $1.27 over 24 hours. For the week, it is down 5.7%.

The three top gainers over 24 hours were Decentraland (MANA), APENFT (NFT), and yearn.finance (YFI), according to CoinMarketCap data.

MANA spiked 13.4% to $3.31, NFT gained 13% to $0.00000305, while YFI was up 8.2% at $35,385.62 in the period.

See Also: How To Buy Bitcoin (BTC)

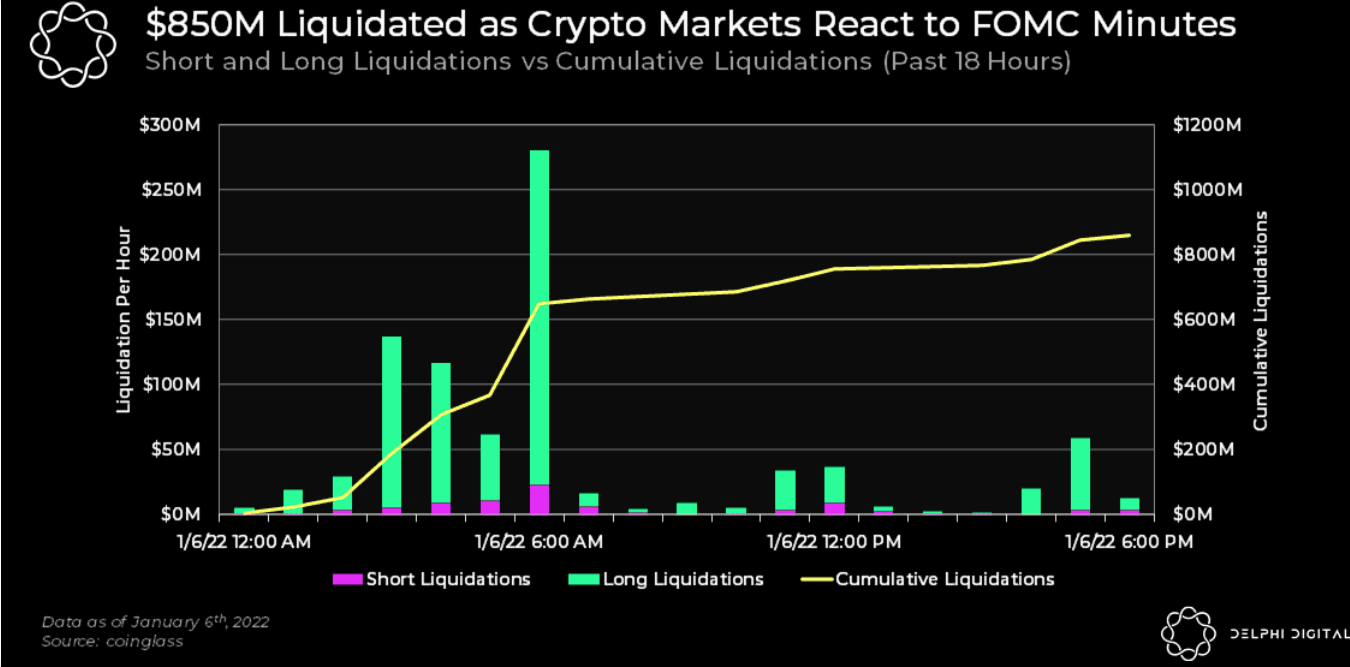

Why It Matters: Leveraged long traders were liquidated on downward price movements, according to Delphi Digital data.

Positions worth $850 million were liquidated on Wednesday, according to the independent research firm.

Short, Long Vs Cumulative Liquidations — Courtesy Delphi Digital

Short, Long Vs Cumulative Liquidations — Courtesy Delphi Digital

“The FOMC minutes were released at 2pm EST yesterday, which triggered the initial sell-off. As the day progressed and prices declined, larger sell-offs and liquidations ensued, exacerbating the drawdown,” wrote Delphi, in an emailed note.

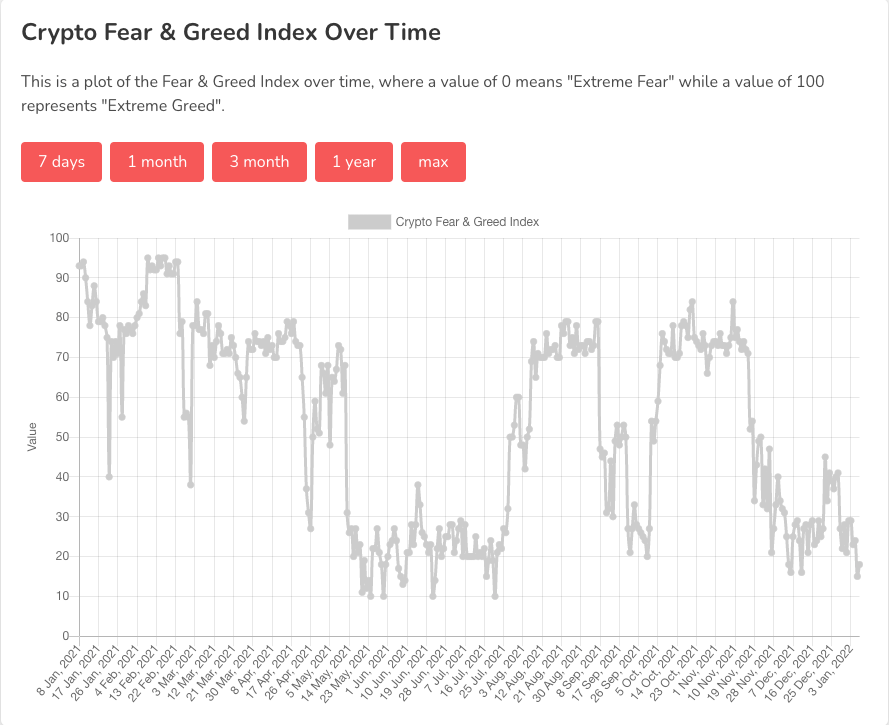

Alternative’s “Fear & Greed Index” flashed “Extreme Fear” at press time, with a value of 18. This is the lowest since July 2021 when Bitcoin touched the $30,000 levels.

Crypto Fear & Greed Index Over Time — Courtesy Alternative

More pain could be in store for investors, according to analysts. On Thursday, Edward Moya, senior market analyst at OANDA said Bitcoin could drop below the $40,000 mark.

“Massive liquidations that totaled over $800 million could have Bitcoin on the ropes for one last major plunge before buyers will be willing to test the waters. Bitcoin could see a plunge towards $37,000 before buyers emerge,” said Moya, in a note seen by Benzinga.

Pseudonymous analyst Kaleo tweeted that the “ugly truth” of the new cycle could be a massive drop in the value of “solid coins” over the next year or two.

The ugly truth everyone new this cycle will learn eventually over the next year or two is that even solid coins can lose >90% of their value in a bad market.

— K A L E O (@CryptoKaleo) January 6, 2022

Plenty will lose another 90% on top of that.

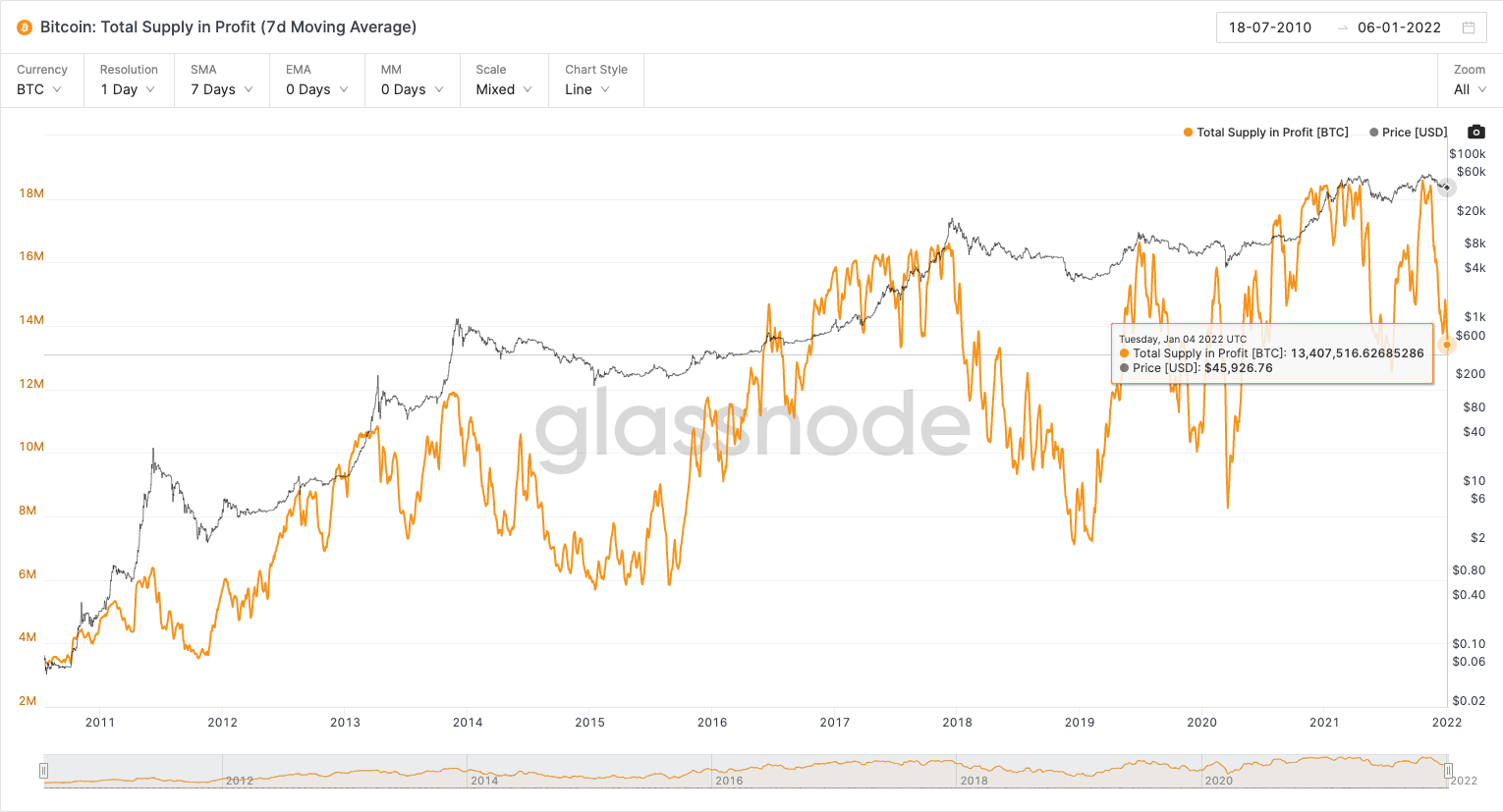

Meanwhile, Bitcoin Supply in Profit (7-day moving average) touched a 5-month low of 13.3 million BTC, according to Glassnode data.

Bitcoin: Total Supply In Profit — Courtesy Glassnode

Bitcoin: Total Supply In Profit — Courtesy Glassnode

A bitcoin is considered to be in profit or loss if the current price is higher or lower than the price at the time it last moved.

On the Ethereum front, the Vitalik Buterin co-created cryptocurrency might be close to a bottom, according to a tweet by Amsterdam-based cryptocurrency trader Michaël van de Poppe.

#Ethereum has been trending south heavily, but actually hitting a massive area on the previous resistance at $3,320.

— Michaël van de Poppe (@CryptoMichNL) January 6, 2022

The next important level after the block is between $3,500-3,600.

Might be close to a bottom too. pic.twitter.com/Wx1WXlAIVO

Read Next: Is Kazakhstan Chaos Really What's Leading To Bitcoin Crash?

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.