Bitcoin BTC/USD traded flat over 24 hours Monday evening as the global cryptocurrency market cap fell 3.5% to $1.99 trillion.

What Happened: The apex coin inched 0.4% lower at $41,707.83 over 24 hours. For the week, it has dropped 10.1%.

Ethereum ETH/USD was down 2.8% at $3,068.59 over 24 hours. Over a seven-day period, it has plunged 18.4%.

Meme cryptocurrency, Dogecoin DOGE/USD, decreased 5.4% to $0.14. Over the last seven days, it has fallen 15.9%.

Shiba Inu (SHIB) was trading 6.2% in the red at $0.0000266. The DOGE-rival has lost 19.4% of its value over the week.

Arweave (AR), Zcash (ZEC), and Terra (LUNA) were the three top gainers over 24 hours, according to CoinMarketCap data.

AR spiked 8.3% to $52.23, ZEC rose 6.4% to $144.77, and LUNA was up 6.2% at $73.43 over the period.

See Also: How To Buy Bitcoin (BTC)

Why It Matters: Bitcoin fell below the psychologically important $40,000 level, while Ethereum slipped below the $4,000 mark in intraday trading on Monday.

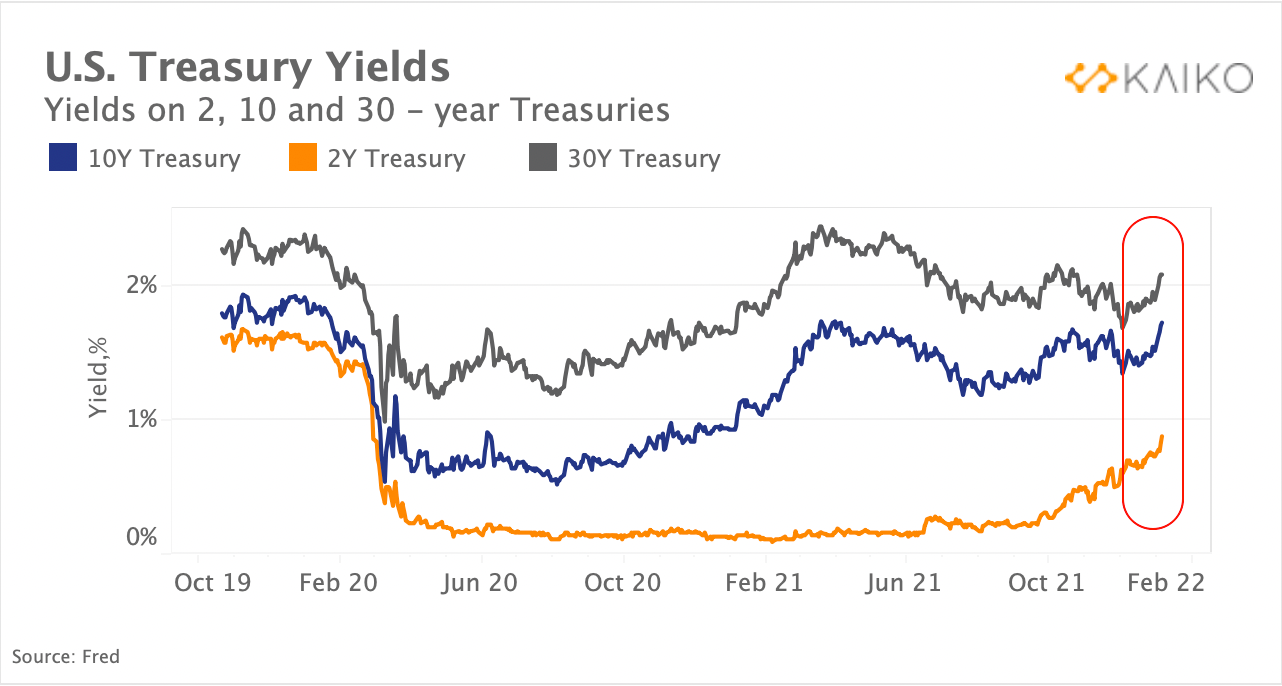

Yields on safe-haven Treasuries have hit multi-month highs last week. Both equities and cryptocurrencies are expected to come under pressure as the attractiveness of bonds rises, said Kaiko Research, in an emailed note.

Treasury Yields Over Time — Courtesy Kaiko Research

Treasury Yields Over Time — Courtesy Kaiko Research

Edward Moya, a senior market analyst at OANDA, said that Treasury Yields surged on Monday as “as expectations remain strong that inflation will not ease anytime soon.”

“Bitcoin’s plunge below $40,000 was short-lived as was Ether’s drop below $3,000,” wrote Moya, in a note seen by Benzinga.

“The top two cryptocurrencies have an uphill battle to return back to their respective all-time highs as the cryptoverse is now providing more investment opportunities that include NFTs, metaverse bets, and several altcoins that are making a run to become the next big blockchain.

At press time, Bitcoin traded 37.59% below its all-time high of $68,789.63, which it touched in November, while Ethereum was down 23.6% from its highest price point of $4,891.70, reached in the same month.

Amsterdam-based cryptocurrency trader Michaël van de Poppe said Monday that there was a “fakeout on the downside for [Bitcoin]. He tweeted that if $40,600 level holds for Bitcoin and there is a continuation upwards to $42,600 then $46,000 is “on the tables.”

Fakeout on the downside for #Bitcoin. If $40.6K holds, continuation upwards to $42.6K and potentially $46K is on the tables. pic.twitter.com/l8rACrtbhC

— Michaël van de Poppe (@CryptoMichNL) January 10, 2022

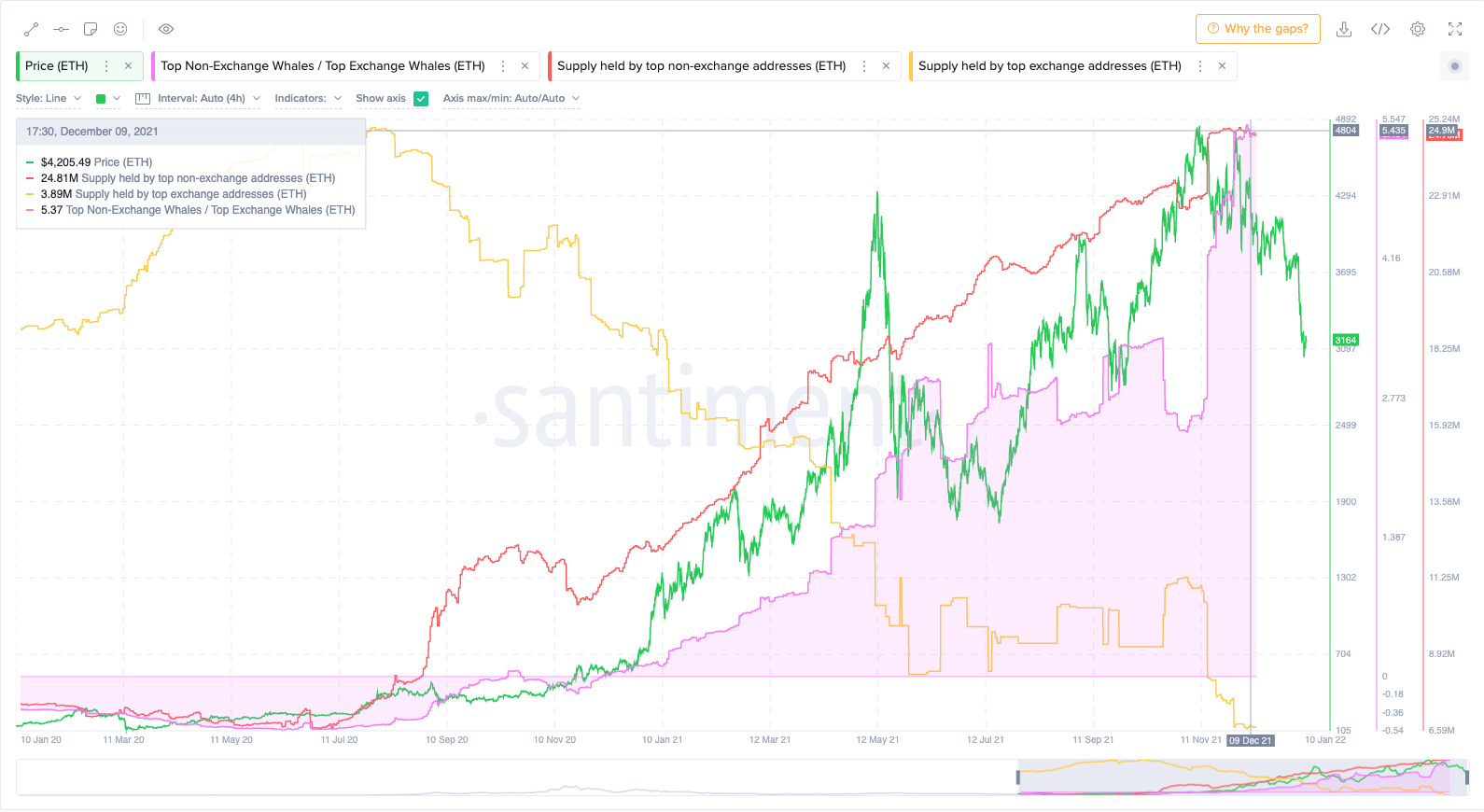

Meanwhile, the amount of Ethereum held by the top 10 non-exchange whale addresses swelled up to 25.7 million ETH on Monday, while the top 10 exchange whale addresses fell to 3.57 million ETH, according to Santiment data.

Chart Depicting Ethereum Holdings Over Time Of Top Non-Exchange Whales and Top Exchange Whales — Courtesy Santiment

The ratio between these two metrics is the highest since the asset’s inception, according to a tweet from Santiment.

Read Next: Bitcoin, Ethereum RSIs At 2-Year Lows — Here's What Experts Are Watching Out For

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.