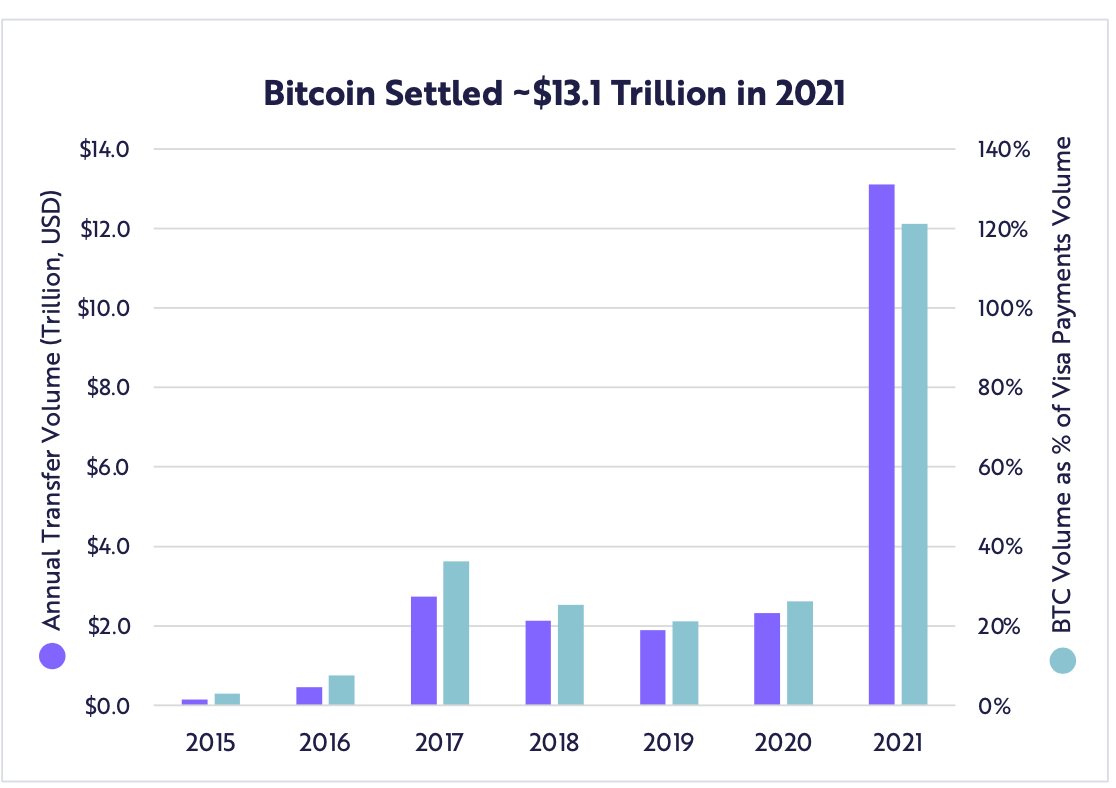

Bitcoin’s BTC/USD annual settlement volume officially exceeded the payments volume of Visa Inc. V last year, Cathie Wood-led Ark Investment Management said in a research report.

What Happened: Bitcoin’s cumulative annual transfer volume in 2021 surged 463% from the prior year to $13.1 trillion, just ahead of Visa's number, ARK analyst Yassine Elmandjra wrote in the report titled “Big Ideas 2022,” citing data from Glassnode, Visa and FRB services.

Bitcoin annual transfer volume measured against Visa's. Courtesy: Ark

Bitcoin’s average daily transfer volume surged more than five-fold year-over-year to $35.9 billion in 2021, while the cryptocurrency’s average transaction value grew six times to $136,555.

Elmandjra also announced the news on Twitter.

Bitcoin's annual settlement volume has officially surpassed Visa's. More than $13.1 trillion of value was settled on-chain in 2021. pic.twitter.com/qwIsNqtu8y

— Yassine Elmandjra (@yassineARK) January 25, 2022

See Also: How To Buy Bitcoin (BTC)

Why It Matters: Launched in 2009, Bitcoin has gained increasing mainstream adoption over the past few years. It is the world’s largest cryptocurrency by market capitalization.

The cryptocurrency is down 47.5% from its all-time high of $68,789.63 reached in November.

Ethereum’s ETH/USD blockchain handles about five times the daily volume of Bitcoin, thanks to its robust ecosystem of decentralized finance (DeFI) protocols, play-to-earn blockchain games and non fungible tokens (NFTs), it was reported in September.

Nevertheless, blockchain intelligence firm Blockdata had noted in December that Bitcoin, which already exceeded PayPal Holdings Inc. PYPL in terms of transaction volume, could surpass Mastercard Inc. MA “in time.”

Price Action: Bitcoin is down 3.1% during the past 24 hours, trading at $36,081.17 at press time.

Read Next: Cathie Wood's Ark Sees Bitcoin Price Rising Above $1M By 2030

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.