Zinger Key Points

- Last week CoinDesk reported some Bitcoin miners had sold their BTC holdings for the first time after months of accumulation.

- “We don’t control the price of Bitcoin, but we can control how prepared we are to capitalize on market opportunities when they present themselves."

- Pelosi’s latest AI pick skyrocketed 169% in just one month. Click here to discover the next stock our government trade tracker is spotlighting—before it takes off.

Major Bitcoin BTC/USD mining companies have opted to sell stock instead of their BTC holdings to maintain their cash reserves.

What Happened: Marathon Digital Holdings Inc. MARA has filed with the SEC to offer up to $750 million of shares and preferred stock, according to a report from Bloomberg.

“We don’t control the price of Bitcoin, but we can control how prepared we are to capitalize on market opportunities when they present themselves, which Marathon has a long track record of doing successfully,” said Charlie Schumacher, a spokesperson for Marathon Digital.

Marathon Digital has been holding on to its stash of Bitcoin since October 2020. Coingecko estimates that at the time of writing, the company has as much as 4,813 BTC worth $212 million.

Another Nasdaq-listed Bitcoin miner Hut 8 Mining Corp HUT has employed a similar strategy. On Friday, Hut 8 also filed to sell up to $65 million worth of common shares.

“We are believers in Bitcoin. Some miners sell Bitcoin or use it to pay expenses. We hold ours,” said Hut 8’s investor relations head Sue Ennis.

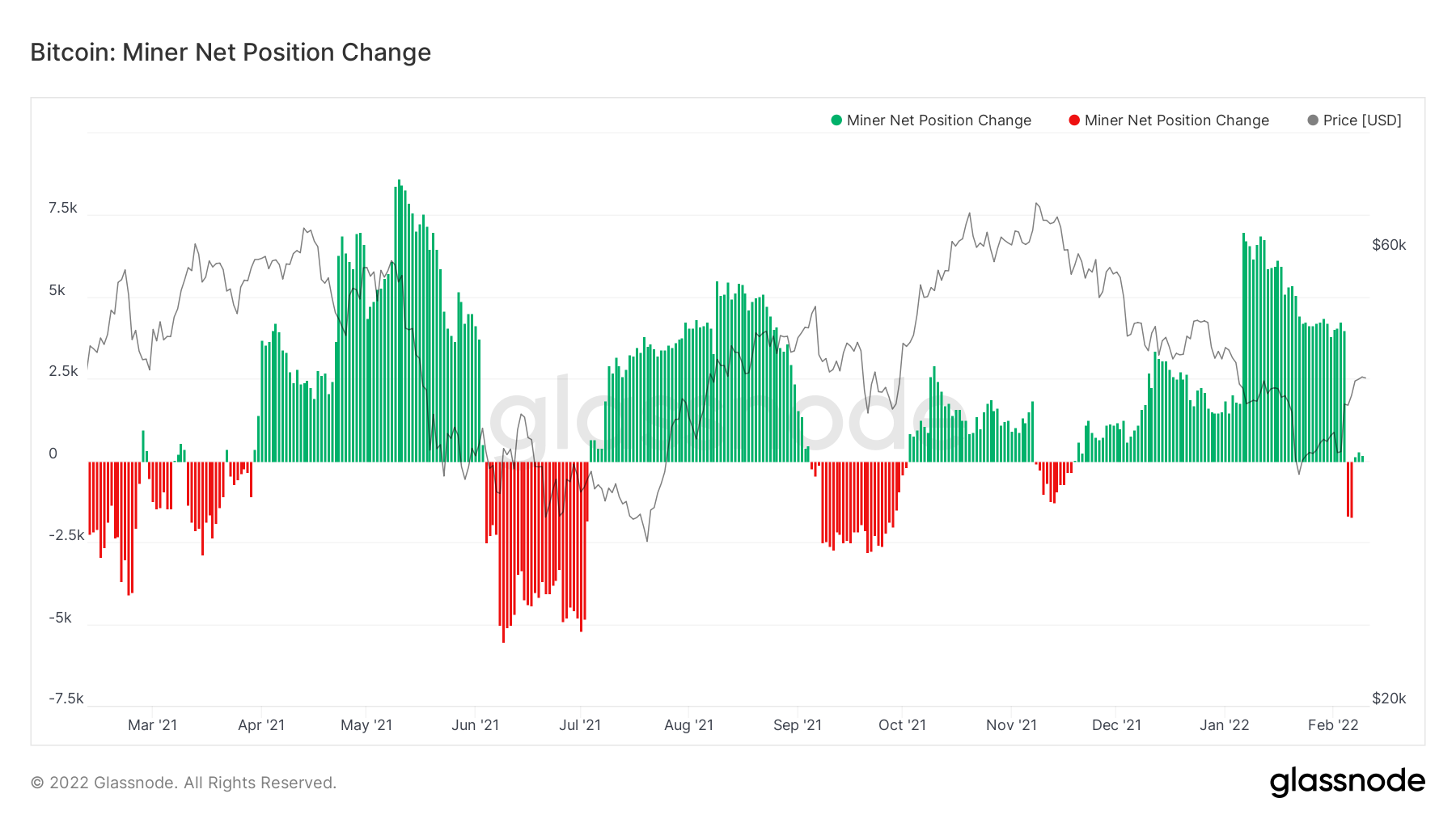

Last week CoinDesk reported some Bitcoin miners had sold their BTC holdings for the first time after months of accumulation.

The change in miners' net position implies that smaller Bitcoin miners could be selling their holdings strategically to meet the cost of operations.

Price Action: Marathon Digital shares closed 12.05% higher at $28.63 on Tuesday.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.