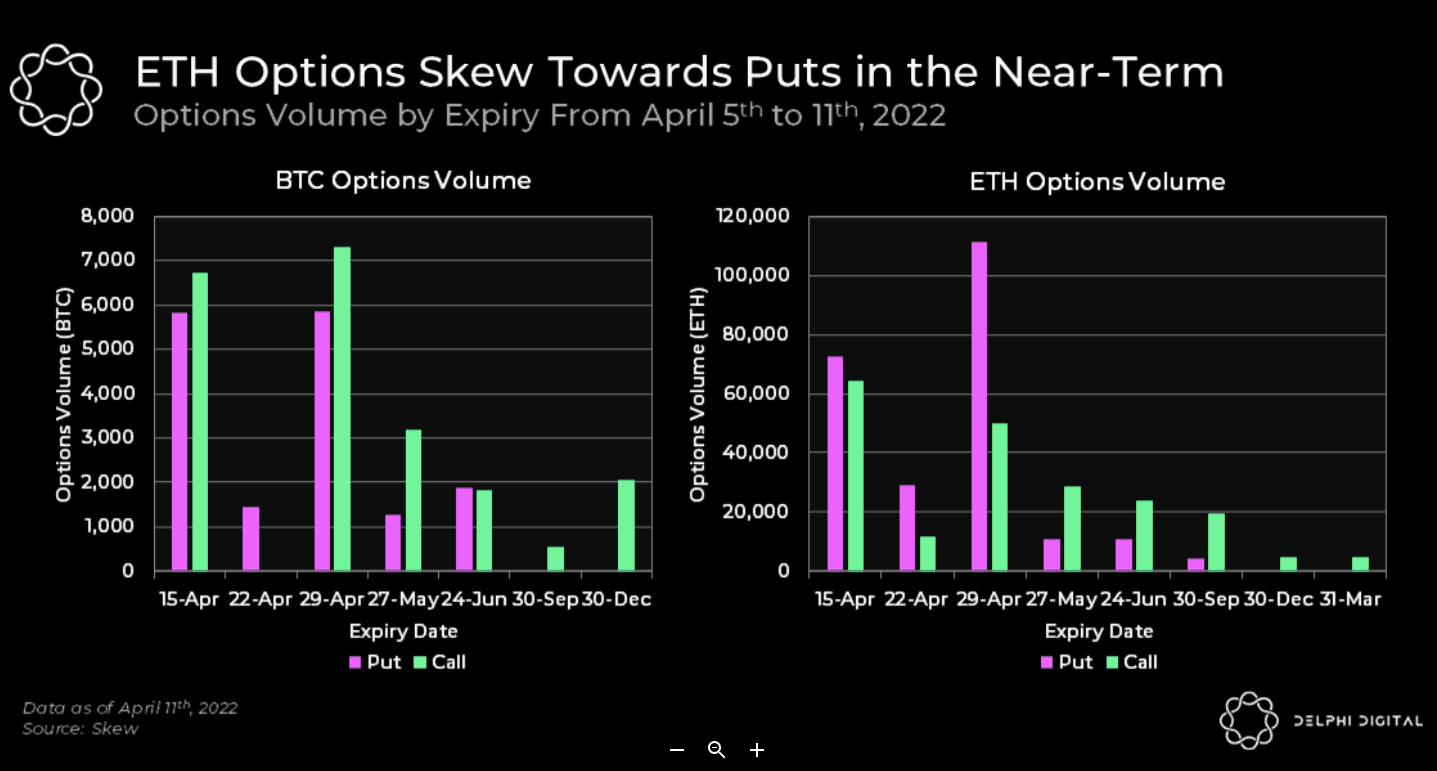

Ethereum ETH/USD options traders appear to be bearish in the near term, while Bitcoin BTC/USD options traders are likely undecided, said Delphi Digital.

What Happened: Delphi Digital said ETH options volume is skewed toward puts compared with BTC options, in a note seen by Benzinga.

Options Volume By Expiry From April 5 To April 11 — Courtesy Delphi Digital

Options Volume By Expiry From April 5 To April 11 — Courtesy Delphi Digital

Implied volatility (IV) continues to trend lower, according to Delphi Digital, and hit new yearly lows over the weekend, noted the on-chain analytics firm.

IV is a measure of market sentiments on how likely an underlying asset is expected to move. Lower means less likely, while higher means more likely.

See Also: How To Get Free Crypto

Why It Matters: There exists a contrarian view on why high ETH put volumes could turn out to be bullish, according to Delphi Digital.

“Investors may be buying cheap protection ahead of CPI release as IV falls.”

Delphi Digital said that the net outflow of ETH from exchanges is an indicator that investors are continuing to accumulate the second-largest coin by market cap ahead of its merge.

The merge is an event where Ethereum will attempt to switch from a proof-of-work model to a proof-of-stake mechanism.

Price Action: At press time, over 24 hours, ETH traded 1.15% higher at $3,014.26, while BTC traded 1.4% higher at $40,077.18, according to Benzinga Pro Data.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.