Dogecoin DOGE/USD was holding up better than Bitcoin BTC/USD on Friday, trading mostly flag while Bitcoin fell over 2%.

Dogecoin’s price action was taking place within Thursday’s trading range, which has settled the crypto into an inside bar pattern on the daily chart.

An inside bar pattern indicates a period of consolidation and is usually followed by a continuation move in the direction of the current trend.

An inside bar pattern has more validity on larger time frames (four-hour chart or larger). The pattern has a minimum of two candlesticks and consists of a mother bar (the first candlestick in the pattern) followed by one or more subsequent candles. The subsequent candle(s) must be completely inside the range of the mother bar and each is called an "inside bar."

A double, or triple inside bar can be more powerful than a single inside bar. After the break of an inside bar pattern, traders want to watch for high volume for confirmation the pattern was recognized.

- Bullish traders will want to search for inside bar patterns on stocks that are in an uptrend. Some traders may take a position during the inside bar prior to the break while other aggressive traders will take a position after the break of the pattern.

- For bearish traders, finding an inside bar pattern on a stock that's in a downtrend will be key. Like bullish traders, bears have two options of where to take a position to play the break of the pattern. For bearish traders, the pattern is invalidated if the stock rises above the highest range of the mother candle.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

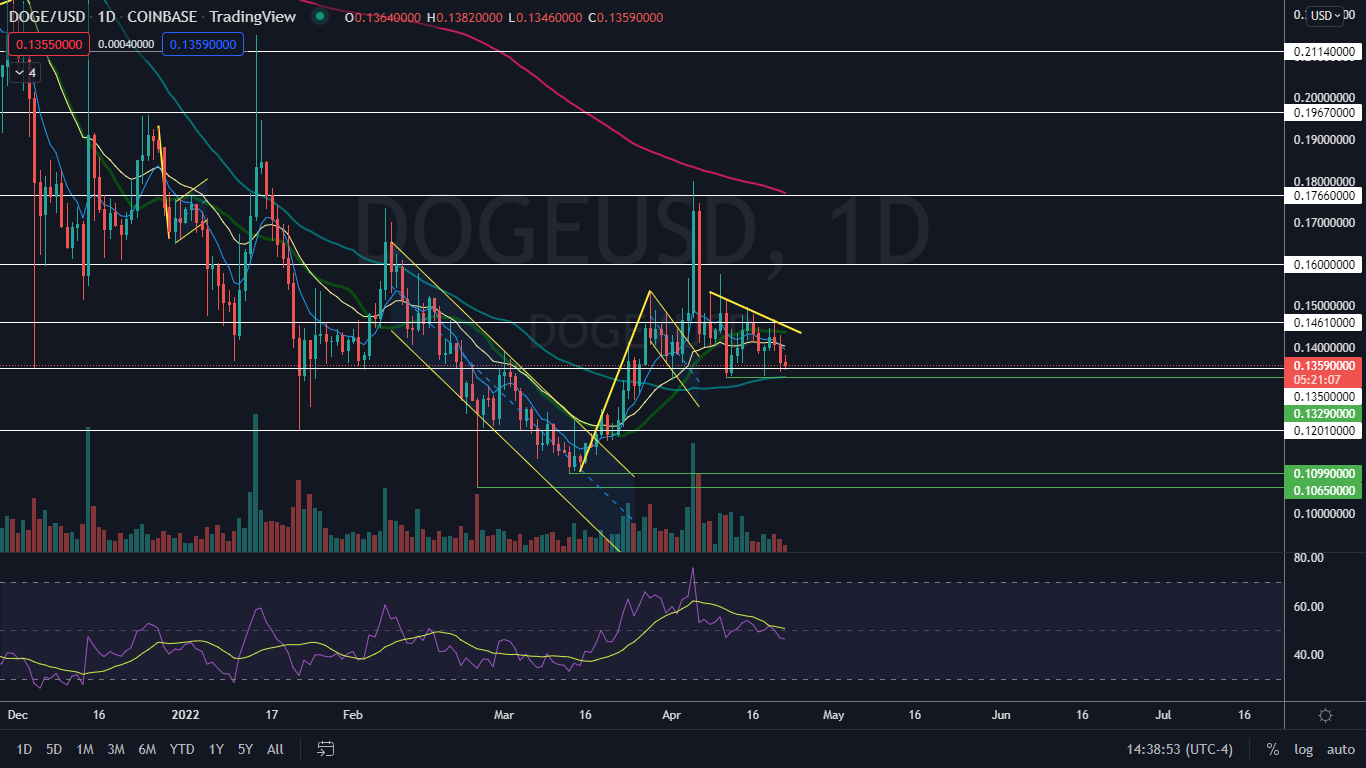

The Dogecoin Chart: Dogecoin’s inside bar is neutral because the stock has been trading sideways in a tightening range since April 11. Traders and investors can watch for a break up or down from the inside bar pattern later on Friday or on Saturday to take place on higher-than-average volume to gauge future direction.

- Dogecoin’s tightening trading range has also settled the crypto into a triangle pattern on the daily chart, making a series of lower highs and higher lows. The crypto is set to reach the apex of the triangle on May 5, and traders and investors can watch for Dogecoin to break up or down from the pattern before that date.

- If Dogecoin closes the trading day flat, it will print a doji candlestick on the daily chart, which indicates indecision but because the stock is printing the candlestick at the lower range of Thursday’s mother bar, the doji could indicate a reversal to the upside is on the way.

- Dogecoin has resistance above at $0.146 and 16 cents and support below at $0.135 and just above the 12-cent mark.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.