Zinger Key Points

- Bitcoin, Ethereum, Dogecoin rally along with stock futures

- Investor sentiment sees improvement in fresh trading week

- Even as Bitcoin on-chain activity remains muted, hodlers of the apex coin remain unfazed

- Get 5 stock picks identified before their biggest breakouts, identified by the same system that spotted Insmed, Sprouts, and Uber before their 20%+ gains.

Bitcoin and Ethereum rallied sharply at press time on Monday evening as the global cryptocurrency market cap spiked 7.5% to $1.3 trillion.

| Coin | 24-hour | 7-day | Price |

|---|---|---|---|

| Bitcoin BTC/USD | 7.8% | 8.4% | $31,653.45 |

| Ethereum ETH/USD | 10.3% | 0.6% | $1,993.84 |

| Dogecoin DOGE/USD | 6.5% | 5.2% | $0.09 |

| Cryptocurrency | 24-Hour % Change (+/-) | Price |

|---|---|---|

| WAVES (WAVES) | +75.6% | $7.72 |

| Axie Infinity (DCR) | +47% | $26.92 |

| Helium (HNT) | +27.9% | $9.38 |

See Also: Best Crypto Debit Cards

Why It Matters: The apex coin traded over $31,000, while Ethereum, the second-largest coin by market cap, traded just below the psychologically important $2,000 level at press time. During intraday trading, BTC and ETH touched $31,949.63 and $2,005.49, respectively.

The gains seen in stocks last week appear to be permeating to cryptocurrencies. At press time, the S&P and Nasdaq futures traded 0.1% and 0.4% higher, respectively.

Risk assets like stocks could get a boost this week as China begins reopening the country due to a drop in COVID-19 cases. Both Beijing and Shanghai are easing restrictions, reported Voice of America.

Cryptocurrency trader Justin Bennett noted that Bitcoin and the S&P 500 have been positively correlated for some time now. He tweeted that while the S&P had an impressive rally last week, Bitcoin was “still sleeping.”

“Looks like [Bitcoin] is about to play catch-up. This would put it in the mid $30k range at current S&P levels.”

$BTC has been positively correlated with the S&P 500 for some time now.

— Justin Bennett (@JustinBennettFX) May 30, 2022

The S&P had an impressive rally last week while #Bitcoin was still sleeping.

Looks like #BTC is about to play catch-up. This would put it in the mid $30k range at current S&P levels. $SPY $SPX pic.twitter.com/3TrZdNVZsm

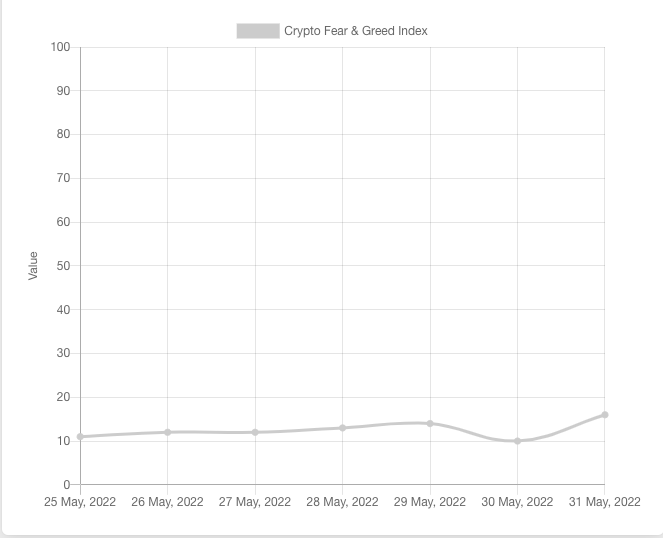

Investor sentiment, as measured by Alternative.me’s “Crypto Fear & Greed Index,” still remains weak. The index flashed “Extreme Fear” at press time and had a value of 16. However, it has improved over last week when it stood at 12.

The "Crypto Fear & Greed Index" By Alternative.me

Old hands have reduced their Bitcoin spending behavior, said chartist Ali Martinez, citing an on-chain metric known as entity-adjusted dormancy flow.

The entity-adjusted dormancy flow is a variation of dormancy, which is a marker of a coin’s lifespan. Analysts use these measures to call out market bottoms and explore long-term market trends.

“A dormancy value of 250K or lower, suggests [Bitcoin] is in a good historical buy zone,” tweeted the chartist.

Martinez said that Bitcoin dormancy value is hovering below 250,000 for the past 6 months and this is a “buy the dip” hint.

Entity-Adjusted Dormancy Flow shows that old hands have reduced their $BTC spending behavior. A dormancy value of 250K or lower, suggests #BTC is in a good historical buy zone.#Bitcoin dormancy value has been hovering below 250K for the past 6 months, hinting "buy the dip." pic.twitter.com/xXGRY5vcEo

— Ali Martinez (@ali_charts) May 30, 2022

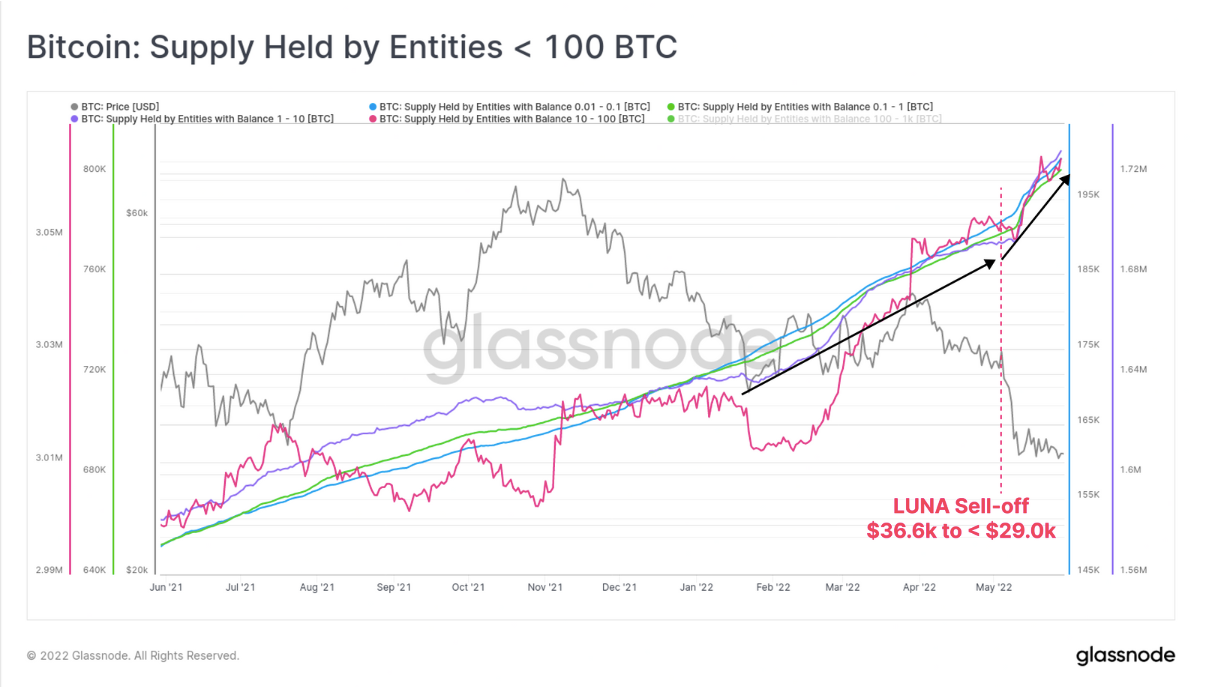

Meanwhile, Bitcoin on-chain activity, which plateaued in September has yet to pick up pace. Glassnode said in a recent note that the Hodler class are the only ones that remain.

The on-chain analysis firm noted that after the Terra (LUNA) meltdown entities holding less than 100 BTC soaked up coin volume sold in distress by the Luna Foundation Guard.

Bitcoin Supply Held By Entities Who Hold Less Than 100 BTC — Courtesy Glassnode

Bitcoin Supply Held By Entities Who Hold Less Than 100 BTC — Courtesy Glassnode

“Alongside a majority of long-term holders, an increasingly large volume of BTC appears HODLed and acquired at these lower prices. This trend, unless disrupted, can be expected to propel Long-Term Holder supply above its ATH over the coming months,” said Glassnode, in a note seen by Benzinga.

Meanwhile, over the long Memorial Day weekend, the beleaguered Terra project attempted a resurrection as it launched a new blockchain and airdropped LUNA 2.0 tokens to holders.

Terra now represents the 2.0 version of the token and is up 60.6% at $9.32, while Terra Classic (LUNC) traded 16.5% higher at 0.000123 at press time.

Read Next: Massive Losses? Not For These Funds Which Made Millions On Their Terra (LUNA) Investment

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.