Zinger Key Points

- Bitcoin, Ethereum, Dogecoin stage recovery after plunging deep over the long weekend

- Bitcoin market underwent a "massive deleveraging' event last week causing various actors to capitulate

- Cryptocurrency trader Justin Bennett sees further downside before relief rally

- Don't face extreme market conditions unprepared. Get the professional edge with Benzinga Pro's exclusive alerts, news advantage, and volatility tools at 60% off today.

Bitcoin and Ethereum traded above key psychological levels on Monday evening after slipping below them over the long holiday weekend. The global cryptocurrency market cap rose 1.1% to $906 billion.

| Coin | 24-hour | 7-day | Price |

|---|---|---|---|

| Bitcoin BTC/USD | 0.65% | -9% | $20,504.76 |

| Ethereum ETH/USD | 0.7% | -7.6% | $1,119.88 |

| Dogecoin DOGE/USD | 0.02% | 9.9% | $0.06 |

| Cryptocurrency | 24-Hour % Change (+/-) | Price |

|---|---|---|

| Synthetix (SNX) | +57.8% | $3.23 |

| 1inch Network (1INCH) | +20.5% | $0.69 |

| Arweave (AR) | +18.2% | $10.13 |

See Also: How To Get Free NFTs

Why It Matters: Cryptocurrencies were buoyant on Monday evening along with other risk assets after Bitcoin and Ethereum dipped below the $20,000 and $1,000 levels over the weekend.

The two largest cryptocurrencies by market cap touched respective lows of $17,708,62 and $896.11 over the weekend.

The S&P 500 and Nasdaq futures were both up more than 1% at press time.

Recession fears have become entrenched in the market. Inflation has gone from being a primary concern to the sole one, according to OANDA senior market analyst Craig Erlam.

“The hope now is that any recession will be mild and brief but the situation is evolving so rapidly, that it's hard to know with any real certainty,” wrote Erlam in a note.

Erlam noted Bitcoin’s quick dip below the $20,000 mark and said it was a much-touted critical level.

“The HODLer mentality is really being put to the test and those that haven't bailed yet may be as tempted as they've ever been.”

Investors will look out for the U.S. Federal Reserve Jerome Powell’s presentation of the Monetary Policy Report to Congress in the fresh and truncated trading week.

Next week, Chair Powell presents the Monetary Policy Report to Congress. The Federal Reserve Chair testifies twice each year on economic developments & monetary policy. (2/2)

— Federal Reserve (@federalreserve) June 17, 2022

Learn more: https://t.co/pgnEGEOsSt

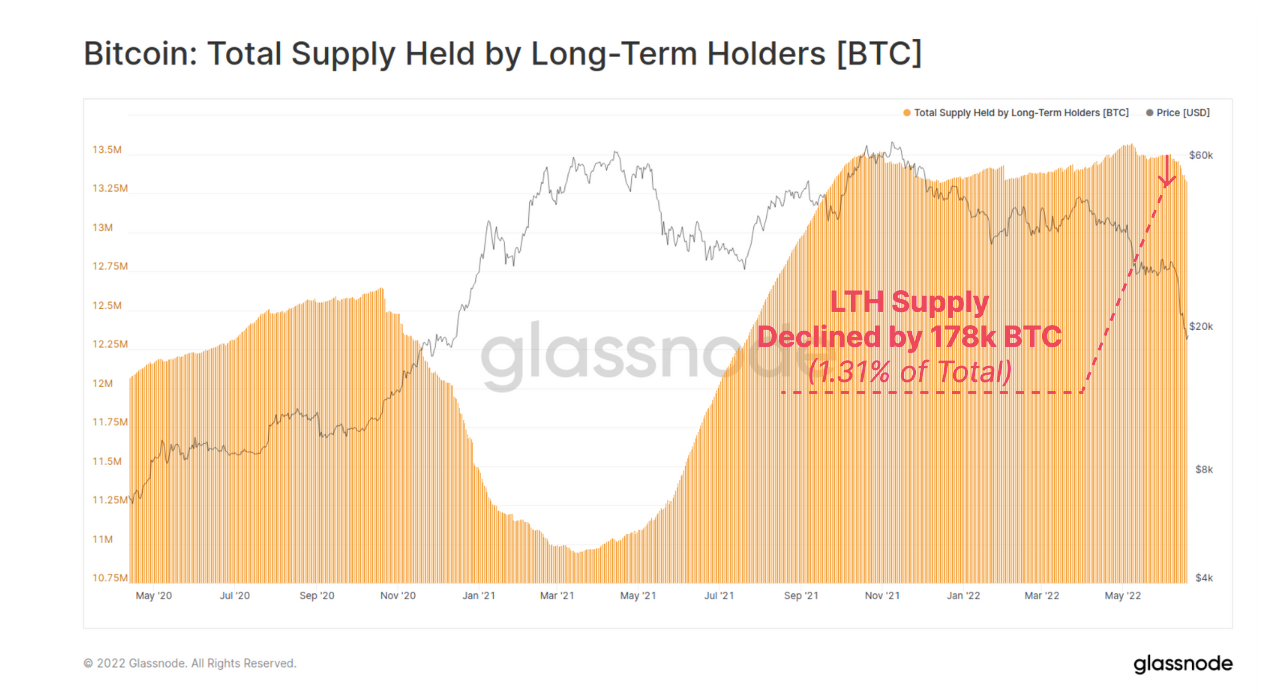

Glassnode said the Bitcoin market underwent a “massive deleveraging event” this week putting pressure on miners, long-term holders, and the aggregate market.

“The falling dominoes of the current bear market are advancing to a new phase. Alongside miners, Long-Term Holders are now beginning to feel the pressure, forcing many of them to sell at an accelerating rate,” said the on-chain analytics company in a weekly blog post.

Bitcoin, Total Supply Held By Long-Term Holders — Courtesy Glassnode

Bitcoin, Total Supply Held By Long-Term Holders — Courtesy Glassnode

Glassnode data indicate that long-term holder supply fell by 178,000 BTC over the last week, which equals to 1.31% of their entire holdings.

Market sentiment continues to remain marred by “Extreme Fear,” according to Alternative.me’s “Crypto & Fear Index.”

Cryptocurrency trader Justin Bennett said on Twitter that the current “bounce” appears to be weak and could be another “bull trap” before we see the next round of selling.

The analyst said the total cryptocurrency market capitalization could touch $670-$730 billion before a relief rally takes place.

This bounce looks weak so far. Most likely another bull trap before the next round of selling.

— Justin Bennett (@JustinBennettFX) June 20, 2022

I still think we see $TOTAL reach the $670-$730B area before a relief rally. That's 17-25% below current levels.

The lower number put forward by Bennett would imply the market cap declines another 26.05% from current levels.

Michaël van de Poppe said the apex coin needs to clear resistance near $20,500 for a continuation towards $23,000.

Good morning!

— Michaël van de Poppe (@CryptoMichNL) June 20, 2022

The markets looking pretty ok, if you'd ask me.#Bitcoin needs to clear that resistance around $20.5K and then we'd be good for continuation towards $23K.

The trader said if Ethereum holds $1,085 levels, he’s assuming we’ll be seeing $1,250 next.

If $1,085 holds for #Ethereum, then I'm assuming we'll be seeing $1,250 next. pic.twitter.com/xb6dY2ulvM

— Michaël van de Poppe (@CryptoMichNL) June 20, 2022

Read Next: Cryptocurrencies Down The Most From All-Time Highs, And No, It's Not DOGE Or SHIB

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.