Zinger Key Points

- Bitcoin, Ethereum, Dogecoin plunge along with stocks

- Bitcoin could touch as low as $18,630, says chartist Ali Martinez

- Long-term holder spent output profit ratio at 0.67 - Glassnode

- Pelosi’s latest AI pick skyrocketed 169% in just one month. Click here to discover the next stock our government trade tracker is spotlighting—before it takes off.

Bitcoin traded below a key psychological level on Monday evening, while other major coins also slid, as the global cryptocurrency market declined 4.05% to $888.7 billion at press time.

| Coin | 24-hour | 7-day | Price |

|---|---|---|---|

| Bitcoin BTC/USD | -3.9% | -1.3% | $19,981.91 |

| Ethereum ETH/USD | -6% | -4.8% | $1,097.13 |

| Dogecoin DOGE/USD | -7.7% | -11.2% | $0.06 |

| Cryptocurrency | 24-Hour % Change (+/-) | Price |

|---|---|---|

| Arweave (AR) | +3.9% | $12.02 |

| Loopring (LRC) | +1.35% | $0.11 |

| Dai (DAI) | +0% | $1 |

See Also: How To Get Free NFTs

Why It Matters: Bitcoin traded below the $20,000 mark, while Ethereum was close to slipping below $1,000 at press time as sentiment around risk assets deteriorated yet once again.

Cryptocurrencies tracked weaker equities on Monday, as major U.S. indices S&P 500 and Nasdaq ended 1.15% and 2.26% lower.

Futures for the S&P 500 and Nasdaq were, however, up 0.04% and 0.01%, respectively, ahead of earnings announcements from major companies.

“Another bear-market rally has come and gone and we now head into earnings season and another week of major economic reports fearful of what may lie ahead. The U.S. inflation data midweek is a standout, as investors cross their fingers for signs of decelerating prices,” said OANDA senior market analyst Craig Erlam, in a note seen by Benzinga.

Erlam’s colleague at OANDA, Edward Moya said that the latest bearish cycle for Bitcoin is close to testing the “historically known 80% drops that we would see in past crypto winters.”

“The $14,000 level seems like it could provide significant support if Bitcoin breaks later this week. This week’s inflation report could be the trigger for one last major plunge for cryptos.”

The U.S. dollar continued to strengthen as expectations heightened for yet another interest rate hike. At press time, the dollar index — a measure of the greenback’s strength against six of its peers — rose to 108.19.

Cryptocurrency trader Justin Bennett warned on Twitter that people should stop trying to call dollar index tops, saying the signs point to 120 for the index. Bennett has commented on the inverse relationship between cryptocurrencies and the dollar in the past.

To whom it may concern:

— Justin Bennett (@JustinBennettFX) July 11, 2022

Please stop trying to call $DXY tops.

While it won't be a straight shot, all signs point to 120 for the USD index. $BTC $ETH https://t.co/fpvbpxOvZm pic.twitter.com/FLb56pKZ4P

The chartist Ali Martinez said that Bitcoin had dipped below its 100-hour moving average down to the $19,900 levels and if these fail to hold, losses could extend towards the $19,300 or even $18,630 levels.

#Bitcoin dipped below the 100-hour MA, triggering a downswing to $19,900.

— Ali Martinez (@ali_charts) July 11, 2022

If this level fails to hold $BTC, the losses can extend toward $19,300 or even $18,630. https://t.co/UJzJT9rPgi pic.twitter.com/AaBcOwdwzo

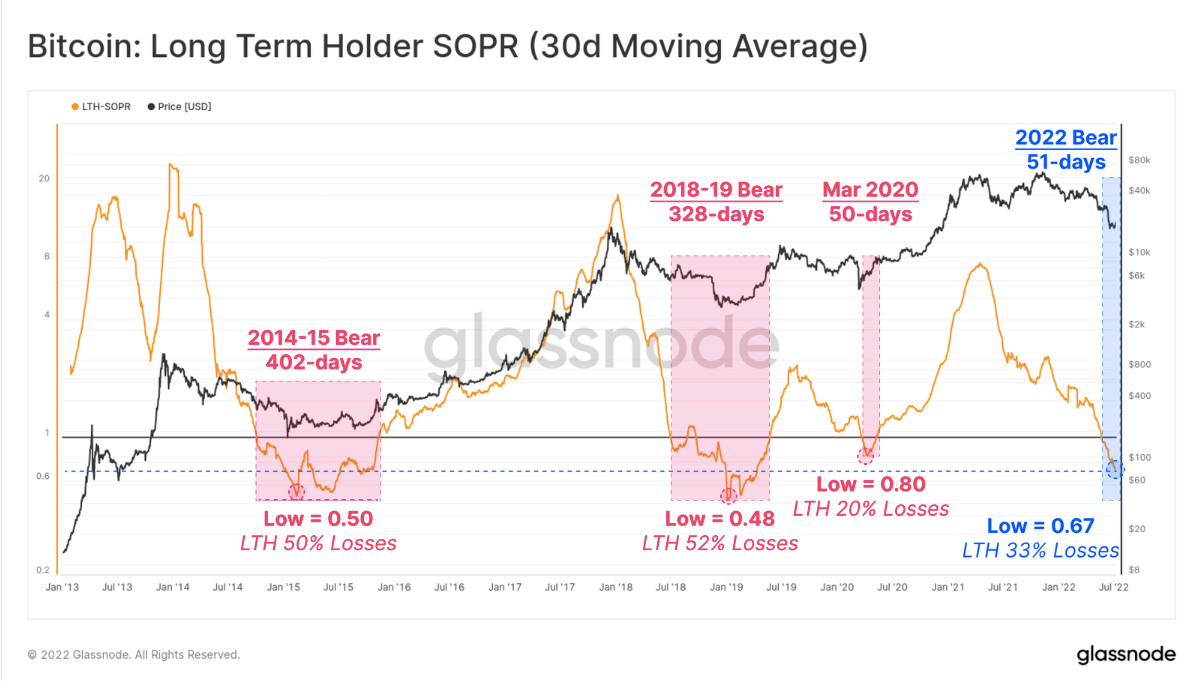

On-chain analysis firm Glassnode said in a note that the long-term holder spent output profit ratio (LTH-SOPR), which indicates the profit ratio captured by long-term holders of Bitcoin, is showing that so-called diamond hands are in pain.

An LTH-SOPR value of 2.0 means long-term holders are spending coins at a price that is 2x their cost basis, while a value that is less than 1.0 means investors realize losses or spend coins at a price below their cost basis.

Bitcoin LTH-SOPR (30-day Moving Average) — Courtesy Glassnode

Bitcoin LTH-SOPR (30-day Moving Average) — Courtesy Glassnode

“LTH-SOPR is currently trading at 0.67, indicating the average LTH spending their coins is locking in a 33% loss,” said Glassnode.

While extreme financial stress and “fingerprint of a widespread capitulation” can be observed, Glassnode said, “there may still be a combination of both time pain (duration), and perhaps further downside risk to fully test investor resolve, and enable the market to establish a resilient bottom."

Read Next: Ethereum Fees Drop Below $0.90 For The First Time In 2 Years

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.