Zinger Key Points

- Bitcoin, Ethereum, Dogecin in the red ahead of key U.S. Federal Reserve meeting

- Crypto trader Michaël van de Poppe says the "worst" from Fed meeting may have been priced in

- Spike in profit-taking could plunge Ethereum to $1,300, says chartist Ali Martinez

- Join Chris Capre on Sunday at 1 PM ET to learn the short-term trading strategy built for chaotic, tariff-driven markets—and how to spot fast-moving setups in real time.

Major coins declined sharply Monday evening as the global cryptocurrency market cap fell 5.9% to $979.9 billion at press time.

| Coin | 24-hour | 7-day | Price |

|---|---|---|---|

| Bitcoin BTC/USD | -5.8% | -5.8% | $21,287.58 |

| Ethereum ETH/USD | -9.8% | -9% | $1,442.71 |

| Dogecoin DOGE/USD | -7.9% | -8.3% | $0.06 |

| Cryptocurrency | 24-Hour % Change (+/-) | Price |

|---|---|---|

| Trust Wallet Token (TWT) | +3.7% | $0.9 |

| TrueUSD (TUSD) | +0.05% | $1 |

| USDD (USDD) | +0.04% | $1 |

See Also: How To Get Free Crypto

Why It Matters: Bitcoin and Ethereum plunged sharply as investor sentiment remained subdued ahead of a key policy meeting of the U.S. Federal Reserve and earnings data from major tech giants.

Cryptocurrencies mirrored the tech-heavy Nasdaq, which ended Monday down 0.4%. The S&P 500 and Nasdaq futures fell 0.4% and 0.5%, respectively, at press time after Walmart Inc WMT cut guidance and said increased inflation was affecting consumer spending.

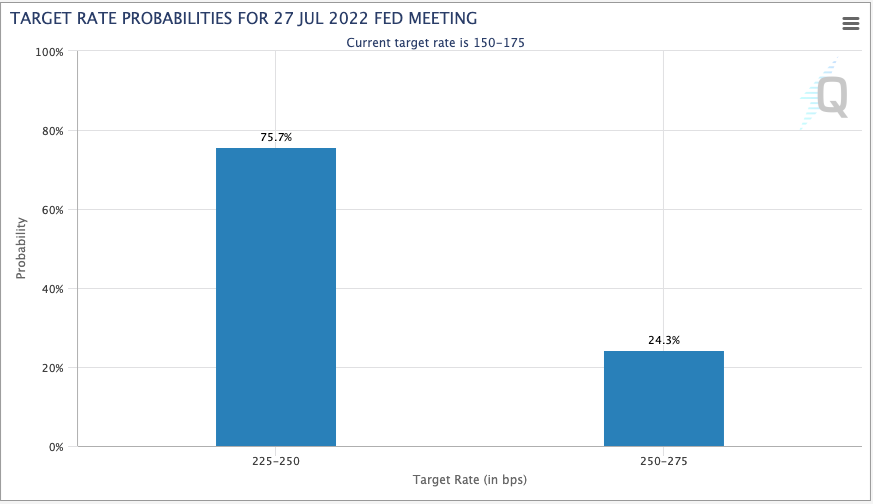

This week’s Federal Open Market Committee meeting could possibly end with a 100 basis points interest rate hike, according to some economists.

The CME FedWatch tool put the probability of a 75 bps rate hike at 77.5%, while for a 100 bps at 22.5% at press time.

Target Rate Probabilities For Jul 27 FOMC Meeting — Courtesy CME Group

Target Rate Probabilities For Jul 27 FOMC Meeting — Courtesy CME Group

The specter of rate hikes and a looming recession have not spared the dollar either, which has been inversely correlated with cryptocurrencies lately. The dollar index, a measure of the greenback’s strength against a basket of currencies, traded 0.08% lower at 106.40 at press time.

Edward Moya, a senior market analyst with OANDA, noted the stack of macroeconomic fundamentals working against Bitcoin in a note seen by Benzinga.

“Cryptocurrencies are broadly weaker as investors await an FOMC decision that will likely conclude with a 75 basis-point rate increase and reaffirm a commitment to fighting inflation.”

Delphi Digital said that going forward, there are two important timeframe levels for investors. If Bitcoin breaks above the current price range of $20,000 to $24,000, “high time-frame resistance” will come into play around the $28,000 to $30,000 region, it said.

“If [Bitcoin] breaks below the current range, we are likely looking at the $10K-$12K price range, with some possible front running in the $14K-$16K region,” Delphi Digital said in a note.

Cryptocurrency trader Michaël van de Poppe said “people really expect the worst” out of Wednesday — the final day of the FOMC meeting — ”but maybe the worst is already heavily priced in.”

People really expect the worst out of Wednesday, but maybe the worst is already heavily priced in.

— Michaël van de Poppe (@CryptoMichNL) July 25, 2022

An indicator that identifies a turning point in an asset’s price trend was used by Ali Martinez on Ethereum’s daily chart. The analyst said that TD Sequential presents a “sell signal.”

“A spike in profit taking that takes [ETH] below $1,550 could trigger a correction to $1,300.”

— Ali Martinez (@ali_charts) July 25, 2022

Ethereum’s gas consumption dominance by non fungible token activities has risen 6.2% since November, while that of decentralized finance applications fell from 27.5% to 15.1%, said Glassnode, an on-chain data focused company.

#Ethereum relative gas consumption dominance by NFT activities has grown 6.2% since November, showing a continued market preference for NFT transactions.

— glassnode (@glassnode) July 25, 2022

Meanwhile, the dominance of DeFi applications has declined from 27.5% to 15.1%.

Live Chart: https://t.co/2UTVHIyjhm pic.twitter.com/2aAIQ39l2n

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.