Open interest in Ethereum ETH/USD options exceeded that of Bitcoin BTC/USD for the first time on Monday.

What Happened: According to data from Glassnode, at press time, the cumulative value of open interest on ETH contracts on dominant crypto derivatives exchange Deribit stood at $5.6 billion, outpacing the $4.3 billion in open interest for BTC.

Deribit accounts for more than 90% of global crypto trading volume and open interest.

According to Glassnode, the open interest of Deribit ethereum options with a notional value of $5.6 billion exceeded the open interest of bitcoin options for the first time in history, and the bitcoin options open interest is about $4.3 billion. pic.twitter.com/AeCU2woiDH

— Wu Blockchain (@WuBlockchain) August 1, 2022

The majority of ETH options were call options, evidenced by a Put/Call ratio of 0.26. Meanwhile, BTC options had a Put/Call ratio of 0.5.

The largely bullish nature of bets on ETH comes as the Merge looms closer, signifying the blockchain’s transition to Proof-of-Stake that will bring a host of changes, including a reduction in ETH’s net issuance.

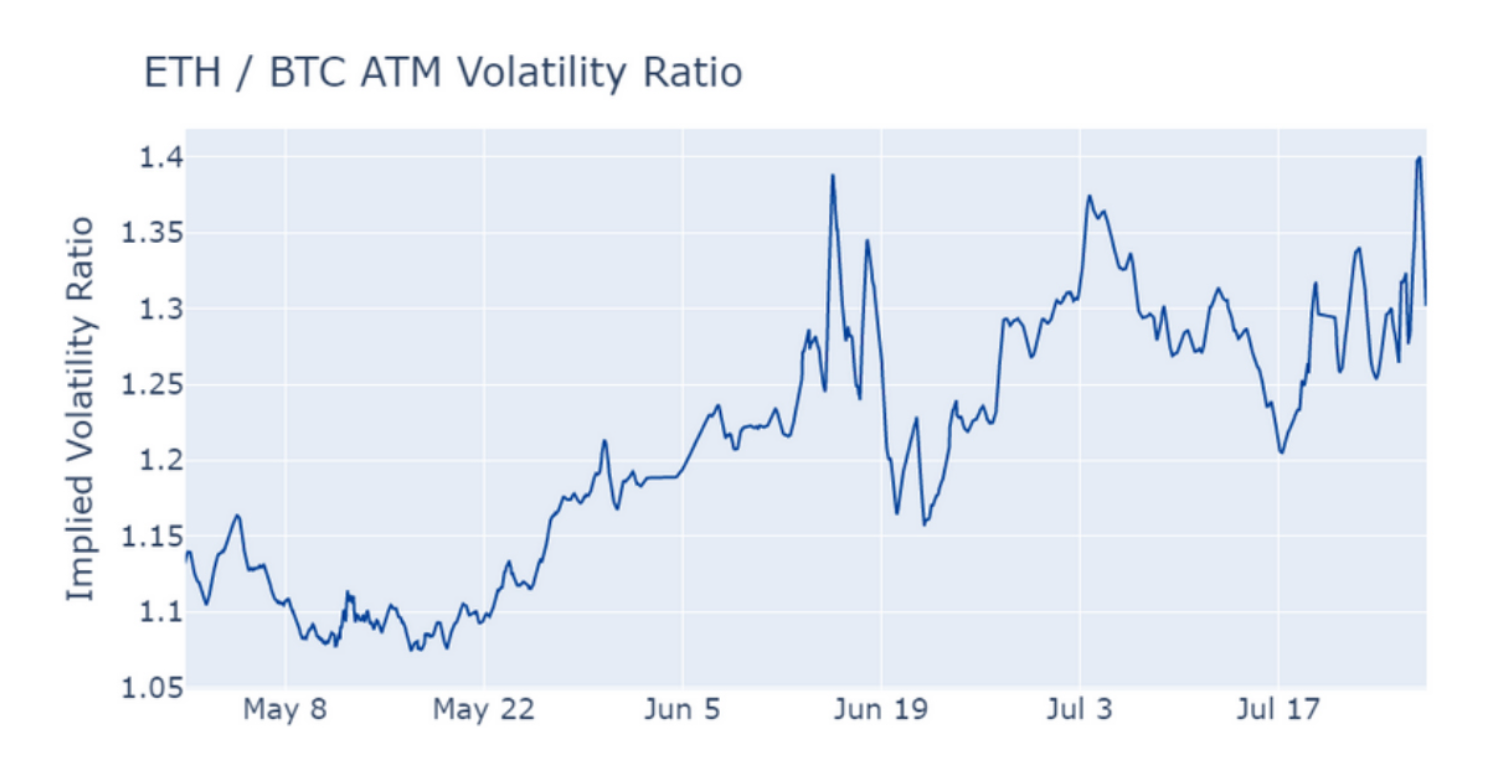

Deribit Insights noted that at-the-money (ATM) implied volatility for ETH has spiked more significantly than implied volatility for BTC.

“The levels of ATM volatility implied by BTC options spiked in a similar way to ETH’s during both spikes in May and June, but took a leg up of only 10 vol percentage points in the aftermath of each crash in contrast to ETH’s two 20 vol point steps,” wrote Deribit.

“That has resulted in a three-month-long trend of ETH’s ATM vol outperforming that of BTC, an occurrence somewhat to be expected given the former’s larger downturn from November’s all-time highs.”

Price Action: According to data from Benzinga Pro, at press time, BTC was trading at $22,946, down 1.9% over 24 hours. ETH was trading at $1,594, down 5.85% over the same period.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.