Zinger Key Points

- The Vermont Department of Financial Regulation suggests Celsius Network is a Ponzi scheme

- The regulator slams Celsius CEO over false and fraudulent statements on the company's financial health

- With stocks plunging, steady income is key. Tim Melvin & Ryan Faloona reveal dividend stocks and deep-value plays on April 8. Reserve your spot now.

The Vermont Department of Financial Regulation has outlined a variety of state concerns about unregistered securities offerings and fraud committed by the cryptocurrency firm Celsius Network, suggesting that the company is a Ponzi scheme.

Statements made by Celsius CEO false and misleading

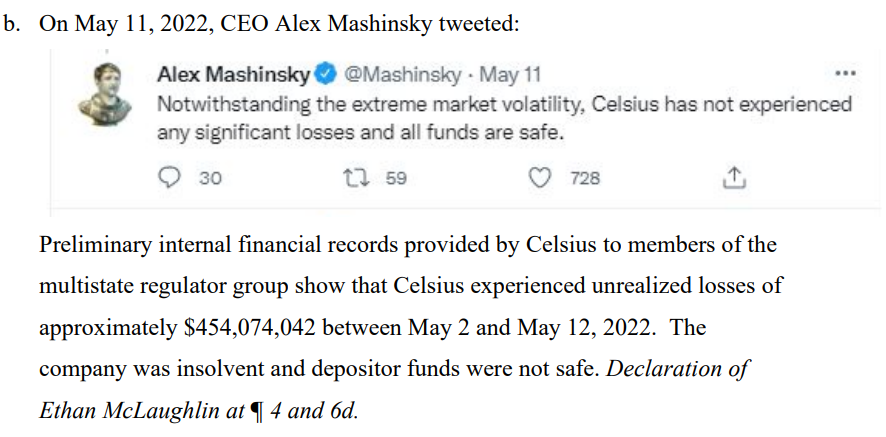

A filing in the United States Bankruptcy Court of the Southern District of New York by the regulator slammed several statements made by Celsius CEO Alex Mashinsky and dubbed them as fraudulent and deceptive.

It adds that despite worries about the volatility in the crypto market, statements made by the CEO likely persuaded retail investors to buy into Celsius or to leave their investments in the company.

The Vermont Department of Financial Regulation terms several statements of Mashinsky as “false” at the time of their publication.

In a blog post published on June 7, he claimed that Celsius has "the reserves (and more than enough ETH) to meet obligations, as dictated by our comprehensive liquidity risk management framework. "

However, according to Celsius's financial records, at the time of the statements, they had a "deeply negative net worth" and lacked the assets necessary to pay back deposits.

In a tweet from a month prior, Mashinsky said the company had not suffered "any significant losses," adding that "all funds are secure," despite the fact that when the announcement was issued on May 11, the company had unrealized losses of more than $454 million between May 2 and May 12.

Additionally, the Vermont regulator claims that the firm was bankrupt and that the funds were not secure.

Additionally, the Vermont regulator claims that the firm was bankrupt and that the funds were not secure.

According to the regulator, other false claims made by the CEO included that Celsius was profitable in 2021 despite massive losses being recorded, that regulators had not discovered anything concerning with the company despite several ongoing actions and investigations against it related to securities laws, and that problems with the company began in the spring of 2022 despite the fact that it had been losing money since 2020.

Celsius did not earn enough revenues to support yields

Another intriguing narrative by the regulator involves a meeting that took place on August 19, 2022.

Celsius acknowledged that "the company had never earned enough revenue to support the yields being paid to investors," at the meeting, known as the 341 meeting.

This “suggests that at least at some points in time, yields to existing investors were probably being paid with the assets of new investors.” the regulator stated.

In other words, Celsius Network was called a Ponzi scheme by the Vermont Department of Financial Regulation.

CEL tokens manipulated

The regulator also addressed several issues with the Celsius token CEL/USD.

“Celsius and its management engaged in the improper manipulation of the price of the CEL token, including by using the proceeds of investor deposits to acquire CEL tokens and increase its Net Position in CEL,” it stated.

The filing also suggests that the token itself may have been utilized to benefit Celsius insiders.

The regulator also took notice of CFO Chris Ferraro's claim that the token's price decrease led to the company's collapse and sought an examiner, with “broad powers” to look into Celsius and its financial problems.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.