Zinger Key Points

- The market capitalization of the cryptocurrency market currently stands at $928 billion.

- Fears of a rate hike by The Fed have pushed Bitcoin, Ethereum down by 14% and 22%, respectively, in the past week.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

Investors have liquidated more than $445 million from the cryptocurrency market in the past 24 hours. This happened after the largest digital currencies of Bitcoin BTC/USD and Ethereum ETH/USD plummeted to new lows over the weekend and traded significantly lower on Monday compared to the previous week.

The market capitalization of the cryptocurrency market currently stands at $928 billion.

Bitcoin Loses Steam

Bitcoin is currently trading at $19,100, down 14% in the past week and down by around 4% over the past 24 hours.

The world’s largest cryptocurrency is now down by a staggering 75% from its all-time high in November 2021 when its market capitalization was $1.27 trillion. It is now down to $366 billion.

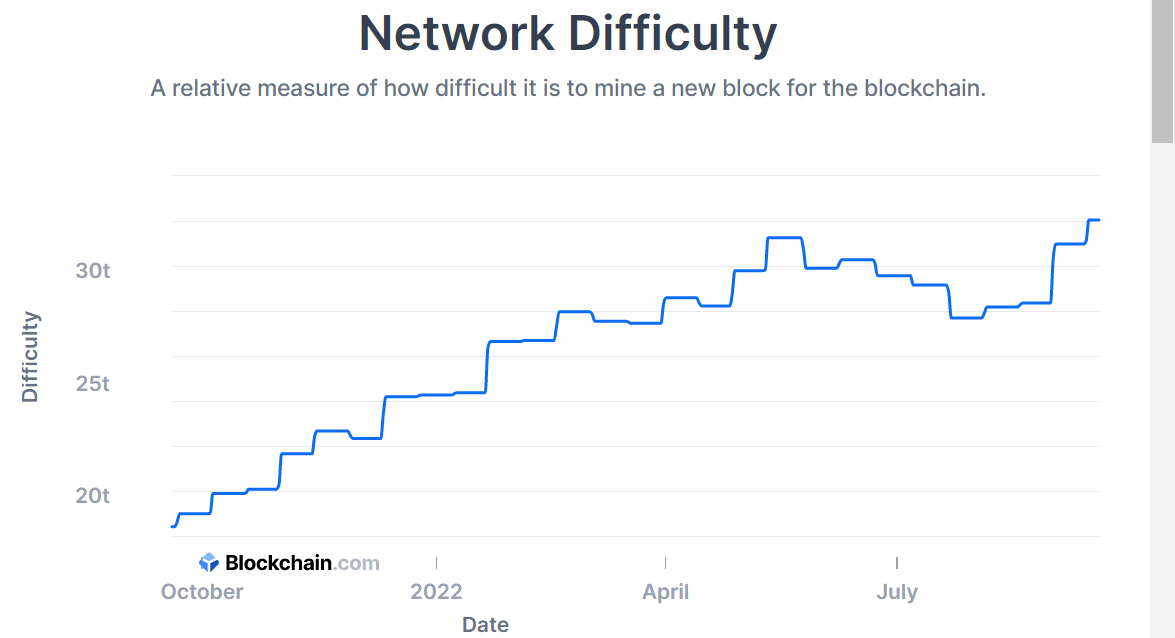

According to Blockchain.com, the network difficulty of Bitcoin hit an all-time high of 32.045t on Sunday.

The computational difficulties involved in mining a block are designated by the term "network difficulty."

The computational difficulties involved in mining a block are designated by the term "network difficulty."

Higher difficulty demands more processing power and has a considerable negative impact on the profitability of miners, which lowers the price of the currency.

Ethereum Follows Suit

The world’s second-largest crypto Ethereum is down a whopping 22% over the past week and currently trading at $1,345 levels, down more than 5% in the past 24 hours.

Ethereum is down about 75% from its all-time high of $4,891.7 recorded in November 2021.

The market capitalization of Ethereum currently stands at $164.5 billion.

$445 Million Liquidated

According to statistics from Coinglass, more than $445 million from over 133,760 traders has been liquidated in the crypto market in the past 24 hours amid bearish sentiments.

About $380 million, or 87%, of the $445 million in liquidated assets were long positions, demonstrating the market's negative sentiments.

Ethereum witnessed the most liquidation at $173 million, followed by Bitcoin at $121 million.

Fed Hike Spooked the Market

Fed Hike Spooked the Market

The possibility of the Fed raising the rate later this week is probably the cause of the market's adverse price response.

According to Reuters, given August's alarming inflation data, a 100-basis point hike is not out of the question with the majority anticipating a 50- to 75-basis point increase.

According to CoinMarketCap, several other prominent cryptocurrencies have seen significant losses in the past 24 hours including Cardano ADA/USD down 10%, Shiba Inu SHIB/USD down 10%, Avalanche AVAX/USD down 10% and Polkadot DOT/USD down 12%.

Are you ready for the next cryptocurrency bull run? Be prepared before it happens! Hear from industry thought leaders like Kevin O’Leary and Anthony Scaramucci at the 2022 Benzinga Crypto Conference on Dec. 7 in New York City.

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.