Zinger Key Points

- Major coins see green ahead of U.S. Federal Reserve policy meeting set to commence Tuesday

- OANDA analyst says cryptoverse "vulnerable to surging borrowing costs'

- Social interest shifts to Ethereum along with XRP and Cardano

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

The two largest coins rose at press time as the global cryptocurrency market cap increased 1.7% to $944.8 billion at 8:18 p.m. EDT on Monday.

| Coin | 24-hour | 7-day | Price |

|---|---|---|---|

| Bitcoin BTC/USD | 0.65% | -12.6% | $19,545.59 |

| Ethereum ETH/USD | 3.2% | -19.6% | $1,337.62 |

| Dogecoin DOGE/USD | 1.9% | -8.3% | $0.06 |

| Cryptocurrency | 24-Hour % Change (+/-) | Price |

|---|---|---|

| TerraClassicUSD (USTC) | +19.7% | $0.035 |

| Helium (HNT) | +15.9% | $4.60 |

| ApeCoin (APE) | +15.8% | $5.88 |

See Also: How To Get Free Crypto

Bitcoin and Ethereum were in the green, along with other risk assets, ahead of the U.S. Federal Reserve’s policy meeting, which is set to commence on Tuesday.

The S&P 500 and Nasdaq futures were up 0.4% and 0.55%, respectively, at the time of writing.

“The entire cryptoverse is vulnerable to surging borrowing costs and that risk remains front and center,” said OANDA senior analyst Edward Moya, in a note seen by Benzinga.

“This week could be the catalyst that sends the market to pricing in peak Fed tightening. This could be the ripping the band-aid off moment for Bitcoin as selling pressure could get ugly here but that might be what is needed to form a bottom.”

Justin Bennett said that Bitcoin is testing the $19,600 level. The trader tweeted, “Reclaim that on the daily chart, and things could get interesting.”

“There are still a lot of short liquidations up to $19,800 and even more at $20,500. We'll see, but so far, this looks like a v-bottom.”

$BTC is testing the $19,600 key area. Reclaim that on the daily chart, and things could get interesting.

— Justin Bennett (@JustinBennettFX) September 19, 2022

There are still a lot of short liquidations up to $19,800 and even more at $20,500.

We'll see, but so far, this looks like a v-bottom.#Bitcoin pic.twitter.com/uxA5MGGF5m

A "V-bottom" refers to a pattern that emerges when the price momentum turns from aggressive selling to aggressive buying — it is considered a bullish reversal pattern.

Michaël van de Poppe said that Ethereum is looking at “weakness” as it lost its “upwards trending structure.” The cryptocurrency trader said on Twitter, “Expecting a response from the region between $1,200-1,300. Not sure whether we'll get a bounce towards $1,425 as FED on Wednesday is most important as a decider of a trend.”

#Ethereum looking at weakness here, as it lost upwards trending structure.

— Michaël van de Poppe (@CryptoMichNL) September 19, 2022

Expecting a response from the region between $1,200-1,300.

Not sure whether we'll get a bounce towards $1,425 as FED on Wednesday is most important as a decider of a trend. pic.twitter.com/BZ7RaaEdqT

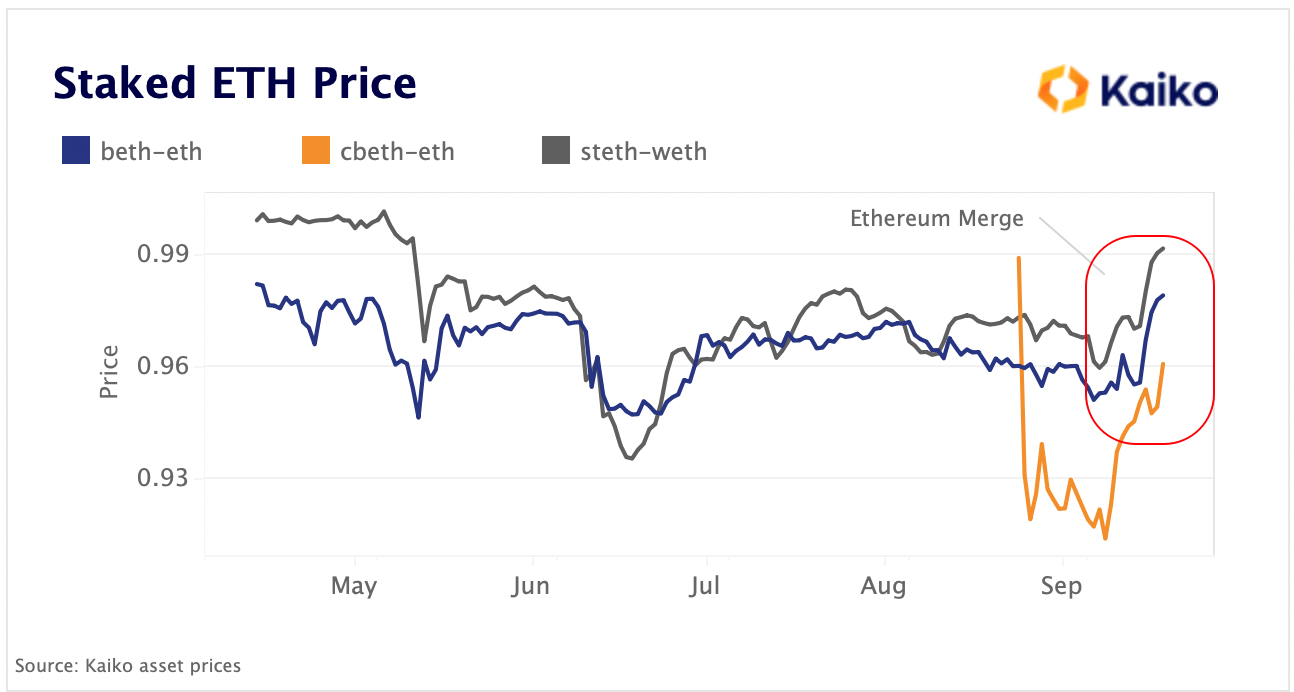

The discount between staked ETH and spot ETH has narrowed to the lowest levels since May. The trend indicates some risk premium is now off the table, according to Kaiko Research.

“Staked ETH discount will likely persist until the next Ethereum upgrade enables staking withdrawals sometime next year,” said the market data provider in a note.

Stake ETH Price Until September — Courtesy Kaiko Research

Stake ETH Price Until September — Courtesy Kaiko Research

“The opportunity costs of holding ETH have now increased (as staking offers additional rewards) which could provide some tailwinds for staked ETH markets."

Meanwhile, despite the cryptocurrency markets taking a hit over the past week, social interest is seeing a shift to Ethereum along with other altcoins such as XRP, Cardano, Polygon and Shiba Inu, said market intelligence platform Santiment on Twitter.

#Crypto markets have obviously taken a big hit over the past week, but it's interesting to see where social interests have shifted. $ETH, $XRP, $ADA, $MATIC, and $SHIB have increased in discussions, while most other assets are being discussed far less. https://t.co/B461oasvSr pic.twitter.com/c6FVIS90gG

— Santiment (@santimentfeed) September 19, 2022

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.