Zinger Key Points

- Factors influencing the S&P 500 are likely to affect cryptos as well.

- A typical crypto bear market lasts for 306 days, but it could be different this time.

- Don't face extreme market conditions unprepared. Get the professional edge with Benzinga Pro's exclusive alerts, news advantage, and volatility tools at 60% off today.

With the cryptocurrency market being in its fifth historic bear market, which began in November last year, prices of major tokens have declined substantially from their all-time highs.

How long will the current bear market last, is the question everyone is asking.

By analyzing historical data and fusing observations from previous bad markets and recessions over the past 100 years, we attempt to provide an answer to this question.

How do the terms "bear market," "recession," and "depression" differ?

We must first define these terms to comprehend what we are talking about.

Bear Market

When the price of stocks or cryptocurrencies drops by 20% or more and the slide continues for at least two months, it is considered to be in a bear market.

Bear markets occur frequently. In the stock market, they typically happen every three to four years. The intervals between bear cycles in crypto markets are shorter, at about 2 years.

Recession

A recession is commonly defined as an economic downturn lasting at least two consecutive quarters, as measured by a reduction in the gross domestic product (GDP).

They occur every 10 years on average.

It is crucial to realize that, even though crypto bear markets frequently overlap with financial markets, a recession affects more than just the financial markets.

The entire economy is slowing down during a recession.

Depression

A three-year or longer recession is considered to be a depression.

The U.S. downturn of the 1930s is one extremely unusual instance of depression.

Over the past century, several depressions have occurred in various countries globally.

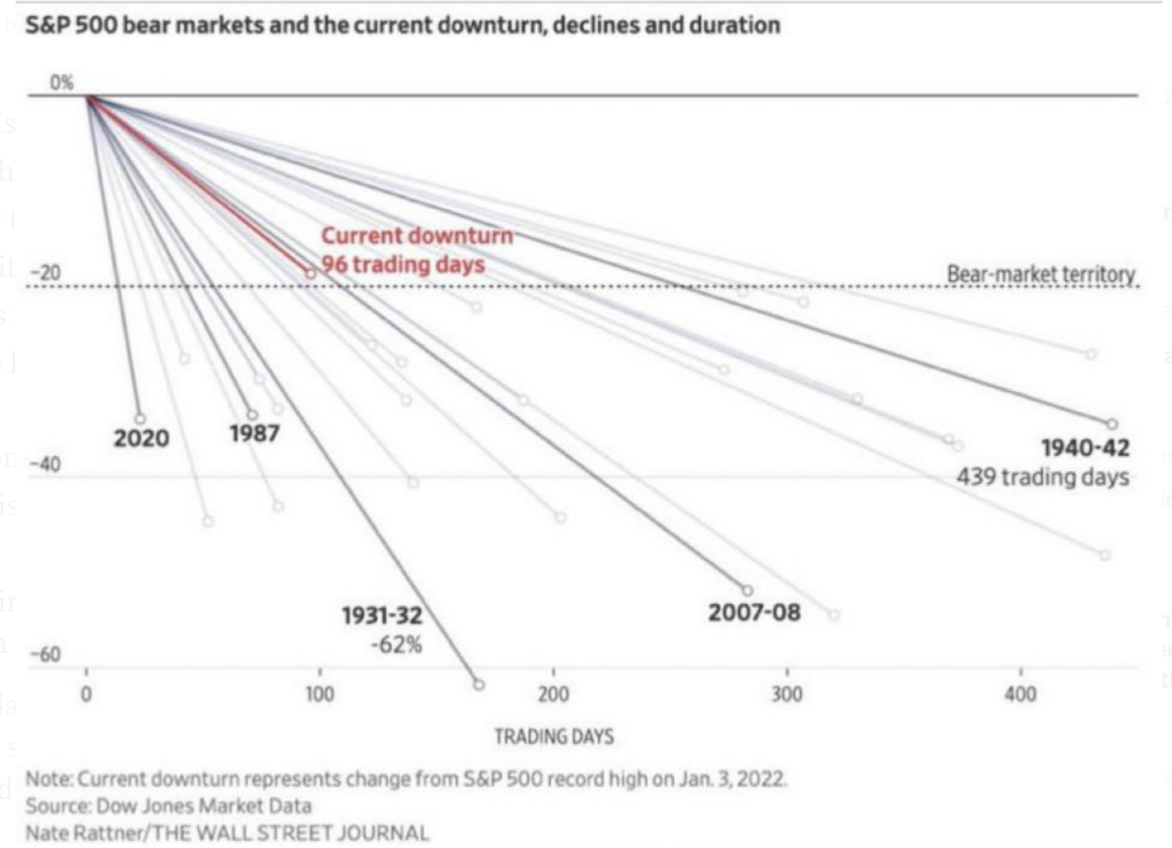

The present and historical economic downturns in the U.S. are illustrated in this graph.

It demonstrates the extent of the S&P 500's drop and the duration of each bear market during the last 90 years.

This graph does not include the 2000 bear market because it lasted for more than 600 days.

Compared to certain historical precedents, the current bear cycle for U.S. stock markets, which started in January 2022, might still be regarded to be fairly mild.

When analyzing the crypto bear market, why consider the U.S. stock market?

There are numerous parallels between the two financial markets.

Since the stock markets have a far longer history, there is a lot to be learned from them.

Cryptocurrencies and US stock markets have a strong link.

Therefore, a rise or fall in the stock market is very likely to affect the crypto market as well.

In other words, anything that influences the S&P 500 is likely to have an effect on the crypto markets as well.

Based on the current data, we can draw initial conclusions:

Are we in a bear market?

Yes. For several months, both the cryptocurrency and stock markets have seen huge losses.

Have we entered a recession?

Yes. The global economy has only gotten worse since the start of 2022 and has now had two consecutive quarters of negative growth, which is critical.

And with the worst expected in the future, the recession may continue to affect us far beyond 2023.

Are we in a depression?

Not yet. This would require the present economic crisis to continue through 2024–2025.

What have previous crypto bear markets taught us?

What else can we infer from historical data now that we are aware of our current economic situation?

One apparent first approach is to consider how long and how sharply previous crypto bear markets have declined.

2011–2012 market downturn

Duration: 185 days + months of sideways market movement.

Reduction: -40%

2013-2015 bear market

Duration: 415 days plus months of sideways market movement.

Reduction: -83%

2017–2018 market gloom

Duration: 365 days plus the sideways-moving months.

Reduction: -84%

Bear market in 2019–2020

Approximately 260 days.

Reduced by -62%

As we can see, the typical crypto bear market experienced a draw-down of roughly 61% and lasted for 306 days, plus a lot of sideways movement in the months that followed.

But it could be different this time

As discussed earlier, we are now entering a recession, and this is the first time a crypto bear cycle and a recession have coincided.

What possible repercussions may this have?

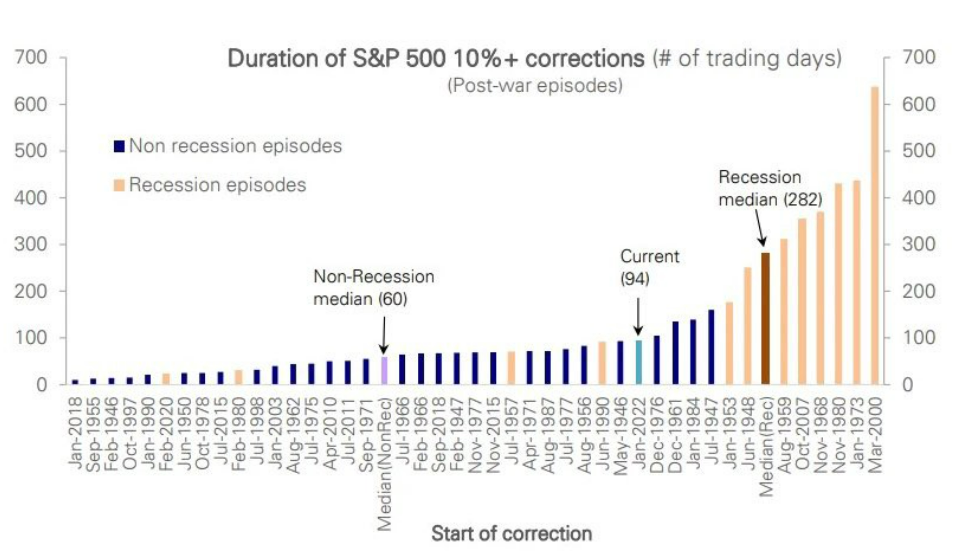

Bear markets in the S&P 500 are far shorter when they do not coincide with a recession than they are when both are happening at the same time.

Non-recessionary bear cycles in the US stock markets typically only last a few months and result in a draw-down of around 22%.

The rehabilitation process typically takes 11 months to reach the former high.

However, markets lose value by 30% on average during a recession.

The median amount of time it takes to rebound to the previous high once the bottom is established is 48 months.

Does this all imply that the current crypto bear market may be more severe and prolonged than previous ones?

Without a doubt, that is possible.

Additionally, a quick return to stronger market prospects is unlikely given the broader macroeconomic circumstances.

Any good news then?

Yes. Technical charts are showing some positivity.

The relative strength index (RSI) for the month is at the same extremely low level as it was at the conclusion of the bear markets in 2013–2015, 2017–2018, and 2019–2020.

This was a signal that the bottom was getting close to previous bear cycles.

Conclusion

It does not seem like this negative cycle will stop anytime soon based on historical data.

We still need to prepare for several months of declining pricing or, at the very least, flat prices.

But we also know from history that the mood towards cryptos may shift suddenly.

In any situation that arises, it is important to maintain composure.

Contrary to popular belief, the last third of a bear market is when investors often experience their worst losses.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.