Zinger Key Points

- Bitcoin slips below the $20,000 mark, OANDA analyst says not much has "changed."

- MVRV ratio indicates bottoming on apex coin, trader urges his followers to "accumulate."

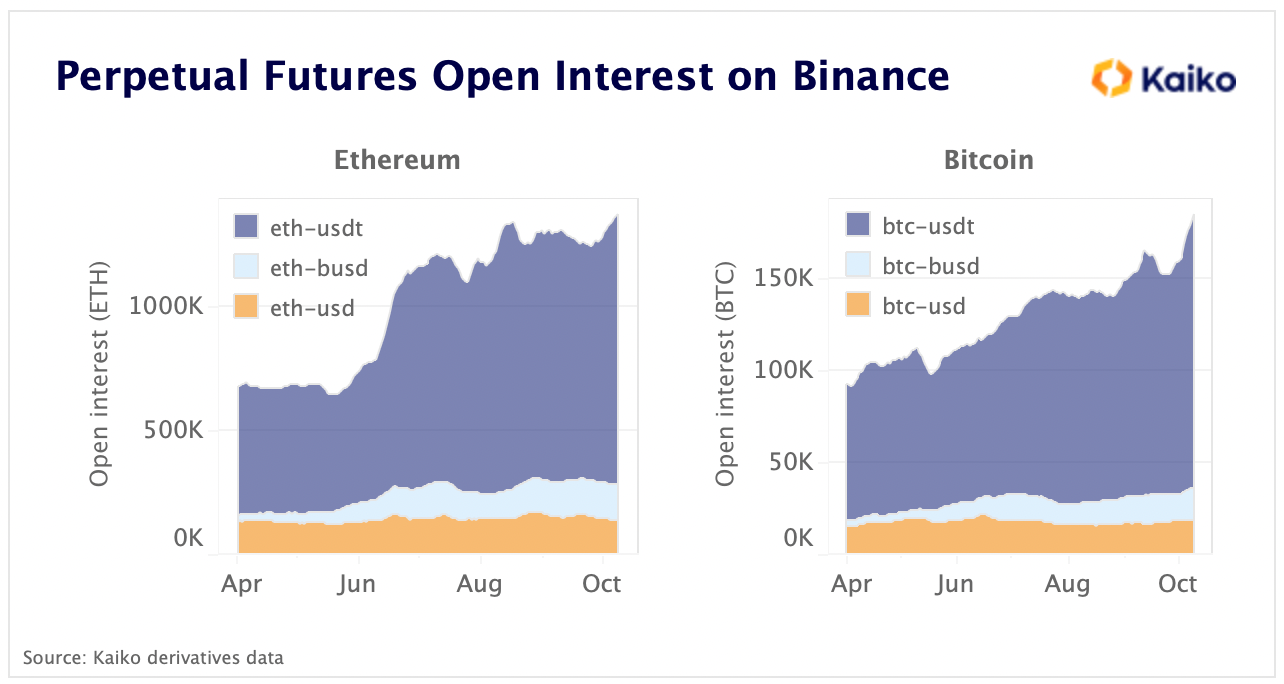

- Bitcoin, Ethereum open interest rises to all-time highs on Binance, says Kaiko Research.

- Our government trade tracker caught Pelosi’s 169% AI winner. Discover how to track all 535 Congress member stock trades today.

The two-largest cryptocurrencies traded in negative territory Monday evening as the global cryptocurrency market cap slipped 3% to $918.7 billion at 9:12 p.m. EDT.

| Coin | 24-hour | 7-day | Price |

|---|---|---|---|

| Bitcoin BTC/USD | -2.3% | -2.7% | $19,059.17 |

| Ethereum ETH/USD | -4.1% | -3.2% | $1,279.79 |

| Dogecoin DOGE/USD | -5.8% | -2.4% | $0.06 |

| Cryptocurrency | 24-Hour % Change (+/-) | Price |

|---|---|---|

| TerraClassicUSD (USTC) | +22% | $0.04 |

| Huobi Token (HT) | +20.1% | $5.15 |

| Maker (MKR) | +5.1% | $956.84 |

See Also: How To Get Free NFTs

Why It Matters: Bitcoin and Ethereum followed major U.S. stock market indices that ended Monday in the red. The S&P 500 and Nasdaq closed 0.75% and 1% lower, respectively. At the time of writing, stock futures were marginally in the green.

Bitcoin is showing signs of struggles at the beginning of the week after it slipped below the $20,000 mark, according to Edward Moya, a senior market analyst with OANDA.

“Ultimately, little has changed though. The cryptocurrency has been fluctuating around $20,000 for months and that remains the case now.”

Michaël van de Poppe said that the Market Value to Realized Value (MVRV) ratio of Bitcoin — which is its market capitalization divided by realized capitalization — is at its lowest point.

“It means that the current traded price per Bitcoin is far beneath the fair value,” said the cryptocurrency trader on Twitter. He also mentioned other occasions when this happened, including the COVID-19 crash.

Van de Poppe urged his followers on the social media platform to “accumulate” Bitcoin.

The MVRV ratio for #Bitcoin is at its lowest point.

— Michaël van de Poppe (@CryptoMichNL) October 10, 2022

It means that the current traded price per Bitcoin is far beneath the fair value.

Previous times of these levels;

- Q4 2011

- 2015

- 2018 November-April 2019

- COVID-19 crash

We are bottoming on #Bitcoin, accumulate. pic.twitter.com/C4nGIPycHw

Meanwhile, the dollar index, a measure of the greenback’s strength against a basket of six currencies, rose 0.3% on Monday. Analyzing a chart of the index, Justin Bennett, a cryptocurrency trader, said it was showing “some early signs of weakness.”

$DXY showing some early signs of weakness.

— Justin Bennett (@JustinBennettFX) October 10, 2022

1h chart: pic.twitter.com/pXSLfv9ewp

Notably, cryptocurrencies and other risk assets have recently moved in the opposite direction to the dollar index.

Kaiko Research said both Bitcoin and Ethereum open interest on Binance — the largest derivative exchange — has risen to all-time highs, which is a signal that fresh capital is entering the cryptocurrency markets.

Perpetual Futures Open Interest On Binance — Source Kaiko Research

Perpetual Futures Open Interest On Binance — Source Kaiko Research

The cryptocurrency market data company said in a note, seen by Benzinga, that Bitcoin open interest has shot up by 20% since the end of September to 183,000 BTC, while in a similar period Ethereum open interest rose by 10% to 1.3 million ETH.

Meanwhile, Bitcoin’s mining difficulty has adjusted to a new all-time high thanks to a rapid increase in network hash power, tweeted Glassnode.

“This increases the [BTC] cost of production, and puts additional stress on miners,” said the on-chain analysis company.

#Bitcoin Difficulty has adjusted to a new all-time-high due to a rapid increase in network hashpower.

— glassnode (@glassnode) October 10, 2022

This increases the $BTC cost of production, and puts additional stress on miners.

We have launched a new dashboard tracking miner capitulation riskhttps://t.co/oFj1RFiVoe pic.twitter.com/8z3iNlaREo

Read Next: Kevin O'Leary Says There's One Primary Catalyst That Can Push Bitcoin Higher

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.