This educational guide “How To Protect Crypto Assets in a Bear Market” was created in conjunction with Caleb & Brown. Caleb & Brown is the world’s leading cryptocurrency brokerage. Learn more here.

Something unique is happening in financial markets at large, much to the distress of investors across asset classes of every stripe.

For the first time ever, the so-called crypto winter, or the cyclical downturns the cryptocurrency market experiences, is occurring at the same time as a global bear market. While bear markets occur cyclically across all asset classes, this 2-for-1 walloping may feel especially punishing to investors following 2021’s great bull market, during which many portfolios grew at mind-bending rates.

In 2021, Bitcoin’s BTC/USD price increased to an all-time high of $69,044.77 (a 120% increase from its closing price on Jan.1), and the price of Ethereum ETH/USD skyrocketed to an all-time high of $4,868 (a 500% increase from its closing price on Jan. 1).

To put that into perspective, the annual return of the Nasdaq Composite Index in 2021, from its first-day close to its yearly high, was 27%. The Nasdaq Composite Index includes almost all stocks listed on the Nasdaq Capital Markets exchange. Along with the Standard & Poor 500 and the Dow Jones Industrial Average, it’s one of the premier benchmarks for economic performance.

Despite their astronomical 2021 gains, both Bitcoin and Ethereum have nearly returned to their pre-2021 price levels. And instead of finding refuge in the equities market, investors looking to recoup their losses by diversifying from cryptocurrency or pivoting away entirely are met with more of the same decline. The bear market of 2022 has even taken down typically well performing tech stocks such as Apple Inc. AAPL, Netflix Inc. NFLX and Tesla Inc. TSLA, with painful declines of 27%, 72% and 45%, respectively. Many experts believe a slew of macroeconomic factors have contributed to this decline, including rampant inflation, a European war, an excess increase in monetary supply and pandemic repercussions.

In such hostile conditions, the main prerogative of the astute investor and trader is survival, and the first step of survival is identifying and understanding the threat. With history as a guide, investors can glean the characteristics of crypto winter and bear markets — the two big bullies of 2022 — and figure out a way to stay afloat.

What, then, does history tell us?

Crypto Winter Versus Traditional Bear Markets: How They Stack Up

When comparing the crypto and equities markets, a clear distinction can be made in the nature of their declines. For one, crypto winters, as crypto bear markets are often called, occur at a much higher frequency, experience much larger price changes and occur much more rapidly than those of the equities market. The same holds true for crypto bull markets, which present some of the best investment opportunities in the world. Professional investors see this volatility as an opportunity, turning what some would think of as a ‘bug’ into income-generating and portfolio-hedging tools.

These crypto winters are often preceded by macro events like rising inflation, country-wide crackdowns on crypto and regulatory difficulties. Macroeconomic events also spearhead crypto bull markets. In 2021, experts believed the advent of commission-free brokers, the proliferation of cryptocurrency exchanges, the explosion of online spending due to quarantine measures and the release of stimulus cheques may have provided the perfect cocktail for a great bull run in both the equities and cryptocurrency market. The argument that crypto winters are generally more volatile and quicker than those of the equities market is supported by an inspection of periods of decline in Bitcoin, which is often used as a proxy for the market. Specifically, one finds:

- Between Dec. 16, 2017, and Feb. 6, 2018, Bitcoin’s price dropped roughly 70% in 52 days, declining from $19,700 to $5,900.

- Between June 26, 2019, and March 13, 2020, Bitcoin’s price dropped roughly 70% in 261 days, declining from $12,900 to $3,900.

- Between April 14, 2021, and May 19, 2021, Bitcoin’s price dropped roughly 53% in 35 days, declining from $63,500 to $30,000.

- In the current crypto winter, Bitcoin’s price dropped roughly 74% in 227 days, declining from $67,000 to $17,500.

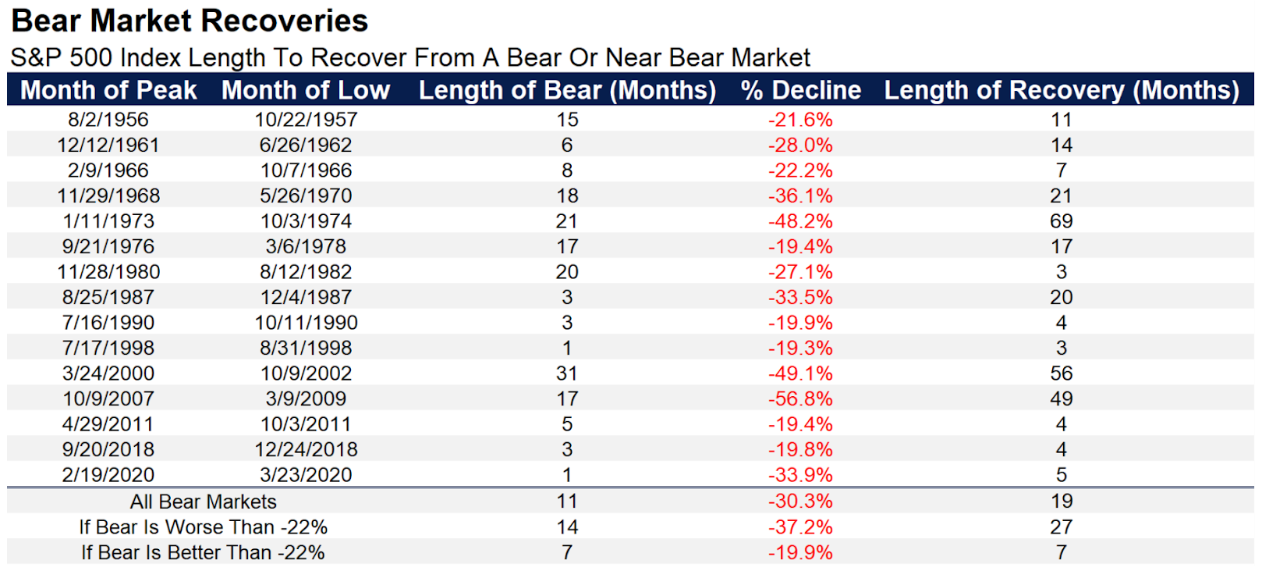

Image depicting all S&P 500 declines since 1956

In comparison, according to LPL Research, the S&P 500 has experienced 15 bear markets since 1956. In that time, the average duration of a bear market is 334 days — 11 months — and the average decline is roughly 30%. While there are certain times in history where losses exceeded 30%, notably the crashes of 1957, 2000 and 2007, these are the outliers.

Image depicting BTC’s declines from 2012 onwards. Taken from TradingView. Image depicting SPY’s 2018 decline of 20%. Taken from TradingView.

Cryptocurrency bear markets, or crypto winters, are far sharper and more abrupt than bear markets in more traditional asset classes. The lowest decline in crypto listed above is 53%, while the shortest bear market is one month.

In fact, using the arbitrary 20% threshold for a bear market with Bitcoin would have yielded a number of bear market misattributions, particularly in its early history. For example, Bitcoin’s price on Jan. 4, 2017, and Jan. 12, 2017, declined by 35% in eight days. In the equities market, this would have been astounding. With Bitcoin, this drop was completely erased in a matter of weeks and later led to a 275% ascension from the lows by May of the same year.

The abrupt declines in the crypto market may scare off investors, but it’s important to note that the opposite occurs in bull runs. As demonstrated in 2021, even in great bull runs in the equities market, the bull runs in crypto tend to be more extreme. This is a characteristic of an exciting, nascent asset class that is just beginning to develop the appropriate infrastructure for mainstream adoption. In other words, it’s a characteristic of an emerging market rather than an abrasion in the asset.

It’s not an exaggeration to say that the cryptocurrency market can provide some of the best investment opportunities in terms of both percentage return and time needed for that percentage to materialize. Because of its volatility, however, robust risk management is needed to tackle this class efficiently. For the layperson, this skill is best achieved through the help of professionals.

What To Do In Survival Mode?

It’s important to note that both Bitcoin and the S&P 500 have survived each of their “catastrophic” declines throughout history. Many investors have used dollar-cost averaging (DCA), hedging and diversification as countermeasures throughout historical bear markets, allowing them to preserve capital for when the next bull market comes knocking.

Although this inspires hope, it should not inspire complacency. In his book “The Psychology of Money” Morgan Housel said, “The challenge for us [investors] is that no amount of studying or open-mindedness can genuinely recreate the power of fear and uncertainty [experienced in bear markets].”

While identifying and learning about threats to your investment portfolio is crucial in creating the confidence you need to weather poor market conditions, aid from professionals often makes this process easier. Providing investors immediate support and attention is a core value at Caleb & Brown, the world’s leading cryptocurrency brokerage.

Armed with deep insight into cryptocurrency markets, Caleb & Brown’s brokerage professionals offer the education and insights to help their clients make the right decisions when their wealth is on the line. Their team of experienced crypto professionals help investors combat bear market conditions, avoid catastrophic decisions and grant their clients the know-how to preserve capital. What’s more: they’re always available.

With both crypto winter and a bear market knocking on investors’ doors, help from professionals has never been more important. With the pros at their backs, investors are far more likely to learn to preserve their capital, and deploy it in a timely and effective manner in preparation for the next bull market.

Click here to meet the professionals.

Featured photo by Hans-Jurgen Mager on Unsplash

This post contains sponsored advertising content. This content is for informational purposes only and is not intended to be investing advice.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.