Not the best month for crypto, given the FTX debacle. Will it result in any change? We can only wait and see, but we know that reform and regulation are often slow.

Will we see another FTX before that happens? Anything is possible.

Looking at bitcoin, the price of this major crypto index has dropped a further 27% since the start of the month. The impact of this drop is that price broke out on the wrong side of the consolidation it had been trading in since June.

Below I have the monthly timeframe for Bitcoin

How far will Bitcoin BTC/USD now fall?

How far will Bitcoin BTC/USD now fall?

Given the negativity and the lack of confidence, it is hard to say. However, markets move in mysterious ways and what has happened with FTX is not a reflection of blockchain technology and its future role.

We may see further weakness, potentially towards the 2019 high or even towards the $1000 round number before the next bull run.

Or the markets may surprise us, absorb the noise around FTX, and December could be the start of a bull market. And when bitcoin decides to move. It covers ground quickly, so patience is rewarded.

If and when that will happen, we have no idea at this stage. I prefer to always let price dictate a move as opposed to predicting. It reduces my risk and increases my profit potential.

For now, I am choosing to stand aside, hold what little I have in Ethereum and look forward to 2023. As a reminder, my investment in the crypto space is a tiny percentage of my overall capital.

My preference will always be stocks due to the maturity of the market, its repetitive behaviour and the sheer number of opportunities that return consistent wealth.

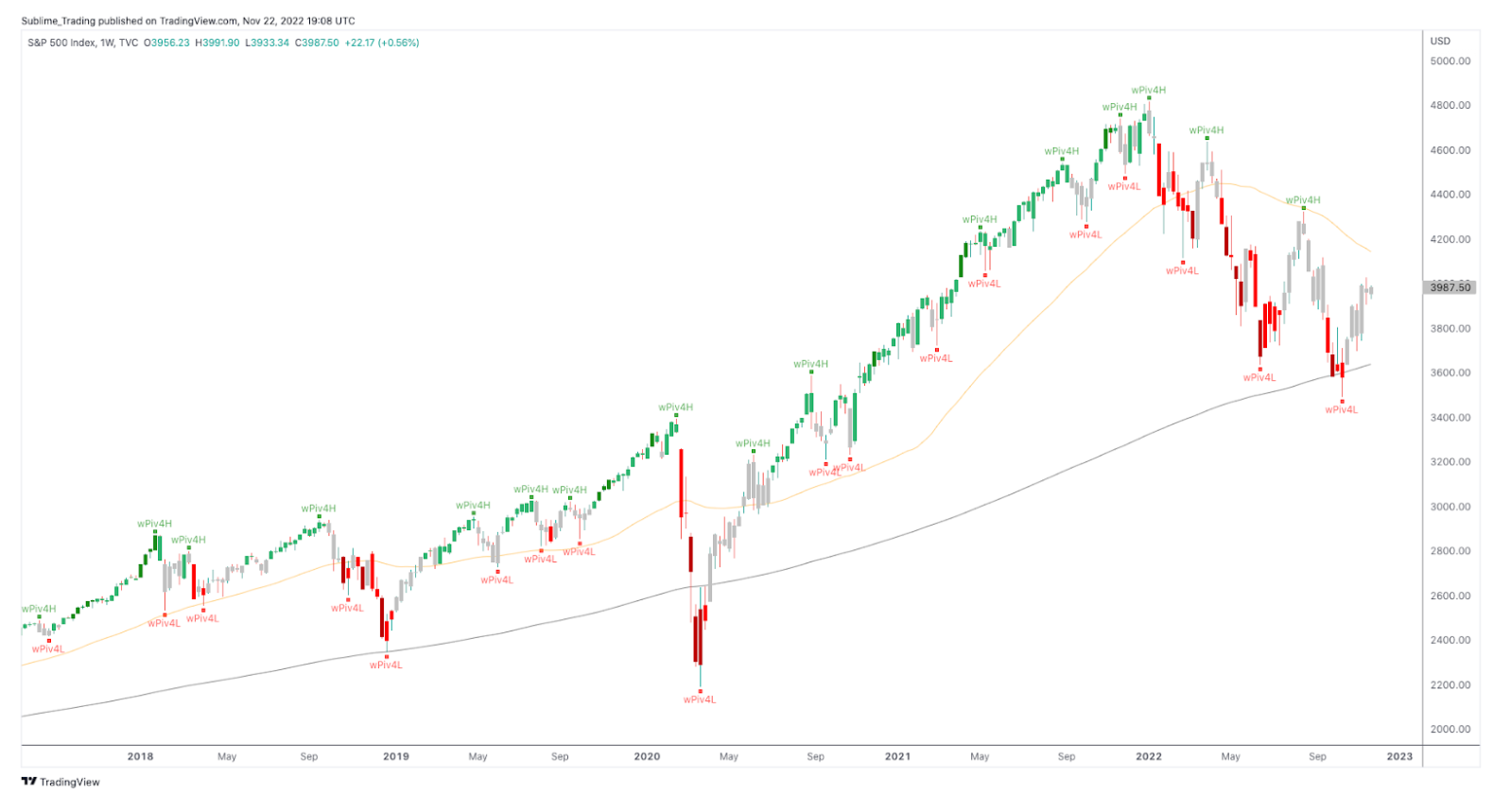

And that takes me onto the S&P 500.

Below I have the weekly time frame

This primary stock index's price has increased by over 14% since bouncing off the weekly 200 simple moving average. I go into detail in this article on why this is significant.

However, it still remains too early to call a stock market bull run, as the price of the S&P 500 SPY has yet to move above the daily 200 simple moving average. The price is also finding resistance at the $4000 round number.

If the price manages to break and close above both of these critical levels AND confirm a bull flag above the daily 200 simple moving average, that will be my sign to start entering the strongest-performing stocks.

I am already building my watchlist of stocks that are breaking out and printing new all-time highs, which you can read here.

Some patience for now, but the stock market is starting to look very interesting.

Image sourced from Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.