Bitcoin BTC/USD and Ethereum ETH/USD were trading flat during Friday’s 24-hour trading session within tight ranges.

Unlike the S&P 500, which took a downturn when the Labor Department released higher-than-expected new job market numbers, Bitcoin and Ethereum didn’t react. This may have been an early indicator that the negative reaction in the stock market wouldn’t gain traction, and by Friday afternoon, the S&P 500 was climbing up to trade within Thursday’s range.

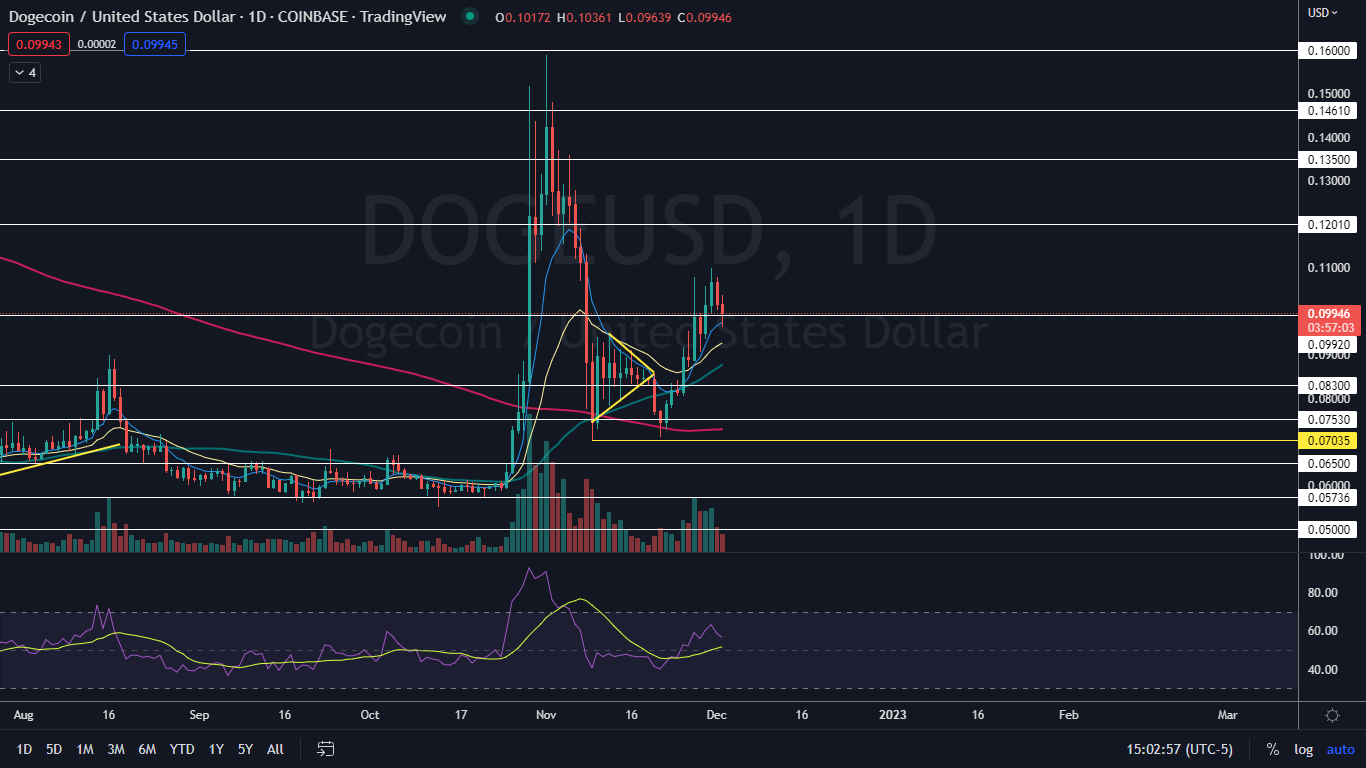

Although Dogecoin was slipping by about 3%, the downturn was unlikely to be linked to the general markets. Dogecoin has been trading in an uptrend since Nov. 21 and hasn’t printed a higher low since Nov. 25, indicating a retracement was likely.

With the S&P 500 trading near the 200-day simple moving average and up about 15% from its lows, traders and investors are watching carefully to see if the index will signal the bear market is over. On the weekend, traders will be watching Bitcoin and Ethereum, in particular, for clues as to how the S&P 500 may behave next week.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

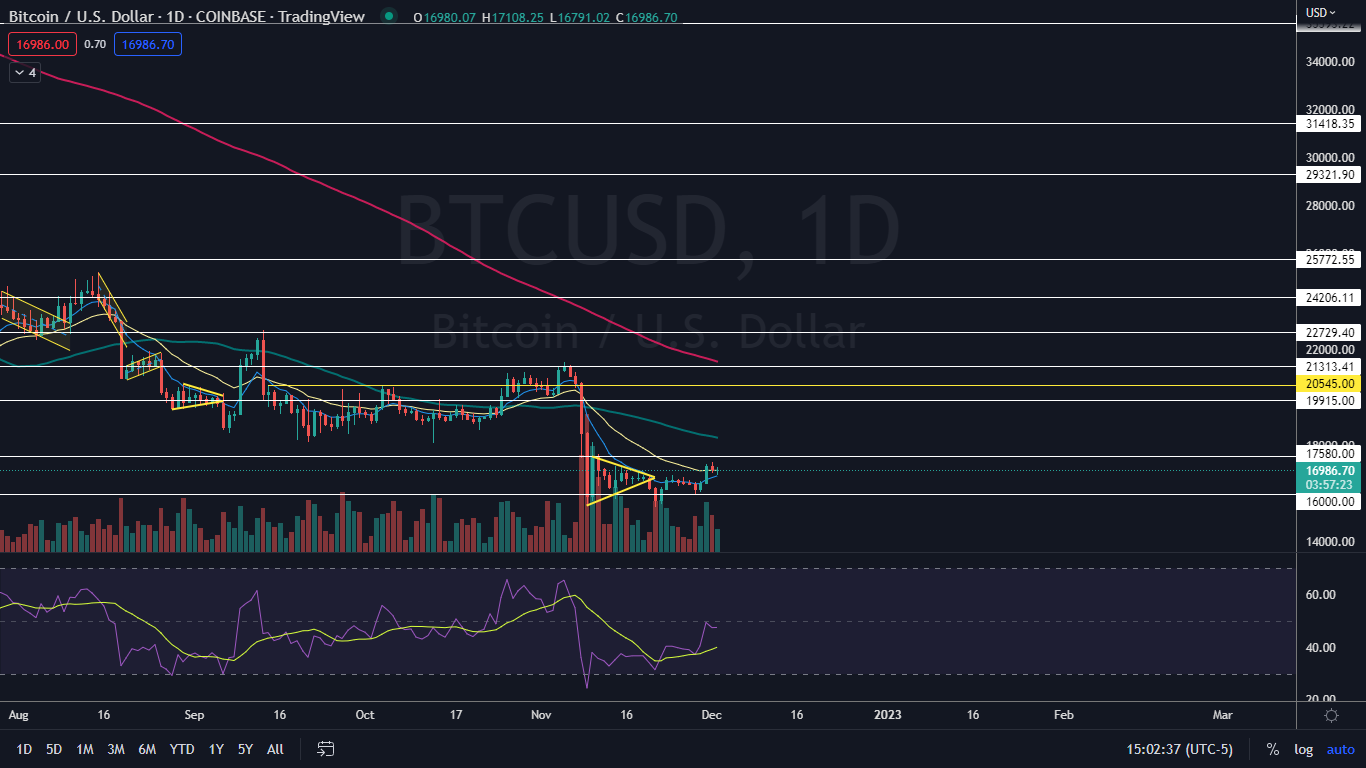

The Bitcoin Chart: Bitcoin reversed into an uptrend pattern on Nov. 22 after printing a double bottom near the $15,500 mark. The crypto's most recent higher high was formed on Thursday at $17,317 and the most recent confirmed lower low was printed at the $15,992 level on Nov. 28.

On Friday, Bitcoin was working to print a doji candlestick, which could indicate the next higher low is in and the crypto will trade higher during Saturday’s session. If that happens, bullish traders will want to see Bitcoin pop up above $17,320 to confirm the uptrend is intact.

There’s also a possibility Bitcoin could be creating a small bull flag pattern on the daily chart. If the pattern is recognized, and Bitcoin breaks up from the flag, the measured move is about 7%, which suggests the crypto could climb up over $18,000 over the next few days.

Bitcoin has resistance above at $17,580 and $19,915 and support below at $16,000 and $15,000.

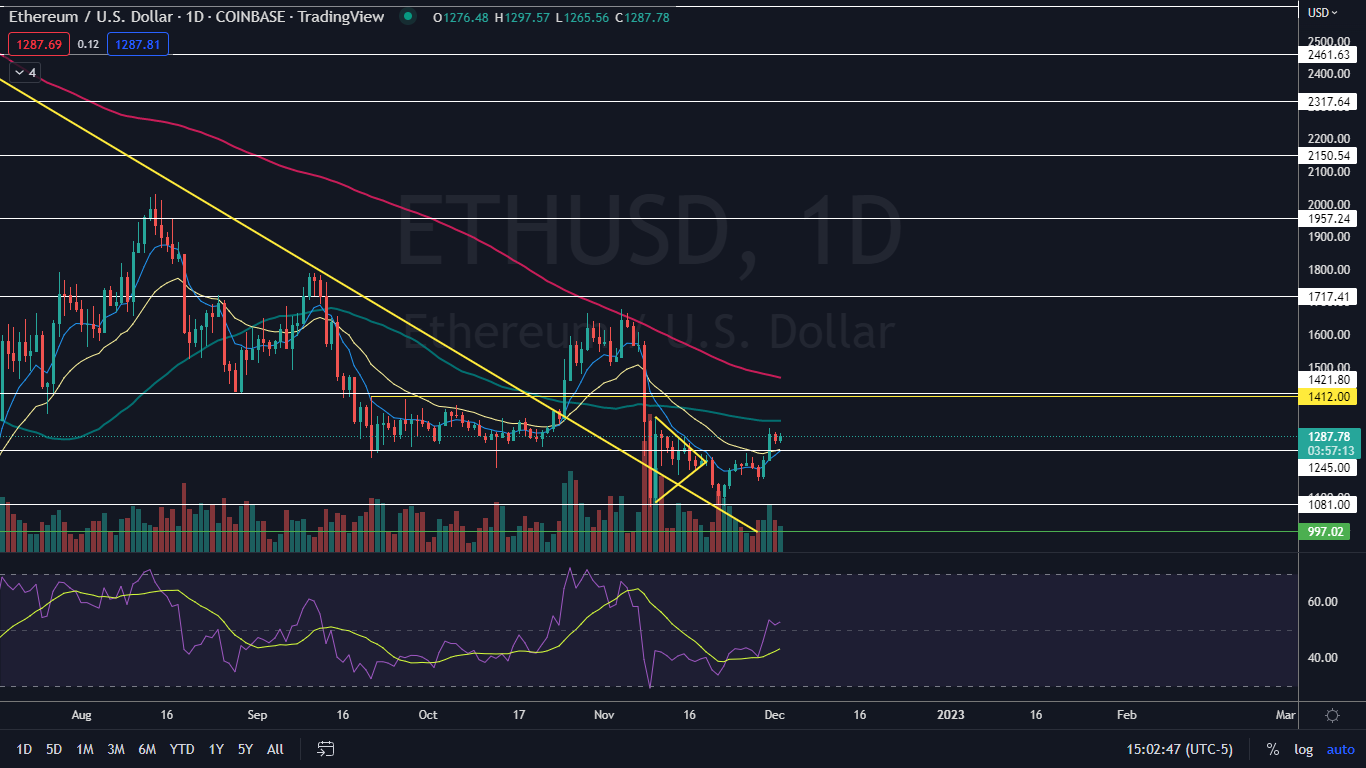

The Ethereum Chart: Ethereum is trading in tandem with Bitcoin, in an uptrend and within a possible small bull flag pattern. Ethereum’s most recent higher high was formed on Wednesday at $1,311 and the most recent confirmed higher low was created at the $1,150 level on Nov. 28.

The Ethereum Chart: Ethereum is trading in tandem with Bitcoin, in an uptrend and within a possible small bull flag pattern. Ethereum’s most recent higher high was formed on Wednesday at $1,311 and the most recent confirmed higher low was created at the $1,150 level on Nov. 28.

The measured move of Ethereum’s bull flag pattern is about 13%, which suggests the crypto could spike up toward $1,430. If Ethereum falls under the eight-day exponential moving average (EMA), the bull flag will be negated.

Ethereum has resistance above at $1,412 and $1,717 and support below at $1,245 and $1,081.

The Dogecoin Chart: Dogecoin reversed into its most recent uptrend on Nov. 22, printing a higher low at 8 cents and a higher high on Wednesday at 11 cents. During Friday’s trading session, the crypto retraced to the eight-day EMA and bounced up from the level.

The Dogecoin Chart: Dogecoin reversed into its most recent uptrend on Nov. 22, printing a higher low at 8 cents and a higher high on Wednesday at 11 cents. During Friday’s trading session, the crypto retraced to the eight-day EMA and bounced up from the level.

If Dogecoin trades higher over the weekend, Friday’s low of day will serve as the next higher low within the uptrend. The lower wick Dogecoin was developing on the chart during the session supports the theory the next low may have occurred.

Dogecoin has resistance above at 12 cents at $0.135 and support below at $0.083 and $0.075. There is also support and resistance at 10 cents, which Dogecoin has been struggling to regain.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Read Next:

Read Next: