Zinger Key Points

- Investor sentiment unchanged from last week indicates 'Crypto Fear & Greed Index.'

- Trader says price action on BTC looks 'incredibly terrible' but altcoin market cap 'doesn't look too bad'

- UTXOs greater than 1000 BTC scarce, expectations 'don't seem to be positive at all' says CryptoQuant analyst.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

Major coins traded in the red on Sunday evening as the global cryptocurrency market cap declined 0.6% to $849.2 billion.

| Coin | 24-hour | 7-day | Price |

|---|---|---|---|

| Bitcoin BTC/USD | -0.7% | -1.6% | $17,016.77 |

| Ethereum ETH/USD | -1.6% | -0.6% | $1,258.81 |

| Dogecoin DOGE/USD | -4.3% | -11.4% | $0.09 |

| Cryptocurrency | 24-Hour % Change (+/-) | Price |

|---|---|---|

| Stacks (STX) | +2.5% | $0.28 |

| Trust Wallet Token (TWT) | +4.1% | $2.64 |

| GMX (GMX) | +1.6% | $54.95 |

See Also: eToro Vs. Robinhood — Which Is Better For Crypto?

Why It Matters: Bitcoin and Ethereum were down at the time of writing while U.S. stock futures started the week on a weaker note as investors await a key policy meeting of the U.S. Federal Reserve.

On Tuesday, investors will receive the November consumer price index numbers and look for signs of inflation softening. The Federal Open Market Committee is due to begin its two-day meeting on the same day.

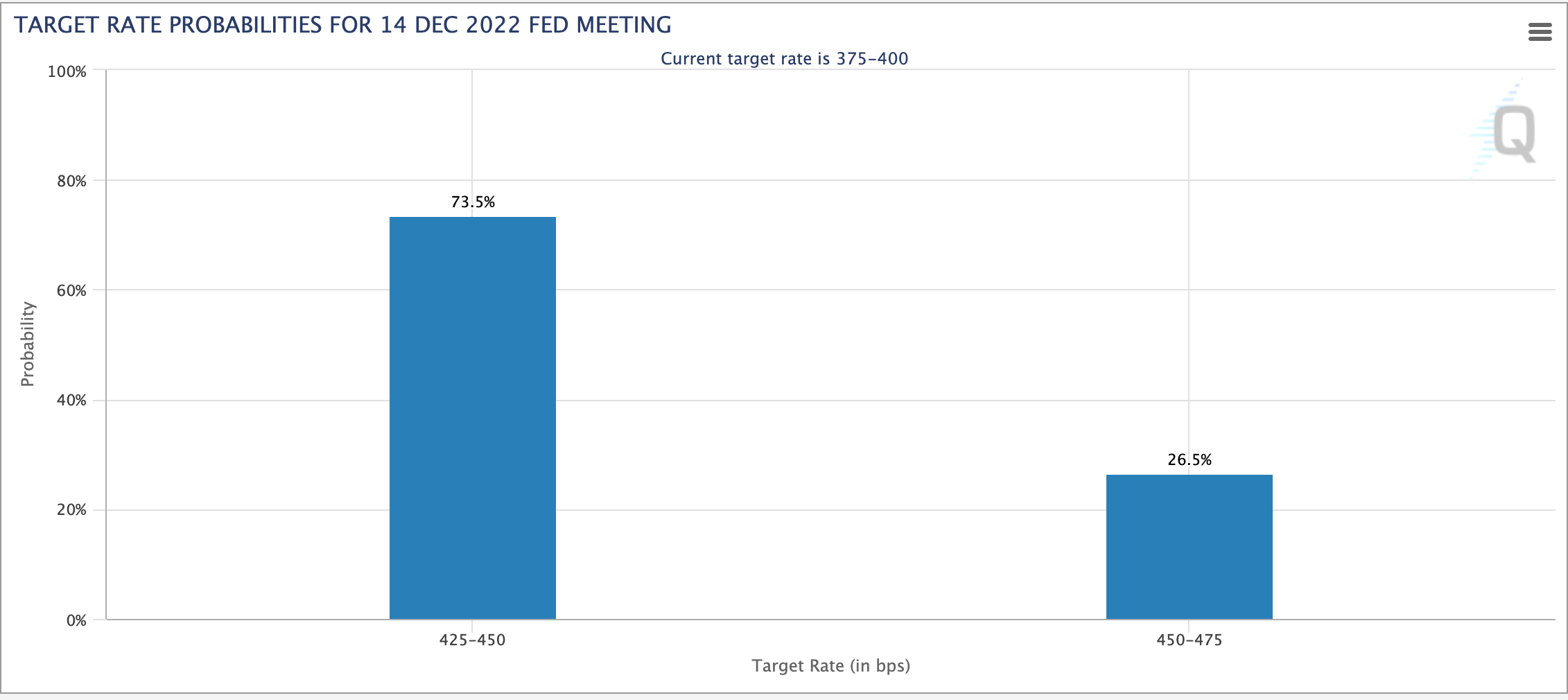

CME Fed Watch Tool data indicates that 73.5% of traders anticipate a 50 basis point rate hike on Wednesday.

Screenshot From The CME Fed Watch Tool

Alternative.me’s “Crypto Fear & Greed Index,” a measure of investor sentiment, was showing “Fear” at the time of writing. The Index flashed “Fear” last week as well.

“Bitcoin isn’t doing much of anything ahead of next week’s FOMC decision,” said OANDA senior market analyst Edward Moya.

“Bitcoin seems stuck around the $17,000 area and that could continue until next week’s FOMC decision. Next week is the last trading week of the year that we will see full participation, so that could finally help Bitcoin have a more meaningful move,” said the analyst, in a recent note seen by Benzinga. “If Wall Street is confident that the Fed will be done hiking after the February rate rise and nothing new breaks in crypto, you could see Bitcoin make a run for the $18,000 level.”

Michaël van de Poppe said that the price action on Bitcoin looks “incredibly terrible.”

Incredibly terrible price action on #Bitcoin.

— Michaël van de Poppe (@CryptoMichNL) December 11, 2022

The trader said altcoin market capitalization “doesn’t look too bad at this point.” He said, “The reclaim of range low at $460 billion. If it cracks $500 billion, we can continue moving towards $600 and $680 billion. Overall, bullish divergence & reclaim are good signals.”

#Altcoin market capitalization doesn't look too bad at this point.

— Michaël van de Poppe (@CryptoMichNL) December 11, 2022

The reclaim of range low at $460 billion.

If it cracks $500 billion, we can continue moving towards $600 and $680 billion.

Overall, bullish divergence & reclaim are good signals. pic.twitter.com/seJsWTMpKo

A CryptoQuant analyst said that despite “giants” like Goldman Sachs stating that the current levels are “great opportunities in crypto” there are fewer and fewer UTXOs (Unspent Transaction Outputs) with a value greater than 1,000 BTC.

STILL SELLING?

— CryptoQuant.com (@cryptoquant_com) December 9, 2022

"Despite giants like Goldman Sachs have said that at these prices there are great opportunities in crypto, there are fewer and fewer UTXOs with a value greater than 1,000 BTC."

by @easy_onchain

Linkhttps://t.co/osIGsb6mQc

“These UTXOs that usually belong to large investors continue to decline despite recent price recoveries. Maybe a good indicator to determine a good market bottom could be when we see this segment increase again or at least stabilize.” UTXO represents cryptocurrency that is left after a transaction has been made.

The analyst for the community-driven platform said, “At the moment their expectations do not seem to be positive at all.”

Read Next: Cathie Wood Predicts FTX Implosion Will Boost One Crypto Sector Which 'Didn't Skip A Beat'

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.