Zinger Key Points

- The $20.6 billion estimate of illicit cryptocurrency transaction volume is a lower bound and expected to increase.

- Sanctioned entities account for 43% of 2022’s illicit transaction volume.

- Join Chris Capre on Sunday at 1 PM ET to learn the short-term trading strategy built for chaotic, tariff-driven markets—and how to spot fast-moving setups in real time.

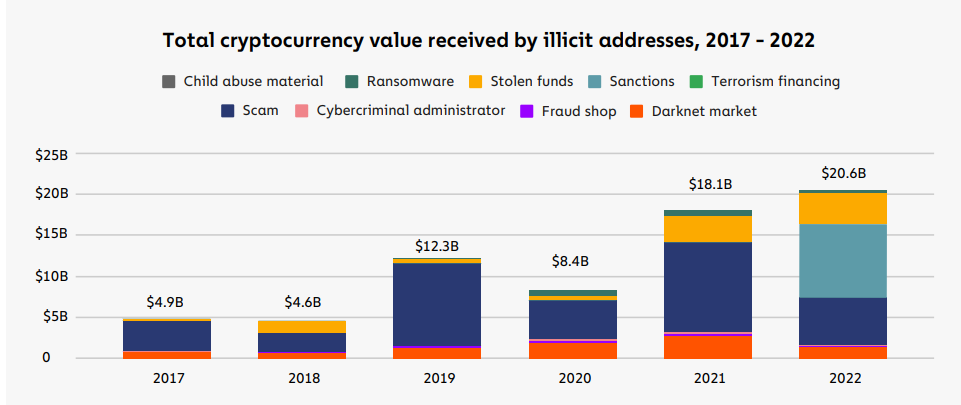

Despite the ongoing market downturn in the cryptocurrency industry, illicit cryptocurrency transaction volume has risen for the second consecutive year, reaching an all-time high of $20.6 billion in 2022, according to a report by blockchain analytics firm Chainalysis.

The estimate is a lower bound, as the actual figure is expected to grow over time as new addresses associated with the illicit activity are identified.

Furthermore, the estimate doesn't capture proceeds from non-crypto-native crime, such as conventional drug trafficking that involves cryptocurrency as a mode of payment.

Chainalysis has raised last year's estimate of $14 billion in illicit activity to $18 billion, primarily due to the discovery of new crypto scams.

This figure is expected to rise even further as more illicit activities are uncovered in the future.

The report also notes that 43% of the illicit transaction volume in 2022 came from activity associated with sanctioned entities.

This is significant as the US Office of Foreign Assets Control (OFAC) launched some of its most ambitious and difficult-to-enforce crypto sanctions yet in 2022.

Also Read: Bitcoin Trading Is Signaling Something It Hasn't For Weeks: Should Traders Be Worried?

Garantex, a Russia-based cryptocurrency exchange that was sanctioned by OFAC in April 2022, accounted for the majority of sanctions-related transaction volume last year.

Despite the overall rise in illicit transaction volume, transaction volumes fell across all the other conventional categories of cryptocurrency-related crime, except for stolen funds, which increased by 7% year-over-year.

The market downturn is likely a contributing factor to this trend.

In general, less money in crypto overall correlates with less money associated with crypto crime.

The share of all cryptocurrency activity associated with illicit activity has increased for the first time since 2019, from 0.12% in 2021 to 0.24% in 2022.

The report highlights the need for continued vigilance and monitoring of the cryptocurrency industry to ensure that the growth of illicit activity is curtailed and that the industry can operate in a safe and secure environment for legitimate users.

Next: Robinhood Faces SEC Probe Over Crypto Business Amid Regulatory Crackdown

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.